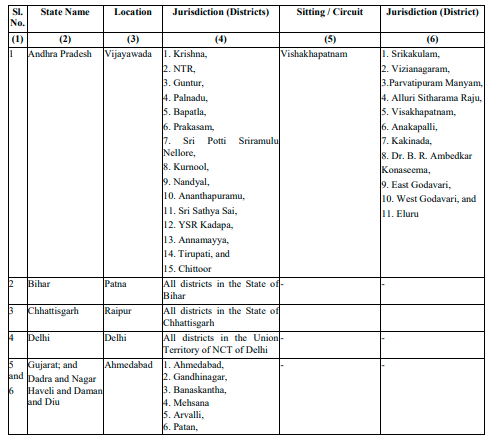

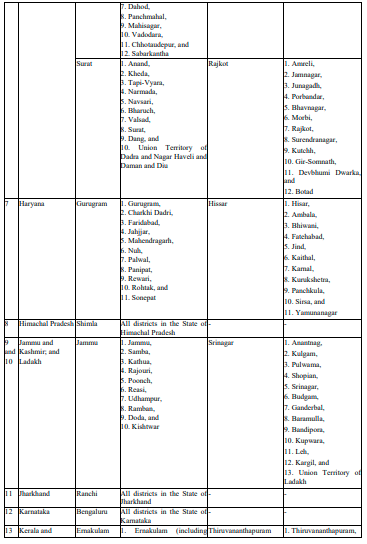

Summary of Territorial Jurisdiction of GST Appellate Tribunals

The government has notified the Territorial Jurisdiction of GST Appellate Tribunals. The Government is using its powers granted in sub section (1) , (3), (4) of section 109 of the CGST Act,2017. These sections are deal with settingup and managing the GSTAT i.e Goods and Service Tax Appellate Tribunals. The Government is modifying a previous notification published in the Gazette of India. This Notification is issued by Ministry of Finance on 31-07-2024 under S.O.3048(E).

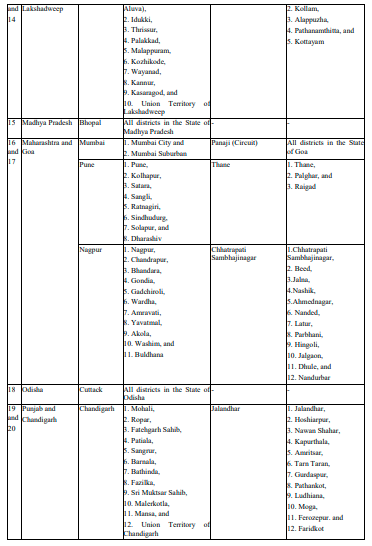

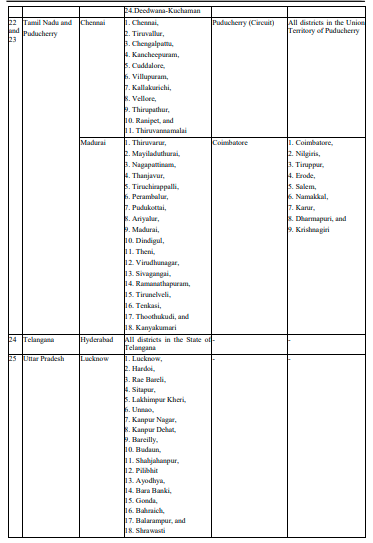

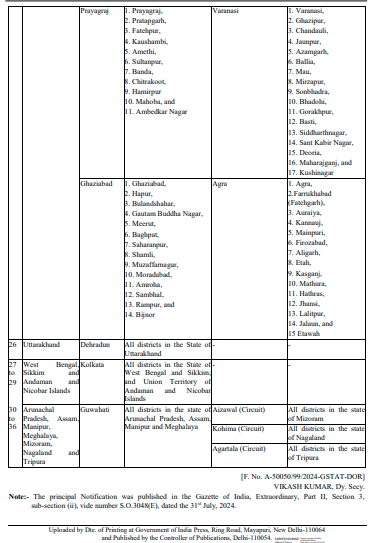

This Notification is about setting up State Benches of GSTAT and defining their Jurisdiction. The Notification lists the districts that will come under the Jurisdiction of Specific state benches of GSTAT.

Details of the Table:

- Column (3) talks about location of each Bench.

- Column (4) talks about Districts that fall under the Jurisdiction

- Column (5) talks about where bench is not permanently located but holds sitting or circuit sessions in other locations with corresponding jurisdiction in Column (6).

These all arrangements come in to the effect from the date the notification is published in Official gazette. which is 26-11-2024.

In short, The Government official announcing :

- Where the GST Appellate Tribunal Benches will be located

- Which Districts each bench will handle.

- Whether some benches will function as travelling (Circuit) Courts.

Download – Notification 5063(E)