Place of Supply of Goods | Know where GST is Payable

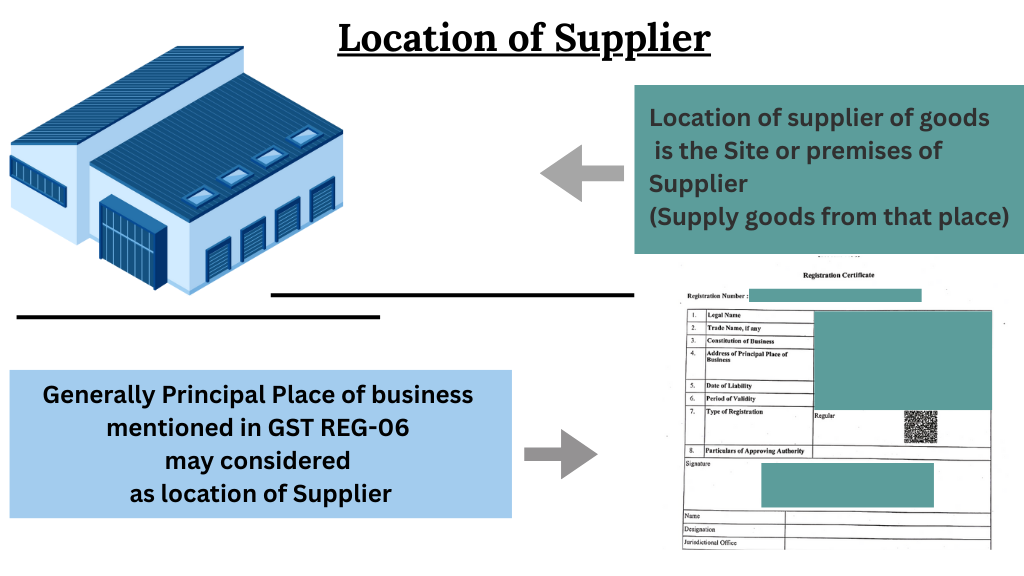

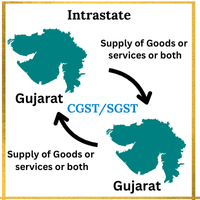

The concept of the Place of Supply of Goods can be quite tricky, as GST follows a consumption-based system.Under this system, the tax is payable in the state where goods or services are actually consumed,rather than originate.The provisions relating to the Place of supply are crucial in identifying the exact location.Based on the place of supply,the nature of the transaction is determined. whether it is interstate or intrastate, which in turn dictates the type of GST to be levied—CGST, SGST, IGST, or UTGST.Correct classification ensures that the appropriate tax is applied and credited to the rightful jurisdiction.The place of supply and the location of the supplier are two major determinants while deciding the nature of supply.

To understand the Place of Supply of Goods it is necessary to understand the Location of Supplier. Let’s understand the location of the Supplier.

The place of supply is important to determine the kind of tax that is to be levied.

Section 10 of the IGST Act for Place of Supply of Goods other than Import and Export.

Section 10(1)(a) of IGST Act: Supply involving movement of goods

Eample 1 : K Limited (Karnataka) sells goods to Mr.R of Rajasthan with instruction to deliver the goods at Rajasthan . In this case the goods will be moving from Karnataka to Rajasthan, and it is Inter-state supply of goods liable for IGST. hence the place of supply will be location of where the delivery terminates. In this case Delivery terminates at Rajasthan , so Place of supply will be Rajasthan.

- Location of Supplier : Karnataka

- Place of Supply: Rajasthan

Example-2

B Limited (Gujarat) sell the 20 sets of Cofee machines to Q limited (Madhya Pradesh). Q Limited has taken the Cofee Machines from supplier’s Place. It is Inter-state supply of goods attracts IGST. It includes the movement of goods hence in such case Place of supply will be where the goods are terminated for delivery. Place of Supply in this case will be Madhya Pradesh.

- Location of Supplier: Gujarat

- Place of Supply: Madhya Pradesh

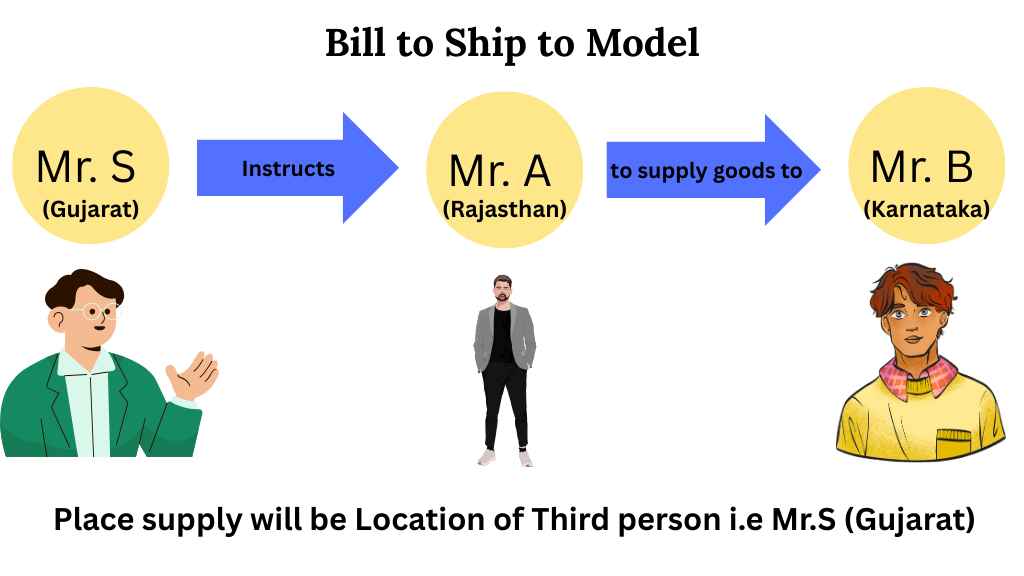

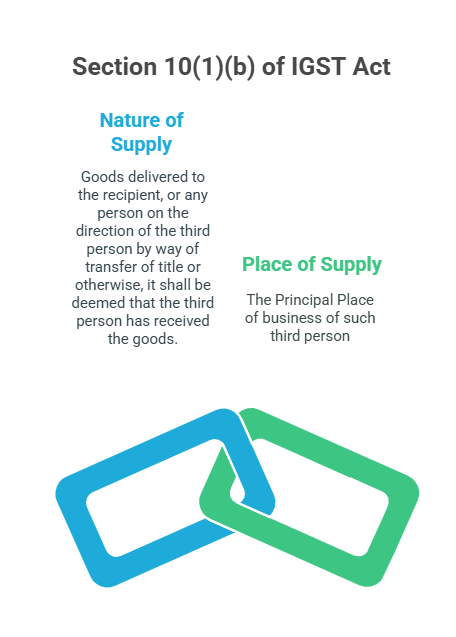

Section 10(1)(b) of the IGST Act—supply on the direction of a third person. (Bill to Ship to Model)

As per section 10(1)(b) of the IGST Act, where the goods are delivered by the supplier to the recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during the movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods, and the place of supply of such goods shall be the principal place of business of such person.

Bill to Ship to Model: In this Model, three parties are involved. The supplier who supplies the goods, the recipient who receives the goods and the third party on whose directions the goods are delivered. Now let’s understand with an example.

Example 1: Mr.X of Gujarat supplied goods to Mr.P of West Bengal. Mr.P instructs the supplier to deliver the goods to Mr.C at Maharashtara on his behalf. In this example, the place of supply will be West Bengal, and IGST will be applicable as it is an interstate transaction.

Example 2: Mr. T (Gujarat) delivers the goods to Mr.Z (Uttar Pradesh) on the instructions of Mr.U (Rajasthan). This is called the bill-to-ship model. In this transaction, two supplies are included:

The first supply is between Mr.U (Rajasthan) and Mr.Z (Uttar Pradesh):

- Place of Supply: Uttar Pradesh (as per Section 10(1)(a)

- Location of Supplier: Rajasthan

The second supply is between Mr.T (Gujarat) and Mr. U (Rajasthan): For this transaction, the bill to ship to the model will be applicable for the determination of the place of Supply.

- Place of Supply: Rajasthan

- Location of Supplier: Gujarat. IGST will be applicable for this transaction as it is an interstate transaction.

Section 10(1)(c) of the IGST Act – Supply not involving movement of goods

Example 1: Mr.X (Rajasthan) visit Maharashtra for business purposes. He purchased the mobile phone from a shop in Maharashtra. Here, in this case, there is no movement of goods as the mobile is directly purchased from the shop by Mr. X and kept with him. Therefore, the place of supply in such a case is Maharashtra – location of such goods at the time of delivery to the recipient—and IGST will be charged on such sales.

Example 2: Mr. J (Madhya Pradesh) has leased the machinery to Mr.Y (Karnataka). After some years, Mr. Y requests that Mr.J to sell the machine to him. Now, in this case, there is no movement of goods; hence, the place of supply will be the location of such goods at the time of delivery to the recipient, i.e., Karnataka.

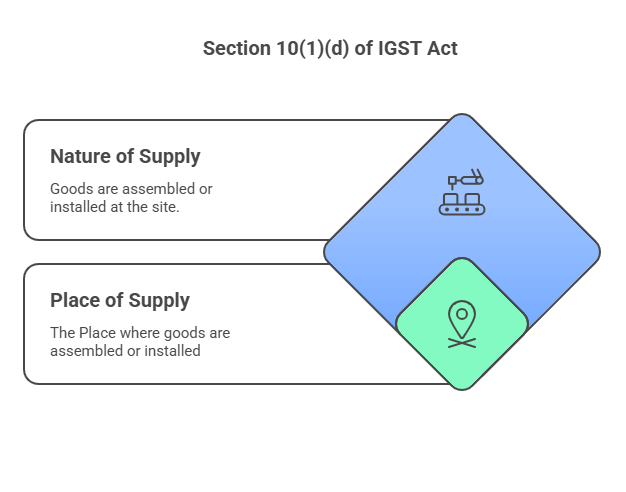

Section 10(1)(d) of the IGST Act – Supply in case of goods assembled or installed

Example 1 : Mr Shailesh (New Delhi) has purchase machine from XYZ Limited (New delhi) which is required to be assembled in factory located in Noida Uttar Pradesh. The Place of supply in such case is the place where goods are assembled or installed i.e Noida Uttar Pradesh.

Example 2: For Power Plant installation, XYZ Limited (Rajasthan) gives contract to LY Limited (Maharashtra) for assembling parts for the plant in the refinery located in Punjab. The Place of supply is the site of assembly of power plant i.e Punjab even XYZ limited is located in Rajasthan.

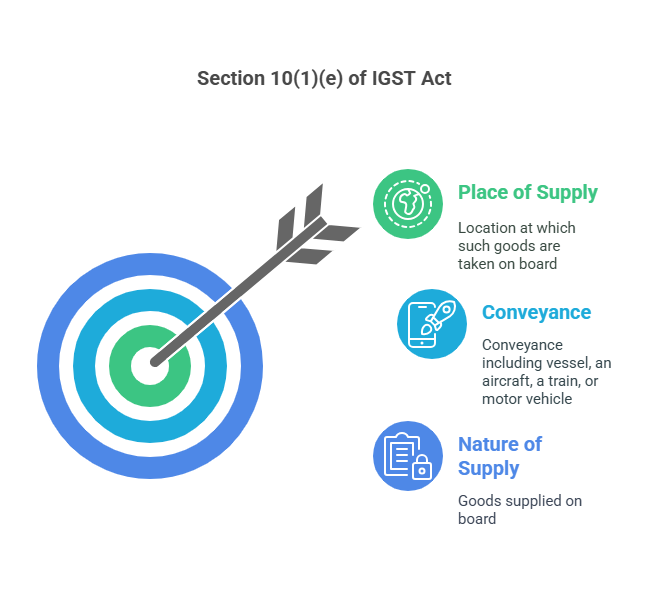

Section 10(1)(e) of the IGST Act – Supply of goods on board a conveyance

Example 1: Mr Paresh ( Ahmedabad) boards the Ahmedabad-Mumbai train at Ahmedabad. He sell the goods taken on board by him (at Ahmedabad), at valsad during the journey. The Place of supply of goods is the location at which the goods are taken on board i.e Ahmedabad and not valsad where they have been sold.

Example 2 : Breakfast served on journey from Ahmedabad to Mumbai. as such food etc are goods supplied on board a conveyance. Hence the location of such supplies will be the location at which such goods are taken on board where such breakfast are taken on board. The Place of supply will Ahmedabaad irrespective of the place of its consumption.

Section 10(2) of the IGST Act – When Place of supply can not determined

If none of the above provisions apply to determining the Place of Supply of goods, the place of supply is determined as prescribed by the government.

Conclusion: Section 10 (1) of IGST Act has provided the mainly 5 rules for determination of place of supply of goods. Correct determination of Place of supply is crucial for ensuring accurate tax compliance.Hence Clear understanding of section 10 is not just the necessity, but practical imperative for smooth GST Compliance and avoiding litigation risks.