Summary of GST Registration Compliance for Metal Scrap Dealers

GST Advisory has been issued for GST Registration Compliance for Metal Scrap Dealers through Form GST REG-07, This Advisory is regarding the New GST provision for Metal Scrap Transactions issued on 13-10-2024.

The GST portal has been updated to facilitate registration compliance for buyers of metal scrap through form GST REG-07.

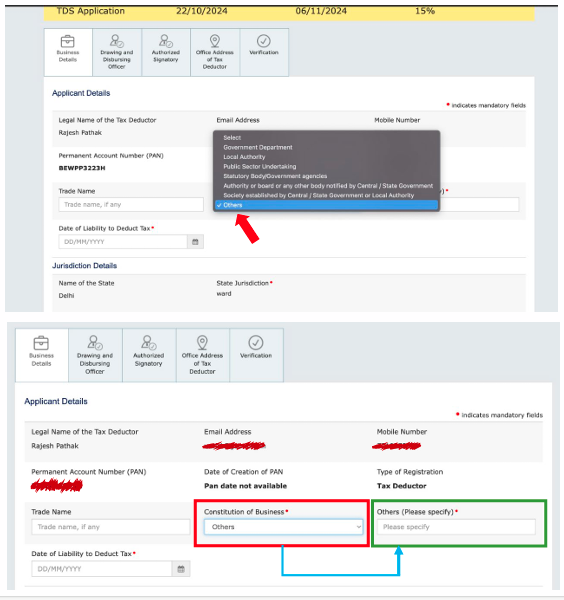

Taxpayers are required to select “Others” in Part B of Table 2 under the “Constitution of Business” Section. A text box will appear where the taxpayer must enter “Metal Scrap Dealers.” This entry is mandatory for those selecting the “Others” option. Once this is completed, the remaining details in form GST REG-07 should be filled and submitted on the common portal to meet the registration requirements as per Notification No. 25/2024 – Central Tax, dated October 9, 2024.

Once this is completed, the remaining details in the GST REG-07 form must be filled and submitted on the common portal to comply with registration requirements as per Notification No. 25/2024 – Central Tax, issued on October 9, 2024.

A screenshot of the form GST REG-07 is enclosed below with the relevant sections highlighted:

Downlaod – GST Advisory on GST Registration Update for Metal Scrap Buyers