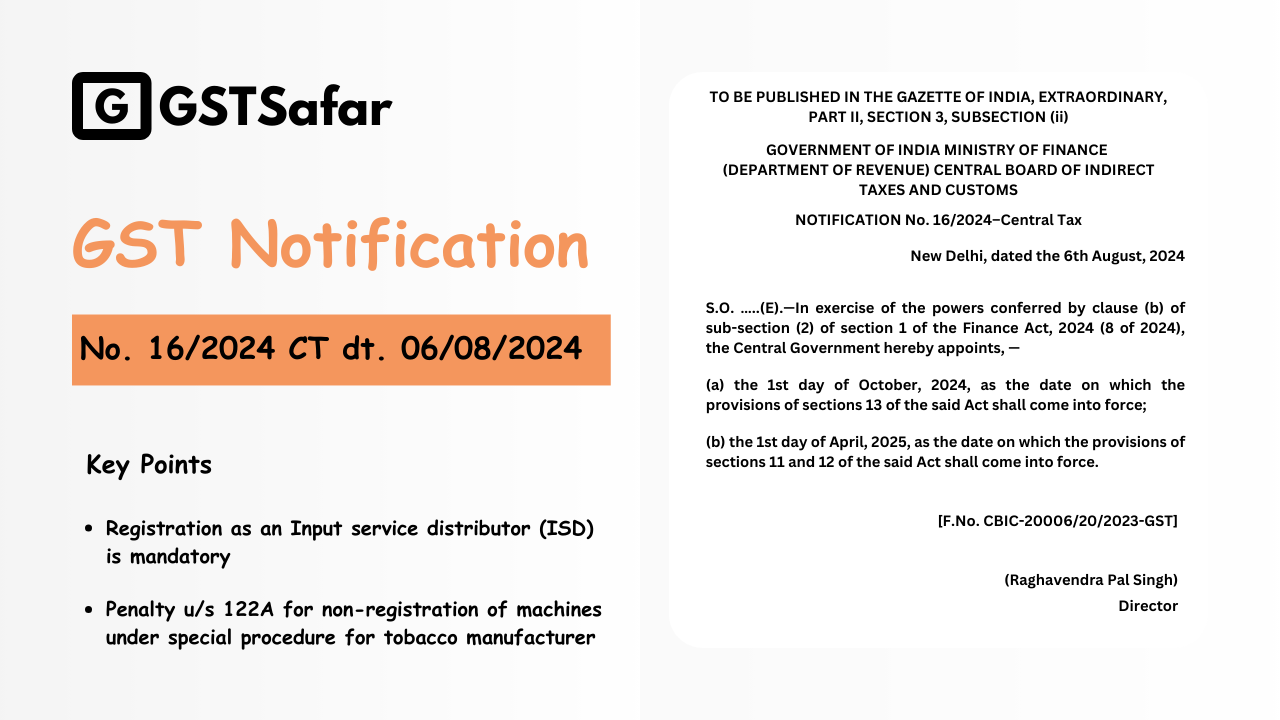

Summary of GST Notification No 16/2024 – CT dated 06-08-2024:

This Notification GST No 16/2024-CT dated 06-08-2024 provides updates related to Input service distributors and the Penalty under section 122A for non-registration of Machines under the special procedure for tobacco manufacturers. The Changes regarding input service distributors are outlined in sections 11 and 12 of the Finance Act,2024. The Penalty provision under section 122A is addressed in section 13 of the Finance Act,2024 as proposed in the Finance Bill 2024 – Part-1.

List of Major Points of the GST Notification No 16/2024:

- Registration as an Input service distributor is mandatory for credit distribution effective from 01-04-2025.

- Penalty u/s 122A for non-registration of machines under special procedure for tobacco manufacturers.

1. Registration as an Input service distributor (ISD) is mandatory for credit distribution effective from 01-04-2025

With effect from 01-04-2025, any office of the supplier of goods or services, or both, that receives tax invoices for input services is required to get registered as an Input service distributor u/s 24 to distribute credit for all invoices, including RCM invoices, from HO to branches or units of the same business registered under the same PAN, in the manner prescribed in Section 20 of the CGST Act, 2017.

Detailed Analysis:

- In the Finance Bill 2024, the government has proposed compulsory registration u/s 24 as an Input service distributor for suppliers who receive tax invoices for input services to distribute credit among the branches for all invoices, including RCM Invoices.

- As a result, from 01-04-2025 suppliers who receive the tax invoices for input service are required to register as ISD to distribute the credit of all the invoices, including RCM invoices, in the manner specified in section 20 of CGST Act,2017.

Note: Provisions of Sections 11 & 12 of the Finance Act 2024 are made effective from 01-04-2025 by GST Notification No 16/2024 CT dated 06-08-2024.

2. Penalty u/s 122A for non-registration of machines under special procedure for tobacco manufacturer

The Penalty provision for non-registration of machines under special procedure by tobacco manufacturers, proposed in finance bill 2024, will be applicable from 01-10-2024 under section 122A of CGST Act,2017.

Detailed Analysis:

- As per Notification No.04/2024- Central tax dated 05-01-2024, every Registered person engaged in tobacco manufacturing is required to register their machines as per the procedure notified u/s 148.

- The government has proposed a new section 122A for penalties, seizure and confiscation of machines in case of failure of register machines used in the manufacture of goods as per special procedure in this budget 2024.

- With effect from 01-10-2024, a penalty of Rs.1 lakh will be applicable for every machine not registered as per section 122A of CGST Act, 2017. In addition to penalties, every machine shall be liable for search and confiscation. However, if an imposed penalty is paid & machines are registered within 3 days of receipt of communication of the order of penalty then such machines will not be confiscated.

Note: Provisions of Section 13 of the Finance Act 2024 are made effective from 01-10-2024 by GST Notification No 16/2024 CT dated 06-08-2024.

Download – GST Notification No 16/2024-CT dated 06-08-2024