GST Advisory on Electronic Credit Reversal and Re-claimed Statement has been issued by the government. The Government introduced certain changes in Table 4 of Form GSTR-3B so as to enable the taxpayers in reporting correct information regarding ITC availed, ITC reversal, ITC re-claimed and ineligible ITC “Vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 (read with circular 170/02/2022-GST, Dated 6th July,2022),. The re-claimable ITC earlier reversed in Table 4(B) 2 may be subsequently claimed in Table 4(A) 5 on fulfilment of necessary conditions. Such reclaimed ITC in Table 4(A) 5 also needs to be explicitly reported in Table 4D (1).

Notification No.14/2022-Central Tax dated 05-07-2022

As per Notification No.14/2022-Central Tax dated 05-07-2022 following changes has been take place in Table 4 of GSTR-3B FORM.

| Details | Integrated Tax | Central Tax | State/UT Tax | Cess |

| (1) | (2) | (3) | (4) | (5) |

| (A) ITC Available (whether in full or part) | ||||

| (1) Import of goods | ||||

| (2) Import of services | ||||

| (3) Inward supplies liable to reverse charge (other than 1 & 2 above) | ||||

| (4) Inward supplies from ISD | ||||

| (5) All other ITC | ||||

| (B) ITC Reversed | ||||

| (1) As per rules 38, 42 and 43 of CGST Rules and sub-section (5) of section 17 | ||||

| (2) Others | ||||

| (C) Net ITC Available (A) – (B) | ||||

| (D) Other Details | ||||

| (1) ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period | ||||

| (2) Ineligible ITC under section 16(4) and ITC restricted due to PoS provisions |

Note: ITC restricted due to POS provisions

For E.g. – ABC Ltd having GSTIN in the state of Gujarat booked a hotel for accommodation in the state of Maharashtra. Hence, The ITC of the Hotel accommodation is not eligible as the ABC Ltd. is not having a GST registration in the State of Maharashtra.

Circular 170/02/2022-GST Dated 06-07-2022

Circular 170/02/2022-GST dated 06-07-2022 states clarification for the above changes in Table 4 of GSTR-3B Form are as under:

Furnishing of information regarding ITC availed, reversal thereof and ineligible ITC in Table 4 of GSTR-3B

As of December 2020, Form GSTR-3B is auto-generated on the GST portal, with input tax credit (ITC) auto-populated from Form GSTR-2B and liabilities auto-populated from Form GSTR-1.

There is also some confusion about how to report information about the reversal of ITC and ineligible ITC in Table 4 of Form GSTR-3B.

Table 4(A) of Form GSTR-3B contains information about the input tax credit (ITC) that is available to the taxpayer. This information is auto-populated from Form GSTR-2B, which is a monthly statement of inward supplies.

Certain reversals of ITC must be made by the taxpayer in Table 4(B) of Form GSTR-3B. These reversals are required under Rule 42 and Rule 43 of the CGST Rules, which deal with the reversal of ITC on account of supply of exempted goods or services, and on account of capital goods used for non-business purposes, respectively.

The passage notes that different practices are being followed by taxpayers to report ineligible ITC and various reversals of ITC in Form GSTR-3B. This could lead to errors and inconsistencies in the filing of returns.

The net ITC available is calculated by deducting the ineligible ITC and the reversals of ITC from the total ITC available.

The ineligible ITC is ITC that is not allowed under the GST law, such as ITC on inputs used for non-business purposes.

The reversals of ITC are ITC that must be reversed due to certain events, such as the supply of exempted goods or services.

The ITC that is credited to the ECL can be used to offset future tax liabilities up to the amount of eligible ITC available.

The facility of a static monthly auto-drafted statement in Form GSTR-2B has been introduced for all registered persons from August 2020.

This statement provides invoice-wise total details of ITC available to the registered person, including the details of the ITC on account of import of goods.

The details of this statement are auto-populated in Table 4 of Form GSTR-3B, which can be edited by the registered person.

It is important to note that the entire set of data that is available in Form GSTR-2B is carried over to Table 4 of Form GSTR-3B, except for the details regarding ITC that is not available to the registered person either on account of limitation of time period or where the recipient of an intra-State supply is located in a different State/UT than that of the place of supply.

The ineligible ITC, which was earlier not part of the calculation of eligible/available ITC, is now part of the calculation of eligible/available ITC in view of the auto-population of Table 4(A) of Form GSTR-3B from various tables of Form GSTR-2B.

The registered person is required to identify ineligible ITC as well as the reversal of ITC to arrive at the net ITC available, which is to be credited to the ECL.

The following procedure is to be followed by the registered person for correct reporting of information in the return:

- Download Form GSTR-2B from the GST portal.

- Review the details of ITC available in Form GSTR-2B.

- Identify any ineligible ITC and reversals of ITC.

- Make the necessary adjustments to the ITC available in Table 4 of Form GSTR-3B.

- File Form GSTR-3B

Total ITC (eligible and ineligible) is auto-populated from Form GSTR-2B in different fields of Table 4A of Form GSTR-3B.

The ineligible ITC on account of limitation of time period or where the recipient of an intra-State supply is located in a different State/UT than that of the place of supply is not auto-populated.

The registered person will report the reversal of ITC in Table 4(B) (1) if the reversal is absolute in nature and is not reclaimable. This includes reversals on account of rule 38, rule 42, and rule 43 of the CGST Rules and for reporting ineligible ITC under section 17(5) of the CGST Act.

The registered person will report the reversal of ITC in Table 4(B) (2) if the reversal is not permanent in nature and can be reclaimed in future subject to fulfilment of specific conditions. This includes reversals on account of rule 37 of CGST Rules, section 16(2) (b) (goods/service has not received) and section 16(2) (c) (Supplier has not make the payment to Govt) of the CGST Act. Such ITC may be reclaimed in Table 4(A) (5) on fulfilment of necessary conditions.

Table 4(B) (2) may also be used by the registered person for reversal of any ITC availed in Table 4(A) in previous tax periods because of some inadvertent mistake.

The net ITC available will be calculated in Table 4(C) of Form GSTR-3B, which is the difference between the total ITC available (Table 4(A)) and the reversals of ITC (Table 4(B) (1) and Table 4(B) (2)).

The details of ineligible ITC under section 17(5) are being provided in Table 4(B), so there is no need to report them in Table 4(D) (1).

ITC not available on account of limitation of time period or where the recipient of an intra-State supply is located in a different State/UT than that of the place of supply may be reported by the registered person in Table 4(D)(2).

The reversal of ITC of ineligible credit under section 17(5) or any other provisions of the CGST Act and rules thereunder is required to be made under Table 4(B) and not under Table 4(D) of Form GSTR-3B.

Let’s understand with example.

Illustration:

A Registered person M/s ABC is a manufacturer (supplier) of goods. He supplies both taxable as well as exempted goods. In a specific month, say April, 2022, he has received input and input services as detailed in Table 1 below. The details of auto-population of Input Tax Credit on all Inward Supplies in various rows of Table 4 (A) of FORM GSTR-3B are shown in column (7) of the Table 1 below:

Table -1

| Sr No | Details | IGST | CGST | SGST | Total | Remarks |

| 1 | ITC on Import of goods | 100000 | – | – | 100000 | Auto-populated in Table 4(A)(1) |

| 2 | ITC on Import of Services | 50000 | – | – | 50000 | |

| 3 | ITC on Inward Supplies under RCM | – | 25000 | 25000 | 50000 | Auto-populated in Table 4(A)(3) |

| 4 | ITC on Inward Supplies from ISD | 50000 | – | – | 50000 | Auto-populated in Table 4(A)(4) |

| 5 | ITC on other inward supplies | 200000 | 150000 | 150000 | 500000 | Auto-populated in Table 4(A)(5) |

| 6 | Total | 400000 | 175000 | 175000 | 750000 |

Other relevant facts:

Note 1: Of the other inward supplies mentioned in row (5), M/s ABC has received goods on which ITC is barred under section 17(5) of the CGST Act having integrated tax of Rs. 50,000/-

Note 2: In terms of rule 42 and 43 of the CGST Rules, M/s ABC is required to reverse ITC of Rs. 75,500/- integrated tax, Rs. 52,000/- central tax and Rs. 52,000/- state tax

Note 3: M/s ABC had not received the supply during April, 2022 in respect of an invoice for an inwards supply auto-populated in row (5) having integrated tax of Rs. 10,000/-.

Note 4: M/s ABC has reversed ITC of Rs. 500/- central tax and Rs. 500/- state tax on account of Rule 37 i.e. where consideration was not paid to the supplier within 180 days.

Note 5: An amount of ITC of Rs 10,000/ central Tax and Rs 10,000/- state tax, ineligible on account of limitation of time period as delineated in sub-section (4) of section 16 of the CGST Act, has not been auto-populated in Table 4(A) of FORM GSTR-3B from GSTR-2B.

Answer:

Based on the facts mentioned in Table 1 above, M/s ABC is required to avail ITC after making necessary reversals in Table 4 of FORM GSTR-3B as detailed in Table 2 below:

| Details | IGST | CGST | SGST/UTGST | Explanation |

| A) ITC Available (whether in full or part) | – | – | – | |

| 1. Import of Good | 100000 | – | – | |

| 2. Import of Services | 50000 | – | – | |

| 3. Inward Supplies liable to Reverse Charge (other than 1 & 2 above) | – | 25000 | 25000 | |

| 4. Inward Supplies from ISD | 50000 | – | – | |

| 5. All other ITC | 200000 | 150000 | 150000 | |

| B) ITC Reversed / Reduced | – | – | – | |

| 1. Reversal of ITC as per rule 42 and 43 of CGST Rules | 125500 | 52000 | 52000 | 1. Refer para 4.3 (B) of circular 2. Reversal of Rs. 75,500/- integrated tax, Rs. 52,000/- central tax and Rs. 52,000/- state tax under rule 42 and 43 [Note 2] 3. Ineligible ITC of Integrated tax of Rs. 50,000/- under section 17(5) [Note 1 |

| 2. Others | 10000 | 500 | 500 | 1. Refer para 4.3 (C) of circular 2. Reversal of integrated tax of Rs. 10,000/-, where supply is not received [Note 3] 3. Reversal of ITC of Rs 500/- central tax and Rs 500/- state tax on account of Rule 37 [Note 4] |

| (C) Net ITC Available (A)-(B) | 2,64,500 | 122500 | 122500 | C=A1+A2+A3+A4+A5-B1-B2 |

| (D) Ineligible ITC | ||||

| 1. As per section 17(5) | – | – | – | 1. Refer para 4.3 (E) of circular. 2. Reversals under section 17(5) are not required to be shown in this row. The same are to be shown under 4(B)(1) |

| 2. Others | – | 10000 | 10000 | 1. Refer para 4.3(F) of circular 2. Ineligible ITC on account of limitation of time period as delineated in sub-section (4) of section 16 of the CGST Act, which has not been auto-populated in Table 4(A) of GSTR-3B |

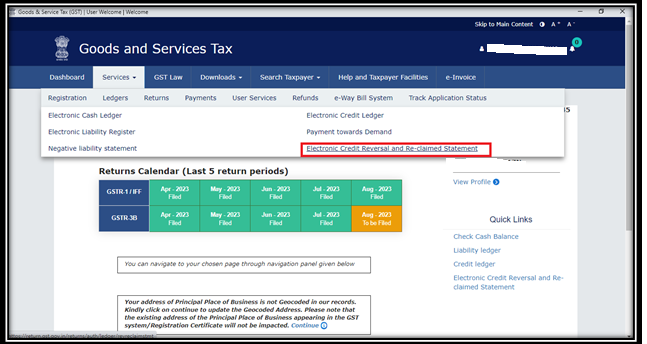

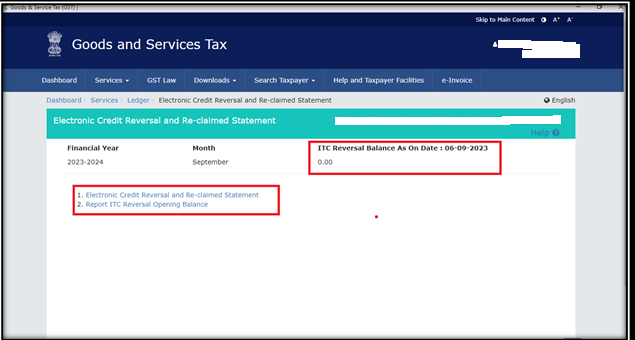

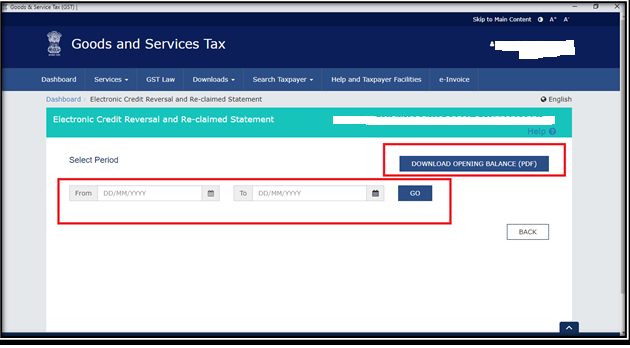

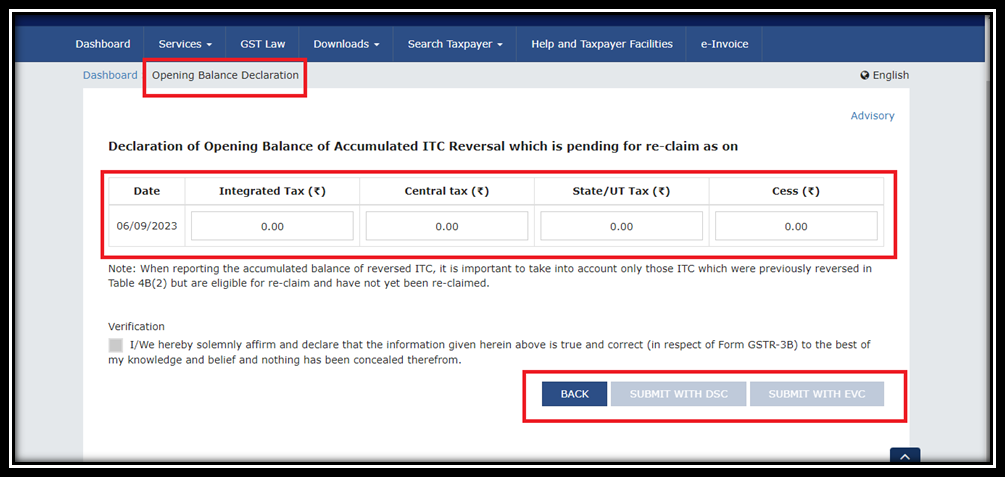

Print Screens of GST portal for Electronic Credit Reversal and Re-claimed Statement

Read similar article