In GST looking to complexity, ambiguity, technical problems in portals, different of opinions between GST Officers and tax payers, huge notifications, frequent amendments in GST law, next coming years the court will be over burdened with huge GST Appeals. Today already there are huge pending appeals in various courts for old tax regimes like service, tax, excise and VAT.

So now all taxpayers, GST consultants, accountants, advocates must be aware with all the provisions of appeals and revision under GST. This article has been prepared to give the details of legal provisions regarding this topic in easy language and in table form. I hope after reading this entire article, all the readers will be having more clarity for this topic.

Before I start this topic, I would like to say Show Cause Notice is the beginning point of any litigations. Question of filling appeal under GST is raised only after adjudication of Show Cause Notice. Therefore, if you want to know about the appeal in gst, we should start learning first about SCN and its adjudication. So I start this article with concept of Show Cause Notice.

Table of Contents

ToggleShow Cause Notice in GST

Show cause notice under GST can be issued under Section 73 or Section 74 of CGST Act, 2017.

Show cause shall be issued under following circumstances

- Tax not paid

- Tax Short Paid

- ITC wrongly availed/utilised

- Erroneous refund

Note: Here only circumstances covered under Section73/74 of CGST Act 2017 only covered. Kindly note that SCN can be issued in many other circumstances also. e.g rejection of registration application.

Time limit to issue Show Cause Notice

In the case other than fraud or any willful-misstatement or suppression of facts to evade tax- (Section 73 of CGST Act 20170

Within 33 months from the due date of filling of annual return of the Financial Year to which such tax amount relates

OR

Within 33 months from the date of erroneous refund if matter relates to refund

In the case of fraud or any willful-misstatement or suppression of facts to evade tax- (Section 74 of CGST Act, 2017)

Within 4.5 years from the due date of filling of annual return of the Financial Year to which such tax amount relates

OR

Within 4.5 years from the due date of filling date of erroneous refund if matter relates to refund

Who can issue Show Cause Notice in GST?

Who can issue SCN in GST? Answer of this question depends upon the monetary limit in SCN

Circular 31/05/2018 dated 09.02.2018

| Monetary Limit for SCN in GST | Authority who can issue SCN in GST |

|---|---|

| CGST Up to Rs 10 lakhs Or IGST Up to Rs 20 lakhs Or CGST+SGST up to Rs 20 lakhs | Superintendent of Central Tax |

| CGST above Rs 10 lakhs but up to Rs 1cr Or IGST above Rs 20 lakhs but up to Rs 2 cr Or CGST+SGST above Rs 20 lakhs but up to Rs 2 cr | Deputy or Assistant Commissioner of Central Tax |

| CGST above Rs 1 cr Or IGST above Rs 2 cr Or CGST+SGST above Rs 2 cr | Additional or Joint Commissioner of Central Tax |

Order of Adjudicating Authority in GST

Section 73 (10) and Section 74(10)

- First of all SCN is issued under Section 73 or 74

- Then reply to SCN in GST is given by assessee

- Then hearing is held

Then based on reply to SCN in GST and representation made during the hearing, adjudicating authority shall pass the order either confirming the liability of SCN or liability may be dropped

Such order shall be passed within following time limit

| In the case other than fraud or any willful-misstatement or suppression of facts to evade tax- | In the case of fraud or any willful-misstatement or suppression of facts to evade tax- |

|---|---|

| Within 3 years from the due date of filling of annual return of the Financial Year to which such tax amount relates OR Within 3 years months from the date of erroneous refund if matter relates to refund | Within 5 years from the due date of filling of annual return of the Financial Year to which such tax amount relates OR Within 5 years from the due date of filling date of erroneous refund if matter relates to refund |

Appeals to Appellate Authority in GST

Section 107 of CGST Act, Rule 108, 109 and 109A of CGST Rules 2017, Notification 02/2017 Central Tax dated 19th June 2017

Who can file appeal to Appellate Authority in GST ?

| Appeal by Assessee | Appeal by Department |

|---|---|

| If assessee is agrrived by any decision or order passed by Adjudicating authority then he shall file appeal to Appellate Authority | •Commissioner may call for and examine the record of proceedings in which order has been passed •Commissioner may direct any officer subordinate to him to apply to the appellate authority •In pursuance of such direction of commissioner, authorized officer shall make an application to Appellate Authority and the same shall be deemed to be appeal |

Appellate Authority in GST

Notification 02/2017 Central Tax

- Commissioner of Central Tax (Appeals)

- Additional Commissioner of Central Tax (Appeals)

- Joint Commissioner of Central Tax (Appeals)

Appeal to which Appellate Authority in GST?

Rule 109A of CGST Rules 2019

| Appeal to Commissioner (Appeal) | Appeal to Joint Commissioner or Additional Commissioner (Appeal) |

|---|---|

| If order passed by Additional or Joint Commissioner | If order passed by Deputy or Assistant Commissioner or the Superintendent |

Time limit of filling appeal to appellate authority in GST

| Appeal by Assessee | Appeal by Department |

|---|---|

| Within three months from the date on which the said decision or order of adjudicating authority is communicated | Within six months from the date on which the said decision or order of adjudicating authority is communicated |

Important points for filling appeal to appellate authority in GST.

| Sr No. | Topic | Details |

|---|---|---|

| 1 | Extension of date for filling appeal | If appeal could not be filed within 3 or 6 months as the case may be, then appellant authority can grant extension of further one month if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within time limit. |

| 2 | Pre-Deposit | 10% of tax amount liability confirmed by Adjudicating Authority will have to be paid. Maximum Rs 25 cr . It must be paid before filling of appeal . Once it is paid recovery proceedings for the balance amount shall be deemed to be stayed` |

| 3 | Hearing | Opportunity of hearing shall be granted before Appellate Authority passes the order Adjournment to the hearing can be granted if sufficient cause is shown. However maximum three adjournment can be granted |

| 4 | Additional Ground in appeal. | Statement of facts and complete ground of appeal is to be mentioned in appeal. Once appeal if filed, and thereafter appellant wants to add any additional ground, then the same can be added in appeal as additional ground. Such additional ground of appeal can be added in hearing. . However Appellate Authority will accept such additional ground only if he is satisfied that such omission of ground was not willful or unreasonable |

| 5 | Remand Back | Appellate authority can not remand back the case to adjudicating authority. Appellate Authority will have to pass order confirming, modifying or annulling the decision or order appealed against. |

| 6 | Decision of appeal | Appellate Authority will hear and decide every appeal within a period of one year from the date on which such appeal is filed. This is only to the extent possible. Not compulsory. |

| 7 | Copy of order | Shall be communicated to appellant , respondent and adjudicating authority . Also to jurisdictional commissioner |

| 8 | FORMS | FORM GST APL-01 for filling appeal to Appellate Authority Provisional acknowledgment shall be issued to the appellant immediately FORM GST APL-03 for application to the Appellate Authroity (Means appeal by department) • FORM GST APL-02 for sending certified copy of Order appealed against (it is to be submitted within 7 days of filling appeal |

| 9 | Date of filling appeal | If certified copy of order appeal against is submitted within 7 days of filling of GST APL-01, then date of filling of appeal shall be the date of issue of provisional acknowledgment If certified copy of order appeal against is submitted after 7 days of filling of GST APL-01, then date of filling of appeal shall be the date of submission of such copy Appeal shall be treated as filed only when the final acknowledgement, indicating the appeal number, is issued. |

Revisional Authority in GST

Section 108 of CGST Act

Revisional Authority may revise the Order passed under CGST Act under the following circumstances

- Order is erroneous in so far as it is prejudicial to the interest of revenue and is illegal or improper or has not take into account certain material facts

- As consequence of an observation by the Comptroller and Auditor General of India

- Revisional Authority will revise such order on his on motion or upon information received by him or on request from the Commissioner of State Tax or the Commissioner of Union Territory Tax

- Revisional Authority can revise such order within three years from the from date of passing order sought to be revised.

- If appeal filed and any point has not been raised and decided in an appeal the time limit to revise the order is three years from the date of order sought to revised or one year from the date of order in appeal which ever is later

Order can not be revised under the following circumstances

- Order is subject to appeal under section 107 or 112 or 117 or 118

- Time limit of filling appeal by Department against the order of adjud

- icating authority has not expired [(Section 107(2)]

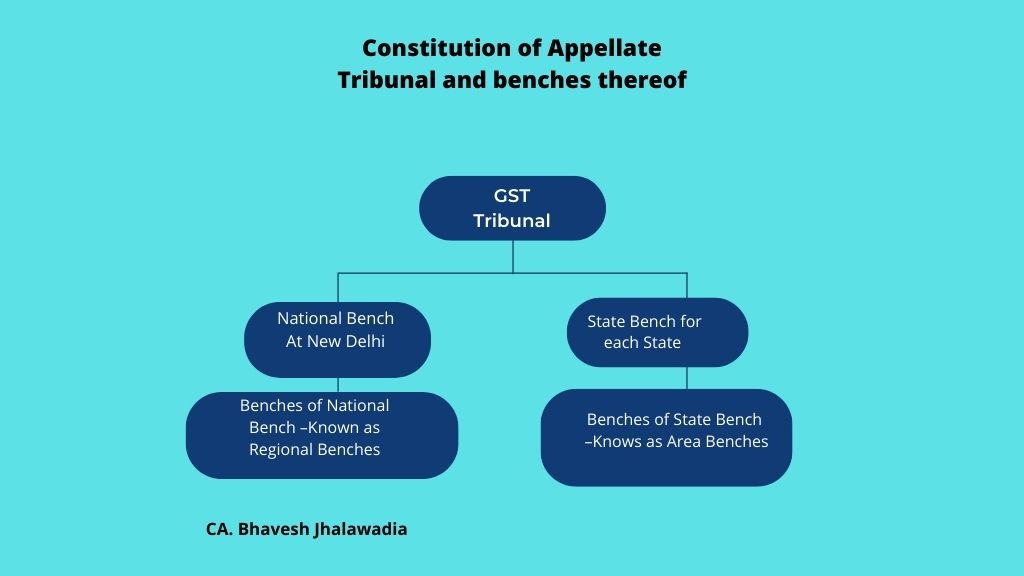

Constitution of GST Appellate Tribunal

Section 109 of CGST Act

The Government shall, on the recommendations of the Council, by notification, constitute with effect from such date as may be specified therein, an Appellate Tribunal known as the Goods and Services Tax Appellate Tribunal for hearing appeals against the orders passed by the Appellate Authority or the Revisional Authority.

National Bench

Members in National Bench

National bench shall be presided over by President. There will be Technical member (State) and another Technical Member (State)

Benches of National Bench –Known as Regional Benches. There will be Judicial Member and Technical Member (Center)/Technical Member (State)

Jurisdiction of National Bench

Jurisdiction to hear appeals against the orders passed by the Appellate Authority or the Revisional Authority in the cases where one of the issues involved relates to the place of supply.

State Bench

Members of State Bench

State bench for each state shall be presided over by President. There will be Technical member (State) and another Technical Member (State)

Benches of State Bench –Knows as Area Benches

Jurisdiction of State Bench

Hear appeals against the orders passed by the Appellate Authority or the Revisional Authority in the cases involving matters other than place of supply

Procedure before Appellate Tribunal in GST

The Appellate Tribunal shall, for the purposes of discharging its functions under this Act, have the same powers as are vested in a civil court under the Code of Civil Procedure, 1908 (5 of 1908.) while trying a suit in respect of the following matters, namely:-

a)summoning and enforcing the attendance of any person and examining him on

oath;

(b) requiring the discovery and production of documents;

(c) receiving evidence on affidavits;

(d) subject to the provisions of sections 123 and 124 of the Indian Evidence Act,

1872, (1 of 1872.) requisitioning any public record or document or a copy of such

record or document from any office;

(e) issuing commissions for the examination of witnesses or documents;

(f) dismissing a representation for default or deciding it ex parte;

(g) setting aside any order of dismissal of any representation for default or any order

passed by it ex parte; and

(h) any other matter which may be prescribed.

Appeal to Appellate Tribunal in GST

Section 112 of CGST Act, Rule 110, 111 , 112 and 113 of CGST Rules 2017

Who can file appeal to Appellate Tribunal in GST?

| Appeal by assessee | Appeal by Department |

|---|---|

| If assessee is agrrived by any order passed by Appellant Authority or Revisional Authority then he shall file appeal to Appellate Tribunal | •Commissioner may call for and examine the record of proceedings in which order has been passed •Commissioner may direct any officer subordinate to him to apply to the appellate authority •In pursuance of such direction of commissioner, authorized officer shall make an application to Appellate Tribunal and the same shall be deemed to be appeal |

Cross Objection by Respondent in GST

The party against whom the appeal has been preferred may file memorandum of cross objections against any party of the order appealed against and such memorandum shall be disposed of by Appellate Tribunal, as if it were an appeal presented

Time limit of filling appeal in GST before Appellate Tribunal

| Appeal by Assessee | Appeal by Department |

|---|---|

| Within three months from the date on which the said order of Appellate Authority is communicated | Within six months from the date on which the said order of Appellate Authority is communicated |

Time limit for filling Memorandum of Cross Objections in GST

| By respondent |

|---|

| Within 45 days of receipt of notice of filling appeal by appellant |

Important points for appeal to Appellate Tribunal in GST

| Sr No | Topic | Details |

|---|---|---|

| 1 | Extension of date for filling appeal /cross objection | If appeal could not be filed within 3 or 6 months as the case may be, then appellant tribunal can grant extension of further three months if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within time limit. By the same way can extent further period of 45 days in the case of delay in filling cross objection. |

| 2 | Pre-Deposit | 20% of tax amount liability confirmed in addition to the amount paid as pre deposit at the time of filling appeal to Appellate Authority . Maximum Rs 25 cr . It must be paid before of filling appeal. Once it is paid recovery proceedings for the balance amount shall be deemed to be stayed` |

| 3 | Hearing | Opportunity of hearing shall be granted before Appellate Tribunal passes the order Adjournment to the hearing can be granted if sufficient cause is shown. However maximum three adjournment can be granted |

| 4 | Production of Additional Evidence | Only evidences produced during the course of the proceedings before the adjudicating authority are allowed to be produced before Appellate Tribunal. However under following circumstances additional evidences are allowed to be produced Where Adjudicating Authority or Appellate Authority had refused to admit evidences Where appellant was prevented from producing evidences by Adjudicating Authority or Appellate Authority Where Adjudicating Authority or Appellate Authority made the order without giving opportunity to appellant to produce evidences |

| 5 | Remand Back | Appellate Tribunal can refer the case back to the Appellate Authority or the Revisional Authority or to the original adjudicating authority for fresh adjudication after taking additional evidence if necessary |

| 6 | Decision of appeal | Appellate Tribunal will hear and decide every appeal within a period of one year from the date on which such appeal is filed. This is only to the extent possible. Not compulsory. |

| 7 | Copy of order | Shall be communicated to Appellate Authority or the Provisional Authority or to the original adjudicating authority , appellant. Also to jurisdictional commissioner |

| 8 | FORMS | FORM GST APL-05 for filling appeal to Appellate Tribunal Provisional acknowledgment shall be issued to the appellant immediately FORM GST APL-06 for filling Memorandum of Cross Objections FORM GST APL-07 for application to the Appellate Tribunal (Means appeal by department) FORM GST APL-02 for sending certified copy of Order appealed against (it is to be submitted within 7 days of filling appeal. |

| 9 | Date of filling appeal | If certified copy of order appeal against is submitted within 7 days of filling of GST APL-05, then date of filling of appeal shall be the date of issue of provisional acknowledgment If certified copy of order appeal against is submitted after 7 days of filling of GST APL-05, then date of filling of appeal shall be the date of submission of such copy Appeal shall be treated as filed only when the final acknowledgement, indicating the appeal number, is issued. |

| 10 | Fees for filling appeal | Rs 1000 for every one lakh rupees of liability determined . Max Rs 25000 |

| 11 | Order | Order of appellate tribunal shall be in FORM GST APL-04 |

Interest on refund paid for admission of appeal in GST

Pre-deposit made at the time of appeal to Appellate Authority and or Appellate Tribunal shall be refunded along with interest if Order of Appellate Authority or Appellate Tribunal is in favor of appellant

Authorized Representative in GST

Section 116 of CGST Act

Following persons can be nominated by Assessee as Authored Representative to appeal before officer or Appellate Authority or Appellate Tribunal

- his relative or regular employee; or

- an advocate who is entitled to practice in any court in India, and who has not been debarred from practicing before any court in India; or

- any chartered accountant, a cost accountant or a company secretary, who holds a certificate of practice and who has not been debarred from practice;

- a retired officer of the Commercial Tax Department of any State Government or Union territory or of the Board who, during his service under the Government, had worked in a post not below the rank than that of a Group-B Gazetted officer for period of not less than two years: Provided that such officer shall not be entitled to appear before any proceedings under this Act for a period of one year from the date of his retirement or resignation; or

Appeal to High Court in GST

Section 117 of CGST Act and Rule 114 of CGST Rules 2017

Who can file appeal to High Court in GST ?

Any person aggrieved by any order passed by the State Bench or Area Benches of the Appellate Tribunal may file an appeal to the High Court

What is time limit for filling appeal in High Court?

Time limit to file appeal in High Court is 180 days from the date of receipt of order by aggrieved person

Can high court entertain appeal in GST after expirty of time period to file appeal?

Yes if it is satisfied that there was sufficient cause for not filing it within such period.

A question of law

SC in case of Chunilal V. Mehta V.Century Spinning AIR

Following test have been laid down to determine whether a substantial question of law is involved

a)To determine whether a substantial rights of parties are affected

b)Whether it is an open issue in the sense that issue is not settled by Supreme Court

c)Issue is not free from difficulty

d)It calls for a discussion for alternative view –

Important points for appeal to High Court in GST

| Sr No | Topic | Details |

|---|---|---|

| 1 | HC can entertain appeal even after expiry of period for filling appeal | If appeal could not be filed within 6 by the appellant, then High Court can entertain appeal if it is satisfied that there was sufficient cause for not filing it within such period. |

| 2 | Issue which HC may decide | The High Court may determine any issue which a) has not been determined by the State Bench or Area Benches; or (b) has been wrongly determined by the State Bench or Area Benches, by reason of a decision on such question of law as herein referred to in sub-section (3). |

| 3 | FORMS | Appeal shall be filed in FORM GST APL-08 |

Appeals to Supreme Court in GST

Who can file appeal to Supreme Court in GST?

An appeal shall lie to the Supreme Court-

from any order passed by the National Bench or Regional Benches of the Appell Tribunal; or from any judgment or order passed by the High Court

Note: Appeal can be filed to Supreme Court only if High Court certifies to be a fit one for appeal to the Supreme Court.

What is time limit for filling appeal in Supreme Court?

The GST Act does not provide any time limit to file appeal to Supreme Court in GST.

However, the order XX-B incorporated in the Supreme Court Rules, 1996 specified the time limit of 60 days for filling appeal under the Cetntral Excise Act and the Customs Act. It is expected that the same time will be specified for filling appeal to Supreme Court under GST Act.

Application for review of order of Supreme Court in GST

Application for review (reconsideration) of judgment of Supreme Court to be filed within 30 days. Hence, review proposal should be sent to Board within 10 days from the order. Review should be applied only in exceptional cases.

FAQs

Who can file appeal in GST?

If assessee is agrrived by any decision or order passed by Adjudicating authority/Appellate Authority then he can file appeal .

On director of commissioner , department can also file appeal against the order of Adjudicating/Appellate Authority.

What is the maximum time limit for filing appeal in GST?

Time limit of filling appeal in GST

Time limit for filling Appeal to Appellate Authority in GST and GST Appellate Tribunal

Assesee can file appeal within 3 months from the date of communication of order of adjudicating authority.

Department can file appeal within 6 months from the date of communication of order of adjudicating authority

For filling appeal to GST Appellate Tribunal

Time limit for filling Appeal to High Court

Assessee and department both can file appeal within 180 days from the date of communication of order of appellate tribunal

Time limit for filling Appeal to Supreme Court

The GST Act does not provide any time limit for filling the appeal to Supreme Court.

However, the order XX-B incorporated in the Supreme Court Rules, 1996 specified the time limit of 60 days for filling appeal under the Cetntral Excise Act and the Customs Act. It is expected that the same time will be specified for filling appeal to Supreme Court under GST Act.

Read more articles