Clarification on Adjudication of Show Cause Notice issued by DGGI

GST Circular has been issued for Clarification on Adjudication of Show Cause Notice issued by DGGI. Lets Understand this in simple way.

How the Changes take Place?

In 2017- Notification No 02/2017-CT dated 19-06-2017 specifies that which tax officers had jurisdiction for various GST Related matters.

In 2022- Notification No 02/2022-CT dated 11-03-2022 added new provision (Para 3A) to the 2017 Notification. This Notification empowered Additional and Joint Commissioner of Central taxe from certain Commissionerates to handle cases across all of india.This applied to cases where show cause notices were issued by officers of Directorate General of GST Intelligence (DGGI).

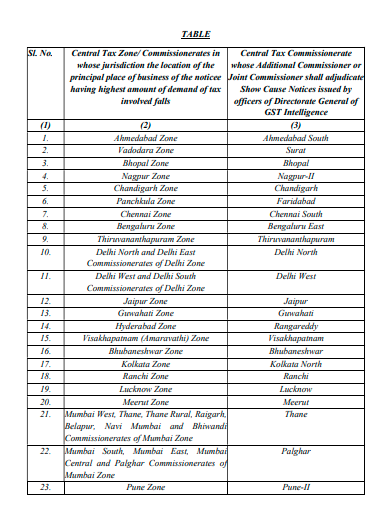

In 2024- Notification No 27/2024 dated 25-11-2024 has been issued to replace Table V in 2017 Notification. This update extended the list of Additional and Joint Commissioners of central tax who are authorised to adjudicate the Show cause notices. The Expanded list of empowered officers came in to effect from 01-12-2024.

What does this Circular Clarify ?

Circular clarifies that:

If DGGI issues show cause notices involving multiple entities or notices across different jurisdictions –

- Certain officers (Additional or Joint Commissioners ) are specially empowered to handled the case regardless of location or amount.

- The case is assigned based on the Highest tax demand and the location of the principal place of business of noticee involved. this ensures streamline process for adjudication.

DGGI issued the notices in the following cases:

- Where show cause notice is issued to multiple noticees, either having same or Different PANs or

- Where multiple show cause notices are issued on the same issue to multiple noticees having same PAN and the principal place of business of such noticees fall under the jurisdiction of multiple central tax commissionerates.

To Resolve the above situations :

1. Where show cause notice is issued to multiple noticees, either having same or Different PANs or:

Specific Additional Commissioners or Joint Commissioners of central tax in certain commissionerates are given All india Jurisdiction to hand the Show cause notices. (Notification No 02/2022-CT and Notification No 27/2024-CT are amended).

2. Where multiple show cause notices are issued on the same issue to multiple noticees having same PAN and the principal place of business of such noticees fall under the jurisdiction of multiple central tax commissionerates.

In case of multiple Show cause notices, the Principal Commissioner of GST Commissionerates will assigned one or more additional or joint commissioner to handle this cases. The Location of Principal place of business of noticee with the highest tax demand in the Show cause notice. The specified Zone or commissionerate linked to that location.

- If show cause notice is later issued to other people or entities with different PANs it will be handled by the same authority if there are multiple noticees and based on highest tax demand or it will handled by local authority if it is one person or entity involved.

- Show cause notice issued before 01-12-2024 will now handled by officers with All india jurisdiction and necessary corrigendum will issued to those show cause notices. This adjudication will follow the same rules regarding Highest tax demand.

Download – Circular No 239/33/2024