Why appeal withdrawn status matter for waiver scheme under GST

GST Advisory has been issued on 14-05-2025 for why appeal withdrawn status matter for waiver scheme under GST. There are two types of appeal withdrawal in GST portal.

1. Before final acknowledgement (APL-02):

If the taxpayer files a withdrawal application (APL-01W) before the final acknowledgement (APL-02) is issued by the appellate authority, then

- The system automatically withdraws the appeal.

- The status changes to Appeal withdrawn on the portal.

2. After final acknowledgement (APL-02):

If the withdrawal application is filed after the acknowledgement has been issued:

- Then the appeal can be withdrawn only after approval by the appellate authority

- once approved, the status also becomes “Appeal withdrawn.”

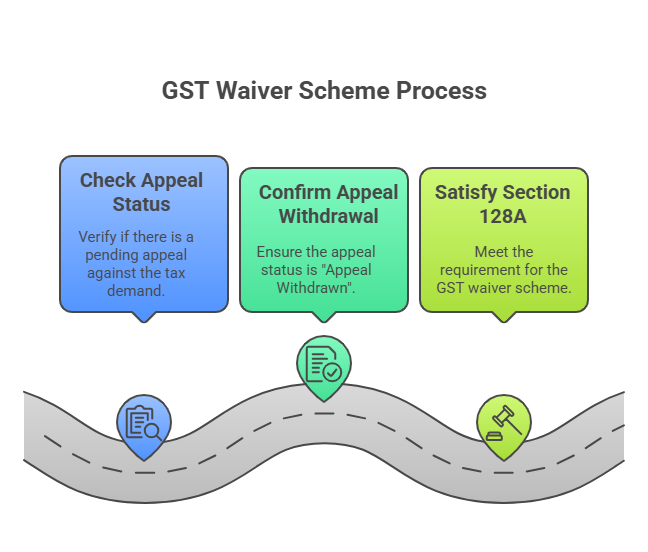

Why is this important for the waiver scheme under GST?

- As per the section 128A ,there should be no pending appeal against the tax demand.

- In both of the above cases, when the appeal status shows “Appeal Withdrawn”, it satisfies the requirement for the section 128A.

What should taxpayers do?

- While filing the waiver application, or if already filed, the taxpayer must upload a screenshot showing the status of the appeal as “Appeal Withdrawn” from the GST portal.

GST Advisory on Withdrawal of Appeal for section 128A pdf