Summary of the Validity of Notice/orders without digital signature of authority

GST Advisory has been issued for Validity of Notice/orders without digital signature of authority dated 26-09-2024.There is some confusion about whether documents like Show cause notices or orders issued by tax officers through the GST Common portal are valid if they don’t have digital signature on the PDF files you download.

- To clarify, these documents are generated on the common portal, and the officer who creates them is logged in using their Digital Signature. So, even though the PDF file itself may not show the digital signature, the document is still valid because the officer is already authenticated through their digital signature when they log in to the system.

- Document Created : The Officer logs in using their digital signature to access the system. so even if the PDF file does not have digital signature on the document, the document is still valid as the officer was authenticated when they logged in.

- No Physical signature required : Since these documents are created by the system at the officer ‘s command they do not need physical signature. The system stores the document details along with officer’s digital signature securely in special format called JSON.

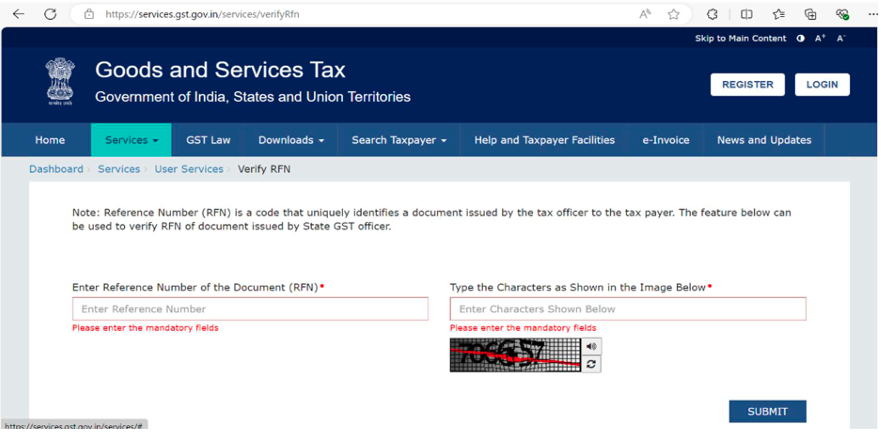

- How to verify the validity : Taxpayer can verify who issued the documents and for what purpose, both before and after logging into the GST Portal by navigating following Path:

Post-login: www.gst.gov.in–>Dashboard–>Services–>User Services–>Verify RFN

Additionally, it is important to know that all critical actions taken by tax officers on GST System require their digital signature for authentication. This ensures that only authorized officers can take certain actions such as :

- Issuing notices in any section of the portal

- Issuing orders in any section of the portal

- Issuing refund orders

Download – GST Advisory onValidity of Notice/orders without digital signature of authority