Introduction to Supply under GST (Section 7): Basics of GST

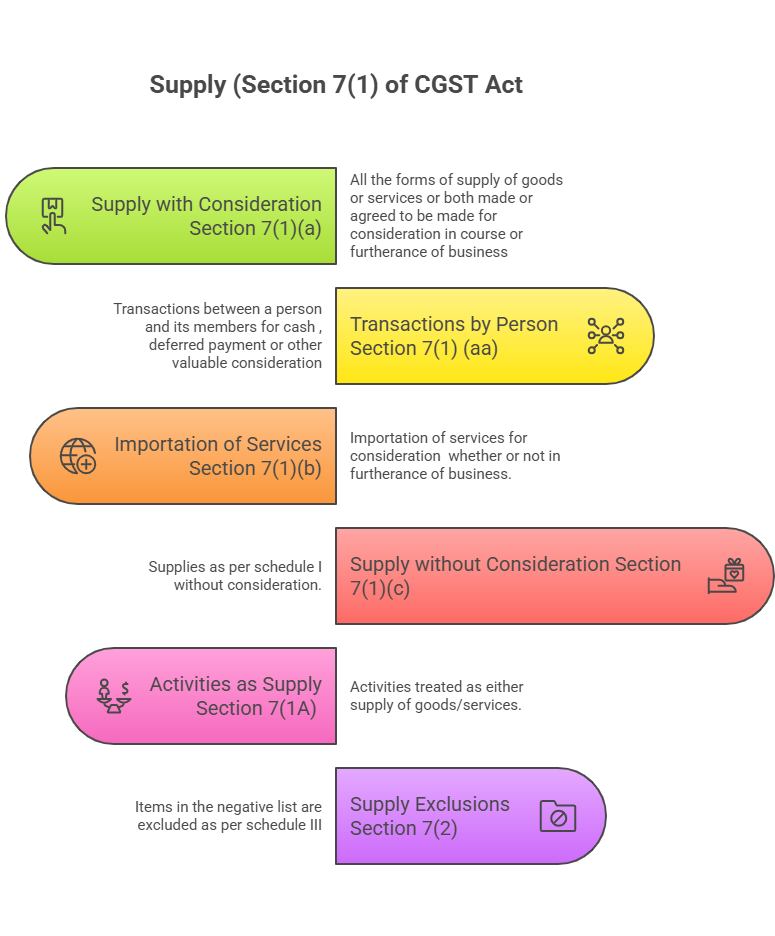

The term supply under GST (Section 7) is a broad term that merges all the taxable activities into a single activity. The supply is a taxable event in whose occurrence or happening tax is applicable. it means the tax becomes payable when liability to pay tax arises, and liability to pay tax arises by the happening of the taxable event.

What is Supply under GST?

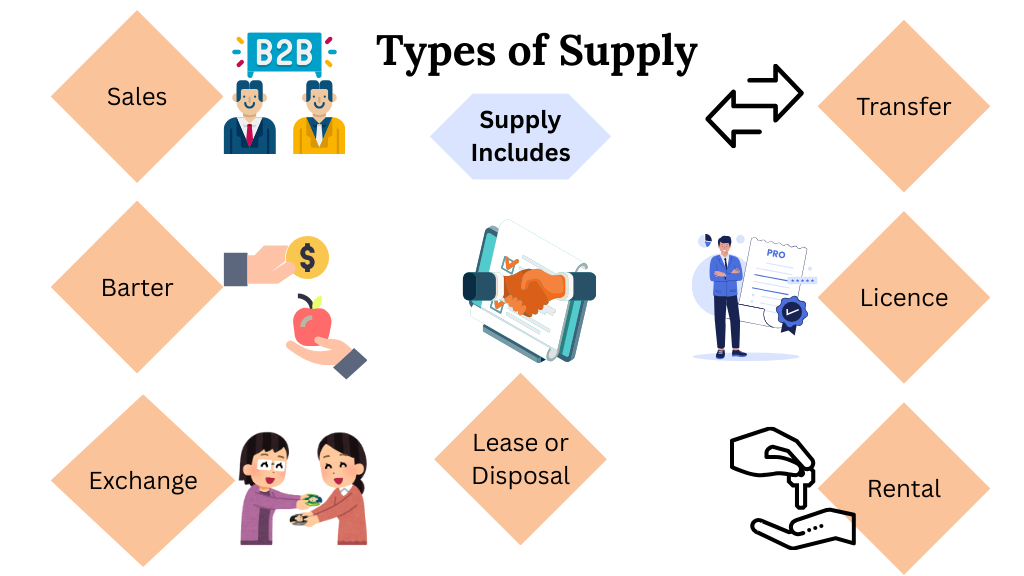

As we all know, GST is the tax charged on the supply of goods or services or both made or agreed to be made for consideration in the course or furtherance of business. So now it is important to know all the relevant terms in order to know about GST.

Let’s understand the supply in a simple chart format:

Goods and Service definition in GST with Example:

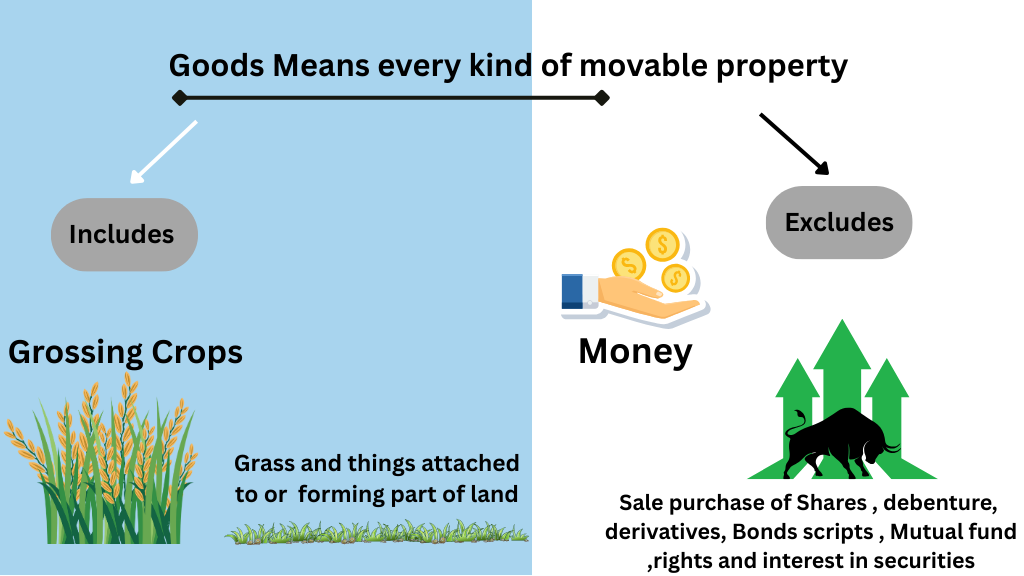

Definition of Goods (Sec 2(52) of CGST Act)

Goods means every kind of movable property other than Money and securities, but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

Definition of Services (Sec 2(102) of CGST Act)

“services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency, or denomination to another form, currency or denomination for which a separate consideration is charged;

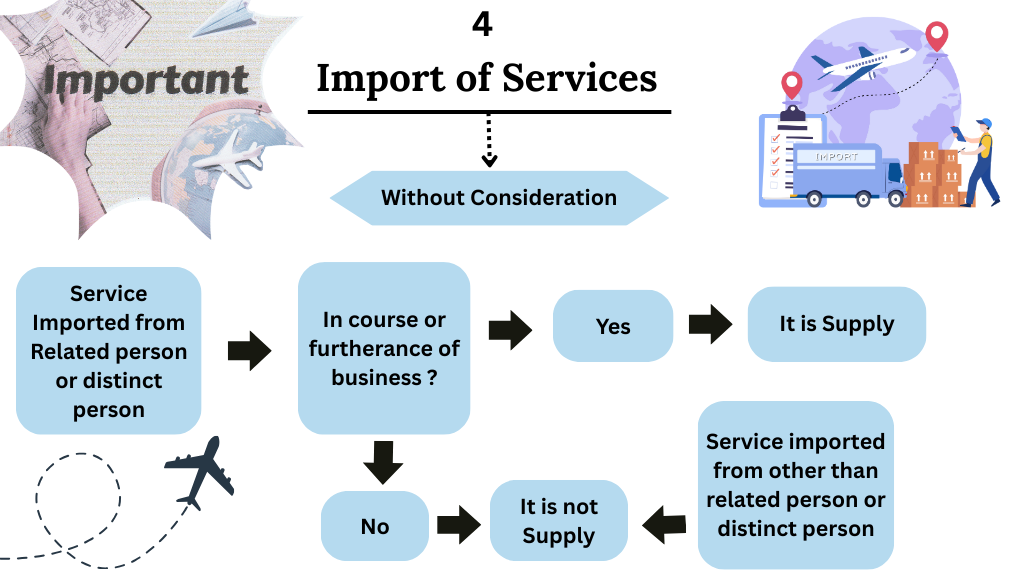

Section 7(1)(c) of the CGST Act states that activities are to be treated as a supply even if made without consideration.

Example 1: M Limited had purchased a Laptop for its business, and ITC on the same has been availed. After 3 years, said laptop will be permanently transferred to the trust for charitable purposes without any consideration. This transfer is permanent and is subject to GST.

Let’s understand the definition of related persons and distinct persons.

Related Person has defined in section 15 of CGST ACt. As per Explanation to section 15 of CGST Act , the following persons shall deemed to be related parties if :

| i) | such persons are officers or directors of one another’s businesses; |

| (ii) | such persons are legally recognised partners in business; |

| (iii) | such persons are employer and employee; |

| (iv) | any person directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares of both of them; |

| (v) | one of them directly or indirectly controls the other; |

| (vi) | both of them are directly or indirectly controlled by a third person; |

| (vii) | together they directly or indirectly control a third person; or |

| (viii) | they are members of the same family; |

Example: Mr. Keshav holds 35% shares of A Limited and 25% shares of B Limited. A Limited and B Limited are related persons.

Distinct Person:

Section 25(4) of the CGST Act, a person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

Establishment of Distinct Persons:

Section 25(5) of CGST Act, 2017, states that where a person who has obtained or is required to obtain registration in a state or union territory in respect of an establishment has an establishment in another state or union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this act.

Example: Mr. S. Trader has a registered office in Gujarat. He has also obtained registration in the state of Rajasthan in respect of his branch. Mr S shall be treated as distinct persons in respect of registrations in Gujarat and Rajasthan.

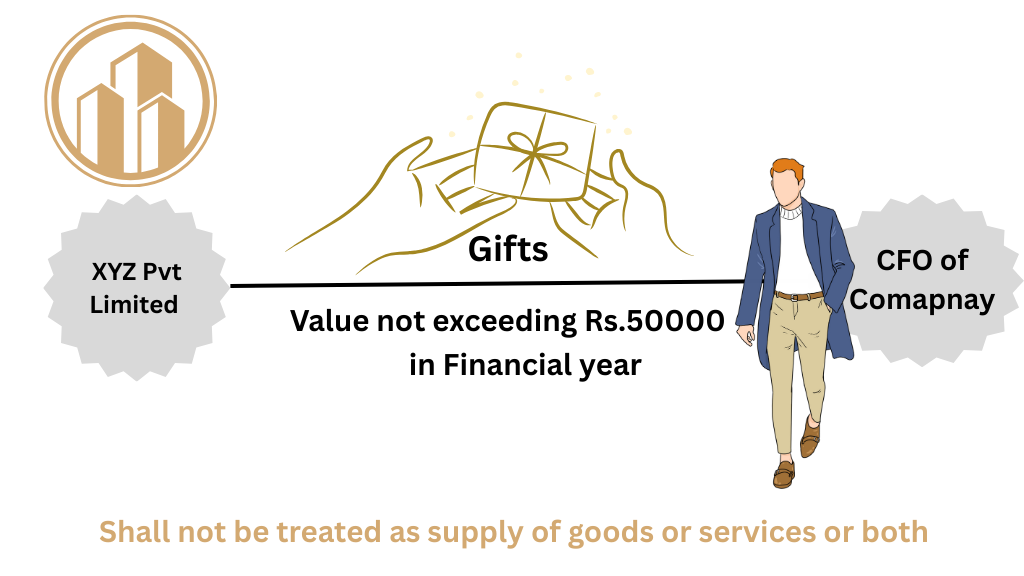

Employer and Employee Relations for Supply

However, as per Schedule III of the CGST Act (Negative List), supply by the employer to the employee in the course of employment is not treated as supplies of services and will not be subject to GST.

It is important to determine whether a principal-agent relationship falls within the scope of Para 3 of Schedule I of the CGST Act. To determine the relation between principal and agent, the only factor is whether the agent has the authority to pass and receive the title of goods on behalf of the principal. In simple words,

Where the invoice for further supply is being issued by the agent in his name, then any provision of goods from the principal to the agent would fall within the fold of para 3.

However, where the invoice is issued by the agent to the customer in the name of the principal, such agent shall not fall within the ambit of para 3 of the above.

(Circular No 57/31/2018 GST Dated 04-09-2018)

Example : Mr X appoints Mr.Y to sell certain goods in the market. Mr.Y arranges all the sales requirements and buyers from the market. The Invoice for the supply of goods is issued by Mr.Y on behalf of Mr.X but in his own name. In this case, Mr Y is not only providing services related to sales of goods but supplying goods on behalf of Mr.X. He has authority to transfer the title of goods on behalf of Mr.X. hence this scenario is covered under para 3 of Schedule I of CGST Act. (as discussed above).

However, in the case of the import of services with consideration, it is treated as a supply under section 7(1)(b) of the CGST Act, regardless of whether it is in the course of furtherance of business.

——————————————————————————————————-

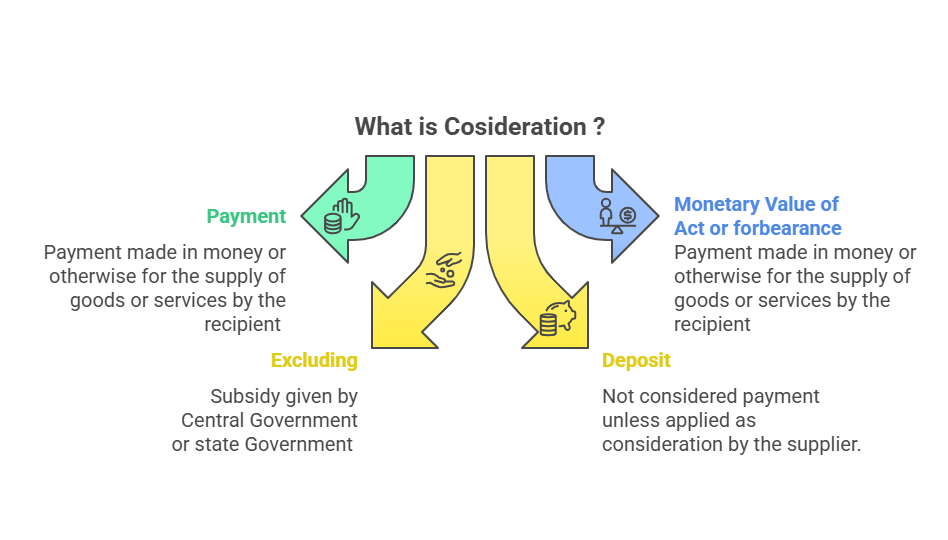

Consideration Under GST as per Section 2 (31) of CGST ACT