Specified Premises under GST | Is My Hotel a Specified Premises? Let’s Break it down.

When it comes to GST Compliance in hospitality sector, One term that is now under spotlight is “Specified Premises under GST. The very next question that naturally follows is – “Is My Hotel a Specified Premises?”. As we know that the new definition of specified premises comes into to effect from 01-04-2025. With this recent changes it is important for hotel owners and service providers to clearly understand what this term means and how it impacts their GST obligation. In this article, we will walk through the concept of Specified Premises in simple and practical way so you know exactly where your hotel stands.

What is the Specified Premises?

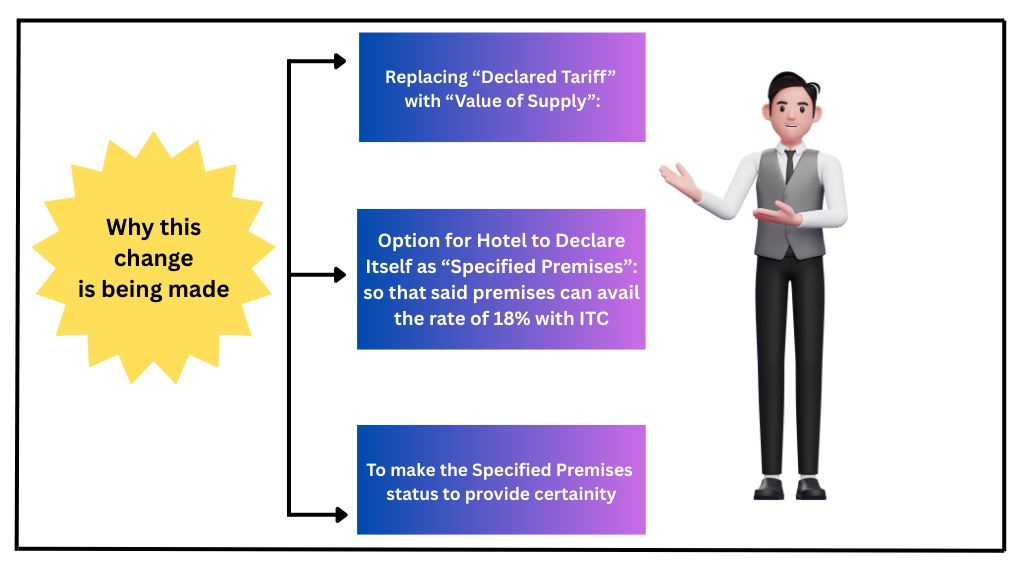

Notification No. 05/2025-CTR dated 16-01-2025, introduces the following Key changes:

- Definition of Specified Premises Introduced

- Removal of the concept of Declared Tariff

- Filling of Opt-In Declaration in Annexure VII & VIII of Notification No. 11/2017-CTR by 31-03-2025.

Specified Premises for a financial year means –

(a) a premise from where the supplier has provided in the preceding financial year, ‘hotel accommodation’ service having the value of supply of any unit of accommodation above seven thousand five hundred rupees per unit per day or equivalent;

or

(b) a premises for which a registered person supplying ‘hotel accommodation’ service has filed a declaration, on or after the 1st of January and not later than 31st of March of the preceding financial year, declaring the said premises to be a specified premises; or

(c) a premises for which a person applying for registration has filed a declaration, within fifteen days of obtaining acknowledgement for the registration application, declaring the said premises to be a specified premises;

- In simple,If in Preceeding Financial year, supplier has provided accomdation services above Rs.7500 per unit per day then next year it will automatically becomes specified premise. or

- Hotel did not meet the requirement of 7500 per day per unit but the supplier wants to treat premises as specified premises then supplier is required to file decalration on or after 01st January but not later than 31st March of preceeding financial year. Next year this premises will be trated as Specified Premises. or

- For new GST registration, if person apply for new registration and want hotel premises to be treated as specified premises then they do so by filling a declaration within 15 days of receiving acknowledgement of their registration application.

Download Notification No. 05/2025-CTR

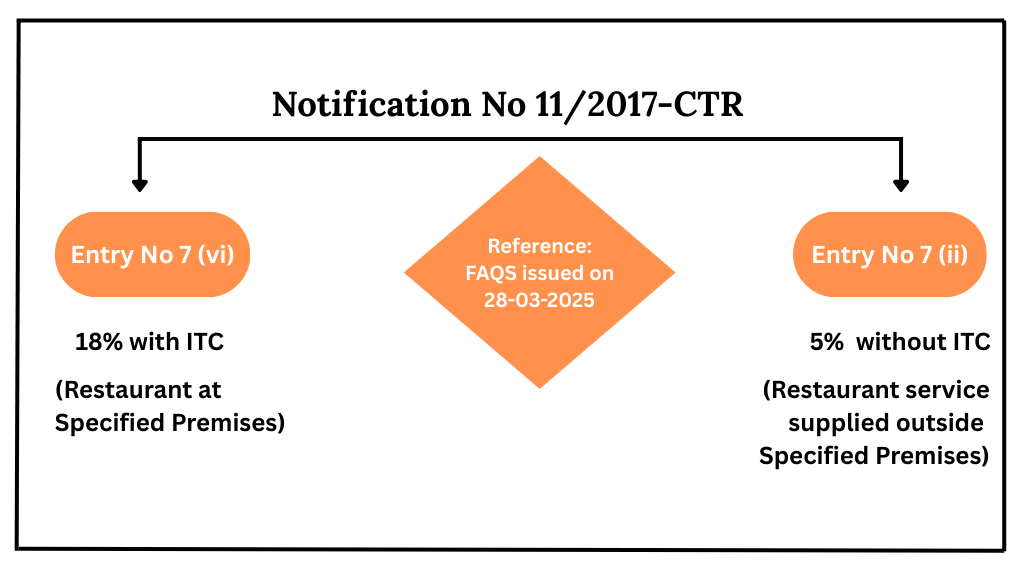

What is the Rate of tax notified by the government for restaurant services supplied in specified premises?

What is the Objective for Changes in Definition of Specified Premises through Notification No.05/2025-CTR dated 16-01-2025?

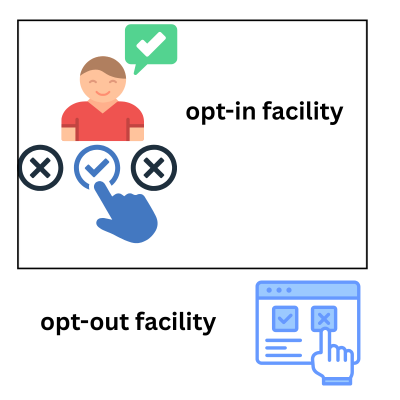

Opt-in & Opt-Out Facility

- In order to facilitate ease of compliance, the Opt-in declarations (Annexures-VII and VIII of Notification No.11/2017-CTR will be valid until the taxpayer decides to Opt-out by filing a declaration in Annexure IX of the same Notification declaring that the premises shall not be Specified Premises.

- This Opt-out declaration shall have to filed between 1st January and 31st March of the financial year preceding the financial year from which the taxpayer wants to opt-out similar to the opt-in declaration ,the opt-out declaration shall also be valid untill the taxpayer decides to opt-in again using the declaration in Annexure-VII.

- The mechanism of opt-in and opt-out wll obviate repeated annual filling of these declarations before the begining of financial year. The status of premises as a Specified Premises or not a Specified Premises shall remain the same for entirety of Financial year and can not be changed during the financial year. The opt-in and opt-out declarations, which are to be filed between 1st jan and 31st March of any FY, shall take effect only from 1st April of the next FY.

Let’s Understand it with Example:

Illustration:

‘A’ is a supplier of hotel accommodation service who has not supplied any unit of accommodation at value of supply above Rs 7500/-in the FY 2025-26. However, ‘A’ would like to operate as a ‘specified premises’ for FY 2026-27 till FY 2029-30. Thereafter, from FY 2030-31 onwards, ‘A’ does not want to operate as a ‘specified premises’.

‘A’ has to file opt-in declaration (Annexure VII) between 1st January, 2026 and 31st March, 2026 and the declaration will be valid for the subsequent years.

‘A’ has to file opt-out declaration (Annexure IX) anytime between 1st January, 2030 to 31st March, 2030, so that he shall no longer be a ‘specified premises’ for FY 2030-31 onwards.

Practical Examples as per FAQs issued on Specified Premises on 28-03-2025.

Question: I am a supplier of hotel accommodation service, and I had supplied a unit of accommodation at the value of supply above Rs. 7,500/- in the preceding financial year. Do I automatically fall under the category of ‘specified premises’ in the current Financial Year, or was I required to file a declaration to this effect before the beginning of the current financial year?

Answer: If you have supplied a unit of accommodation at value above Rs. 7,500/- in the preceding financial year, then you automatically and mandatorily fall under the scope of ‘specified premises’ for the current financial year, and you need not file a declaration to this effect.

_____________________________________________________________________________________________________________________

Question: In case I have not supplied any unit of accommodation at value above Rs. 7,500/- in the current financial year, and I still want to fall under the scope of ‘specified premises’ for the next Financial Year, how can I do so?

Answer: You can do so by filing a declaration (Annexure VII of notification No.11/2017-CTR dated 28.06.2017) between 1st January and 31st March of the current financial year.

_____________________________________________________________________________________________________________________

Question: What will be the modality of filing the above declarations?

Answer: The declarations for FY 2025-26 shall be filed physically/manually before the jurisdictional GST authorities till the time electronic filing of these declarations is enabled.

_____________________________________________________________________________________________

Question: Can I email/post my declaration to the jurisdictional authority?

Answer: Yes. You are allowed to submit the declaration forms through email or post. In such case, dated acknowledgement shall be issued to you in the same mode.

_____________________________________________________________________________________________________________________

Question: Do I (supplier of hotel accommodation service) need to file a declaration every year to continue to function as a ‘specified premise’?

Answer:

(i) For registered persons supplying hotel accommodation service: No. Once a declaration as per Annexure VII is filed in the preceding year, the said declaration will apply to the current year and subsequent Financial Years also, unless the person declares the premises as not a ‘specified premises’ by filing another declaration in the format specified at Annexure IX.

(ii) For a person applying for registration: Once a declaration as per Annexure VIII is filed, the said declaration will be valid from the effective date of registration for the remainder of the current year in which the person has applied for registration and it will apply to the subsequent Financial Years also, unless the person declares the premises as not a ‘specified premises’ by filing another declaration in the format specified at Annexure IX.

_____________________________________________________________________________________________________________________

Question: Can I file a declaration at the time of obtaining a new GST registration?

Answer: Yes. The declaration Annexure VIII can be filed within 15 days of obtaining an acknowledgment for the registration application in FORM GST REG-02, and it shall remain valid from the effective date of registration for the remainder of the Financial Year and shall apply to the subsequent Financial Years also, unless the person declares the premises as not a ‘specified premises’ by filing another declaration in the format specified at Annexure IX.

However, it may be noted that since the revised definition of ‘specified premises’ will come into effect only from 01.04.2025, hence any declarations filed in Annexure VIII before 31.03.2025, by persons applying for registration, will only be effective for FY 2025-26 onwards.

_____________________________________________________________________________________________________________________

Question: I am a supplier of hotel accommodation service having multiple premises under a single GST registration. I have not supplied any unit of accommodation at value above Rs. 7,500/- in the preceding financial year from any of the premises. Does the declaration filed as per Annexure VII/IX apply to all my premises? Or do I have to file separate declarations for each of my premises?

Answer: The declarations as per Annexure VII/IX apply to only one premises, and the supplier of hotel accommodation service shall have to file separate declarations for each of the premises from where hotel accommodation service is supplied.

It may also be added that any premises from which hotel accommodation service for any unit has been provided for a value of supply of greater than Rs. 7500 in the preceding financial year, automatically and mandatorily becomes ‘specified premises’ for the current financial year and no declaration needs to be filed for such premises.

_____________________________________________________________________________________________________________________

Question: I am a supplier of hotel accommodation service having multiple premises under a single GST registration. In FY 2025-26, I have supplied a unit of accommodation having value of supply more than Rs. 7,500 from only one such premises. Will all of my premises automatically and mandatorily become specified premises for the next FY, i.e. FY 2026-27?

Answer: No, only that premise from which you have supplied a unit of accommodation having value of supply more than Rs. 7,500 will automatically and mandatorily become a specified premises for FY 2026-27. This will not affect the ‘specified premises’ status of your other premises.

_____________________________________________________________________________________________________________________

Question: I am a registered supplier of hotel accommodation service and have started providing hotel accommodation services from a new premises which I intend to operate as a ‘specified premises’. Which declaration should I file?

Answer: For a new premises providing hotel accommodation service being set up by a registered supplier of hotel accommodation service, which the supplier wishes to operate as a ‘specified premises’, the person shall have to file declaration in Annexure VIII and the declaration shall be valid for the remainder of the financial year and for subsequent Financial Years also, unless the person declares the premises as not a ‘specified premises’ by filing another declaration in the format specified at Annexure IX.

_____________________________________________________________________________________________________________________

Question: I am a supplier of hotel accommodation service, having multiple premises and am applying for GST registration for all such premises. Does the declaration (Annexure VIII/IX) apply to all my premises? Or do I have to file separate declarations for each of my premises?

Answer: The declarations (Annexure VIII/IX) apply to only one premise, and the person applying for registration shall have to file separate declarations for each of his premises as per his decision to operate each of his premises as a ‘specified premises’ or not.

_____________________________________________________________________________________________________________________

Question: If I have multiple premises from which I supply hotel accommodation service, and some of them are ‘specified premises’ while others are not, what will be the treatment of input tax charged on goods and services used in supplying the restaurant service at these premises?

Answer: As per entry at Sl. No. 7(ii) of Notification No. 11/2017 CT(Rate) dated 28.06.2017, the rate of GST applicable on restaurant services other than at specified premises is 5% without ITC, subject to the condition that the credit of input tax charged on goods and services used in supplying the service has not been taken.

Read with Explanation (iv) of the said Notification, this means that credit of input tax charged on goods or services used exclusively in supplying restaurant services other than at specified premises should not be taken and credit of input tax charged on goods or services used partly for supplying restaurant services other than at specified premises and partly for effecting other services (including restaurant services at specified premises), is reversed as if supply of restaurant service other than at specified premises is an exempt supply.

_____________________________________________________________________________________________________________________

Question: I am a supplier of hotel accommodation service, having premises inside a mall. I have not supplied any unit of accommodation at value above Rs. 7,500/- in the preceding financial year in the said premises and have declared the said premises to be a ‘specified premises’ by filing Annexure VII.

I operate two restaurants from the said mall. Restaurant ‘X’ is located inside the premises from where I supply hotel accommodation service for which I have filed a declaration as per Annexure VII, and Restaurant ‘Y’ not located inside the said premises, but located in the same mall. What would be the applicable GST rate for restaurant service supplied by restaurant ‘X’ and restaurant ‘Y’?

Answer: The address of the premises providing hotel accommodation service inside the mall, declared in Annexure VII filed by the supplier of hotel accommodation service, becomes a ‘specified premises’ by virtue of the declaration filed. Restaurants located inside the said address have to charge GST @18% for restaurant services being supplied from ‘specified premises’.

Therefore, Restaurant ‘X’ shall have to charge GST @18% with ITC for their restaurant services.

Restaurant ‘Y’ is not located within the address declared by the supplier of hotel accommodation service who has filed Annexure VII.

Therefore, restaurant ‘Y’ is not located in the ‘specified premises’ and therefore, shall have to charge GST @ 5% without ITC for their restaurant services.

_____________________________________________________________________________________________________________________

Question: I have filed Annexure VIII declaring my premises as ‘specified premises’ while applying for GST registration. Can I opt out of it by filing Annexure IX?

Answer: Annexure VIII declares a premises as ‘specified premises’ from the effective date of registration for the remainder of the financial year in which the person has applied for GST registration. Annexure IX cannot be filed to opt out for the said financial year.

Annexure IX can be filed by the person to opt out of being a ‘specified premises’ for the subsequent financial year.

_____________________________________________________________________________________________________________________

Question: I am a registered supplier of hotel accommodation service who has not supplied any unit of accommodation having the value of supply above Rs. 7500 in the current FY 2024 25. However, I want to declare my premises as specified premises for FY 2025-26. Therefore, I filed an ‘opt-in’ declaration in Annexure VII before the jurisdictional GST authority on 5th February, 2025. However, subsequently, I changed my mind and now want to withdraw the said declaration so that my premises is not a ‘specified premises’ for FY 2025-26. What should I do?

Answer: You should file an opt-out declaration before the same jurisdictional GST authority before 31st March, 2025. It may be noted that you shall not be allowed to file another opt-in declaration after you have filed the above opt-out declaration.

_____________________________________________________________________________________________________________________

Question: I am a registered supplier of hotel accommodation service who has declared his premises as a ‘specified premises’ for FY 2025 26. To change the status of my premises for FY 2026-27, I filed an ‘opt-out’ declaration in Annexure IX before the jurisdictional GST authority on 5th February, 2026.However, subsequently, I changed my mind and now want to withdraw the said declaration so that my premises is a ‘specified premises’ for FY 2026-27. What should I do?

Answer: You should file an opt-in declaration before the same jurisdictional GST authority before 31st March, 2026. It may be noted that you shall not be allowed to file another opt-out declaration after you have filed the above opt-in declaration.

_____________________________________________________________________________________________________________________

Question: Revised definition of ‘specified premises’ are to come into force with effect from 01st April, 2025.When can I file a declaration to opt-in to operate as a ‘specified premises’ for the FY 2025-26?

Answer: The revised definition of ‘specified premises’ shall come into force w.e.f. 01.04.2025. However, in order to enable filing of declarations for FY 2025-26, the opt-in and opt-out declarations, have been brought into effect from 16.01.2025 vide Notification No. 05/2025-CT(Rate) dated 16.01.2025.

This declaration (Annexure VII) can be filed physically/manually before the jurisdictional authority anytime till 31st March, 2025. The option to opt-out, in case of change in decision, also can be filed before 31st March, 2025 before the jurisdictional authority.

For a person, who has applied for or has obtained registration during the period 16th January, 2025 to 31st March, 2025, the person shall have to file declaration (Annexure VIII) before the jurisdictional authority anytime between 16th January, 2025 and 31st March, 2025.

Annexure VIII in this case would apply for the subsequent FY i.e., FY 2025-26 and would not be applicable for FY 2024-25, as the revised definition of ‘specified premises’ shall come into force only from FY 2025-26 onwards.

Further, once opted in for FY 2025-26 by filing Annexure VIII, such person shall not be able to opt-out for the FY 2025-26.

For a person who has applied for registration after 01st April, 2025, s/he shall have to file declaration (Annexure VIII) before the jurisdictional authority and the declaration shall be valid for the remaining period of the financial year in which the person has applied for registration, i.e., FY 2025 26. The declaration shall continue to be valid for subsequent years unless the person declares the premises to not be a ‘specified premises’ by filing a declaration in the format specified at Annexure IX.

_____________________________________________________________________________________________________________________

Question: Are the revised provisions of ‘specified premises’ also applicable to catering services?

Answer: Yes, the revised definition of ‘specified premises’ is also applicable for determining the rate applicable on catering services, as specified at Sl. No. 7 of Notification No. 11/2017-CT(Rate) dated 28.06.2017.

_____________________________________________________________________________________________________________________

Question: For the financial year 2024-25, I have supplied at least one unit of accommodation service for more than Rs 7500 per unit per day or equivalent. Therefore, I would mandatorily be a specified premises for financial year 2025-26. However, in the financial year 2025-26, I have not supplied any unit of accommodation

having value of supply more than Rs 7500 per unit per day or equivalent. Would I have to file any declaration to ensure that I am not a specified premises for the financial year 2026-27?

Answer: For a supplier of hotel accommodation service, who has supplied any unit of accommodation for more than Rs 7500 per unit per day or equivalent in the preceding year (2024 25), he is mandatorily a specified premises for the current financial year, i.e., in this case for financial year 2025-26. The premises is a specified premises owing to the mandatory condition being satisfied in the preceding year.

However, since the supplier of hotel accommodation service has not supplied any unit of accommodation having value of supply more than Rs 7500/- per unit per day or equivalent in the financial year 2025-26, the premises would not be mandatorily a specified premises for the next financial year 2026-27.

However, in view of the revised definition of specified premises, the supplier can declare the premises to be a specified premises by filing a declaration as per Annexure VII. If he chooses to not file any declaration, then, by default he would not be a specified premises for the year 2026-27, as he does not satisfy the mandatory condition.

There is no requirement to file any declaration to the effect that the premises is not a specified premises in such cases.

_____________________________________________________________________________________________________________________

Question: For the financial year 2025-26, I filed an opt in declaration, declaring my premises as specified premises for the said financial year, and for subsequent years. However, I did not supply any unit of accommodation havi ng value of supply more than Rs 7500 in FY 2025-26. I do not want my premises to be a

‘specified premises’ for FY 2026-27. What am I required to do?

Answer: Even though you did not supply any unit of accommodation having value of supply more than Rs 7500 in FY 2025-26, you will not automatically revert to not being a ‘specified premises’ for FY 2026-27, since you had filed an ‘opt-in declaration’ for FY 2025-26. In this case, you will have to file an opt-out declaration for FY 2026-27, between 1st January, 2026 and 31st March, 2026.

_____________________________________________________________________________________________________________________

Question: Is it mandatory that I should file my declaration for next financial year before 31st March of the preceding financial year?

Answer: Yes. For a registered supplier of hotel accommodation services, the declarations have to be filed within the time period of 1st January, to 31st March of the preceding financial year. No grace period is given for filing the declaration. The timelines are to be strictly adhered to. The status on 31st March, would be taken as the final declaration.

_____________________________________________________________________________________________________________________

Question: Where are the declarations (Annexure VII, VIII and IX) available?

Answer: Apart from the Notifications, the declaration forms have also been made available on the CBIC website under Trade Facilitation > Improving Ease of Doing Business(https://www.cbic.gov.in/entities/cbic-content-mst/MTE5)

_____________________________________________________________________________________________________________________

Question: Who will give the acknowledgment for the declaration filed?

Answer: Dated acknowledgment shall be given by the jurisdictional authority on receipt of declaration forms submitted by the suppliers of hotel accommodation service.

At the time of submission of declaration form, jurisdictional authorities may only verify the completeness of the declaration and issue dated acknowledgement, without scrutinizing other aspects of the declaration, including whether the taxpayer is eligible to file the declaration or not. The declaration may be treated as filed on ‘self-assessment’basis.

Download – FAQs on Restaurent Service, dated 28.03.2025