| Input Service Distributor |

| Preface |

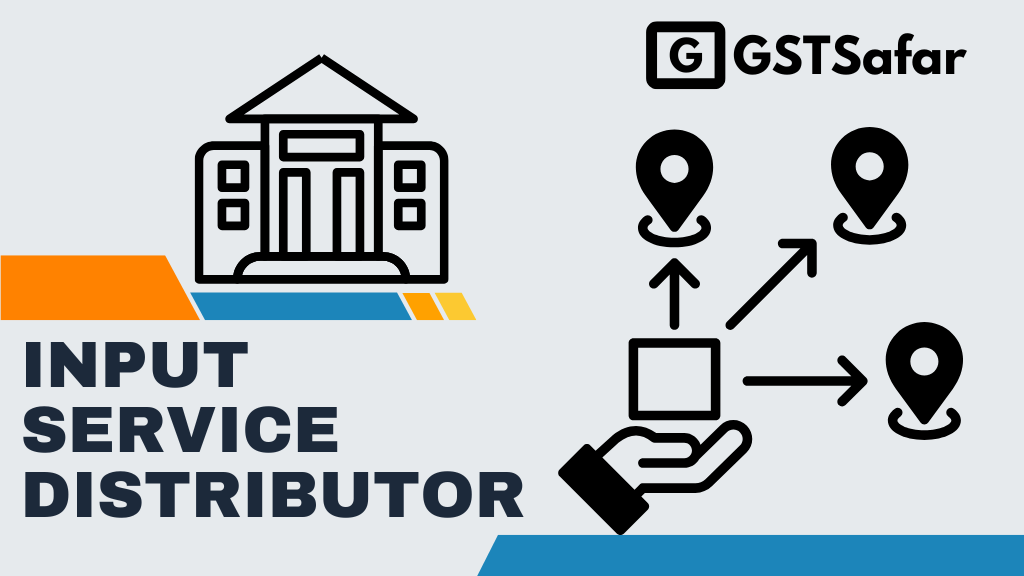

The Input Service Distributor in GST is important for distributing input tax credit for business operating mulitple branches. This article aims to provide understanding of What is Input service distributor with example explanation or what is Input Service Distributor in GST? helping business for proper ITC utilisations and its compliance. One of the important aspect of this topic related to Distribution of Credit by Input Service Distributor and Input Service Distributor Registration Process in GST is also explained thoroughly. we also discuss whether any Input service Distributor invoice format available for ease of GST Compliance. The Input Service Distributor in GST is important for distributing input tax credit for business operating mulitple branches. This article aims to provide understanding of What is Input service distributor with example explanation or what is Input Service Distributor in GST? helping business for proper ITC utilisations and its compliance. One of the important aspect of this topic related to Distribution of Credit by Input Service Distributor and Input Service Distributor Registration Process in GST is also explained thoroughly. we also discuss whether any Input service Distributor invoice format available for ease of GST Compliance. |

| What is Input service distributor with example |

The Government, through the Finance Bill 2024, has proposed an amendment to the definition of ISD, subsequently, via Notification No 16/2024- Central Tax dated 06-08-2024, it has been mandated that the revised definition will be compulsorily applicable from 01-04-2025. Input service Distributor as per Section 2(61) means: An office of the supplier of goods or services or both which receives tax invoices towards the receipt of Input services, including invoices in respect of services liable to tax under 9(3) or 9(4) of CGST Act or section 5(3) or 5(4) of IGST Act,2017.for or on behalf of distinct persons referred to in section 25 and liable to distribute the input tax credit in respect of such invoices in manner provided in section 20.

Example: ABC Limited has its Head office in Delhi and operates branch in Karnataka. The company receives the invoice for Software subscription services used for both the branch. To ensure proper distribution of ITC , Delhi Head office must register as ISD and allocate the Proportionate ITC to Karnataka Branch as per GST Act. |

| Input Service Distributor Registration Requirement |

|

| Distribution of Credit by Input Service Distributor (Section 20 of CGST Act.) |

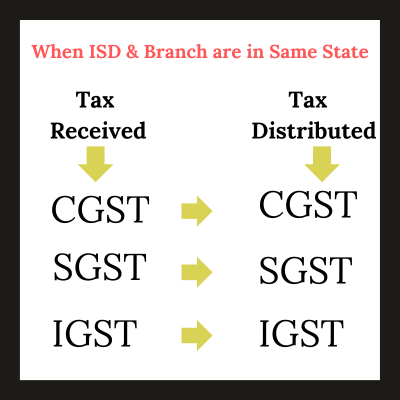

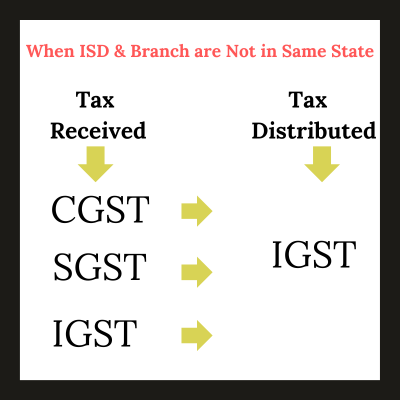

Distribution of CGST/SGST/UTGST: If CGST/SGST/UTGST has to be distributed to recipient in the same state in which ISD is located then it will distributed as CGST/SGST/UTGST respectively. If it is to be distributed to recipient in other state/Union Territory, then the credit can be distributed as IGST. Distribution of CGST/SGST/UTGST: If CGST/SGST/UTGST has to be distributed to recipient in the same state in which ISD is located then it will distributed as CGST/SGST/UTGST respectively. If it is to be distributed to recipient in other state/Union Territory, then the credit can be distributed as IGST.

Distribution of IGST Credit: If IGST is to be distributed , then it will be distributed as IGST only irrespective that whether it is in same state or in the different state. |

| Manner of Distribution of Credit |

Distribution of Credit to Respective Unit : Rule 39(c) of CGST Rules states that the Credit of tax paid on Input services attributable to recipient of Credit shall be distributed only to that recipient. Distribution of Credit to More than One recipient: Rule 39(d) of CGST Rules states that the credit of tax paid on input services attributable to more than one recipient of credit shall be distributed amongst such recipients to whom the input service is attributable and such distribution shall be pro rata on the basis of the turnover in a State or turnover in a Union territory of such recipient, during the relevant period, to the aggregate of the turnover of all such recipients to whom such input service is attributable and which are operational in the current year, during the said relevant period. Distribution of Common Credit to all the Recipients: Rule 39(e) of CGST Rules states that the credit of tax paid on input services attributable to all recipients of credit shall be distributed amongst such recipients and such distribution shall be pro rata on the basis of the turnover in a State or turnover in a Union territory of such recipient, during the relevant period, to the aggregate of the turnover of all recipients and which are operational in the current year, during the said relevant period; |

Formula For Distribution of Common Credit to all recipient |

C1 = (t1 /T) x C Where, “C1”is credit attributable to each recipient “C” is the amount of credit to be distributed “t1 ” is the turnover, as referred to in clauses (d) and (e), of person R1 during the relevant period, and “T” is the aggregate of the turnover, during the relevant period, of all recipients to whom the input service is attributable in accordance with the provisions of clauses (d) and (e). |

| Let’s Understand the Distribution of Common Credit to all recipient with Example | |||||||||||||||

Example XYZ Limited has an office in Maharashtra and a factory in Gujarat and Rajasthan. XYZ Limited has obtained ISD registration at its office in Maharashtra. XYZ Limited has procured the software licensing service from the third-party service provider and the software is separately installed at all 3 locations. The supplier has issued a single bill at the office address i.e. Maharashtra. Details of the Invoice are as under:

| |||||||||||||||

Answer

| ITC will be distributed by using above Formula |

Maharashtra Branch: 1,80,000*15 Crore/30 Crore=90,000. Gujarat Branch: 1,80,000*10 Crore/30 Crore =60,000. Rajasthan Branch : 1,80,000*5 Crore/30 Crore=30,000 Now Lets Understand how this ITC will distributed to the Branches. |

| Senario | ISD Location (Head Office) | Branch Location (Recipient Unit) | Nature of Tax at ISD | ITC Received by ISD | How Tax is Distributed to Branch | Final ITC at Branch

|

| Same States/UT | Maharashtra | Maharashtra | CGST & SGST | ₹90,000 (CGST ₹45,000 + SGST ₹45,000) | CGST/ SGST Distribute as CGST/SGST | CGST-45000 + SGST-45000 |

Different States/UTs

| Maharashtra | Gujarat | CGST & SGST | Rs.60,000 IGST- Rs.60,000 | CGST + SGST Distribute as IGST | IGST- 60,000 |

| Rajasthan | CGST & SGST | Rs.30,000 IGST- Rs.30,000 | CGST + SGST Distribute as IGST | IGST- 30,000 | ||

Note: The amount of the credit distributed shall not exceed the amount of credit available for distribution. | ||||||

Lets change the Question by assuming that in the above example the invoice charged by third party is

- Taxable Value : 10,00,000

- IGST : 1,80,000

Answer

| Senario | ISD Location (Head Office) | Branch Location (Recipient Unit) | Nature of Tax at ISD | ITC Received by ISD | How Tax is Distributed to Branch | Final ITC at Branch

|

| Same States/UT | Maharashtra | Maharashtra | IGST | IGST of Rs.90,000 | IGST | IGST of Rs.90,000 |

Different States/UTs

| Maharashtra | Gujarat | IGST | IGST of Rs.60,000 | IGST | IGST of Rs.60,000 |

| Rajasthan | IGST | IGST of Rs.30,000 | IGST | IGST of Rs.30,000 |

| Input Service Distributor Registration Process in GST |

From 01-04-2025 It is Mandatory to get the Input service Distribution Registration for ITC distribution to distinct person as per section 20 of the CGST Act,2017, if Input services received for multiple location and all the invoices including RCM received by Central office for on or behalf of distinct persons. The Procedure for registration of an Input Service Distributor and registered person is the same under GST. Input Service Distributor shall make separate application for registration as such Input service Distributor. The PAN shall be validated online by the common portal from the database maintained by Central board of direct taxes.Mobile number and email shall be validated by sending OTP. On successful verification of PAN, Mobile and email address, Temporary Reference number shall be generated and communicated to applicant on the said mobile number and email address. Checklist of Documents for Registration under GST:

The appllicant shall while submitting an application, has to undergo authentication of Aadhaar number before grant of registration. |

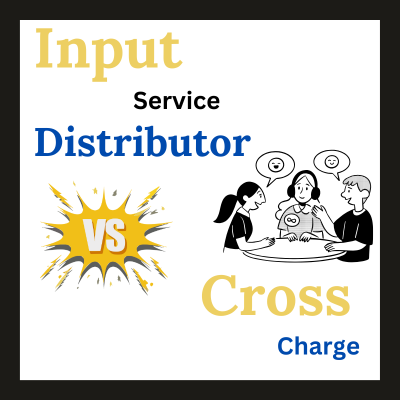

| Input Service Distributor VS Cross Charge Example | |

The Input Service Distributors mechanism facilitates the distribution of Input Tax credit of Input services to its branches. It is applicable only for Input servicres received and does not cover inputs or capital goods. The ITC can be Transfered to respective branches without need to raise an invoice, ensuring ITC Distribution process fruitfully.Additionallly, an ISD is mandatorily required to obtain registration, irrespective of its turnover, to comply with provisions under GST law.

| Cross Charge means issuance of Tax invoice for Internally generated service.Under this system the head office issues tax invoice for internally generated goods or services provided to its branches. This mechanism applies to Input services, Capital goods and goods received ensuring appropraite allocation of costs among its branches. Tax invoice is mandatory for cross charge transactions. However there is no requirement for separate registration under cross charge,as it is internal transfer of resources with in same entity.

|

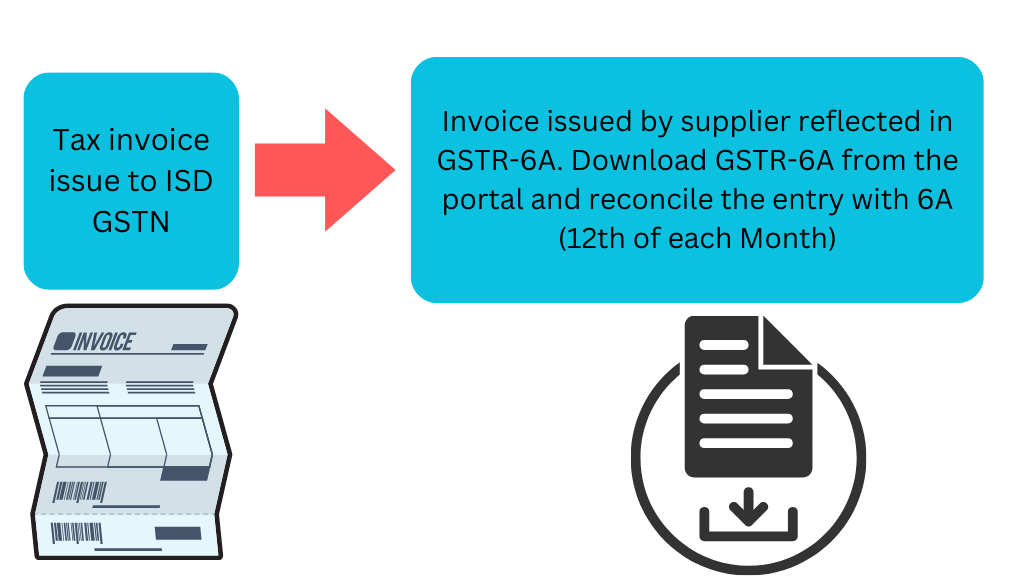

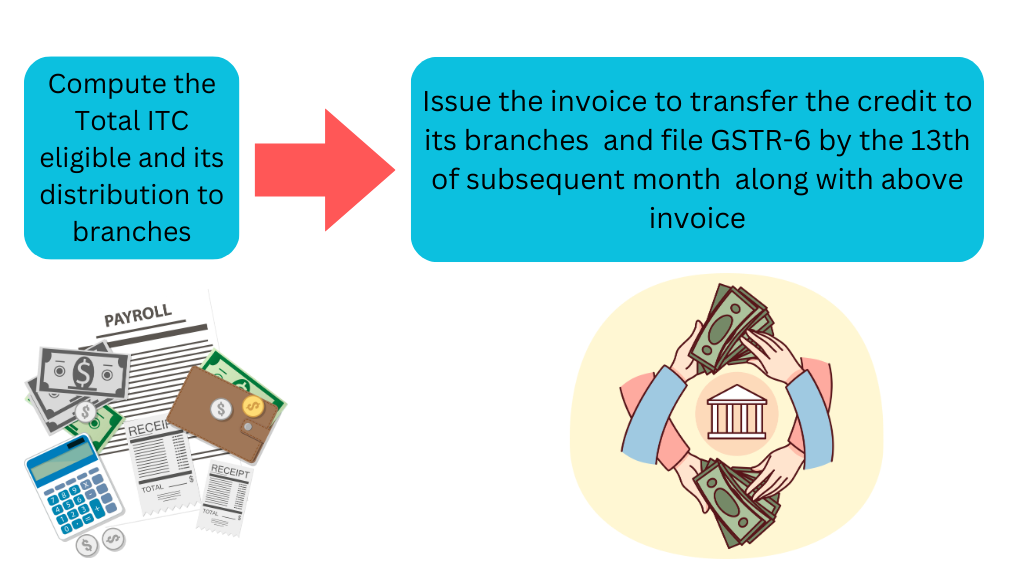

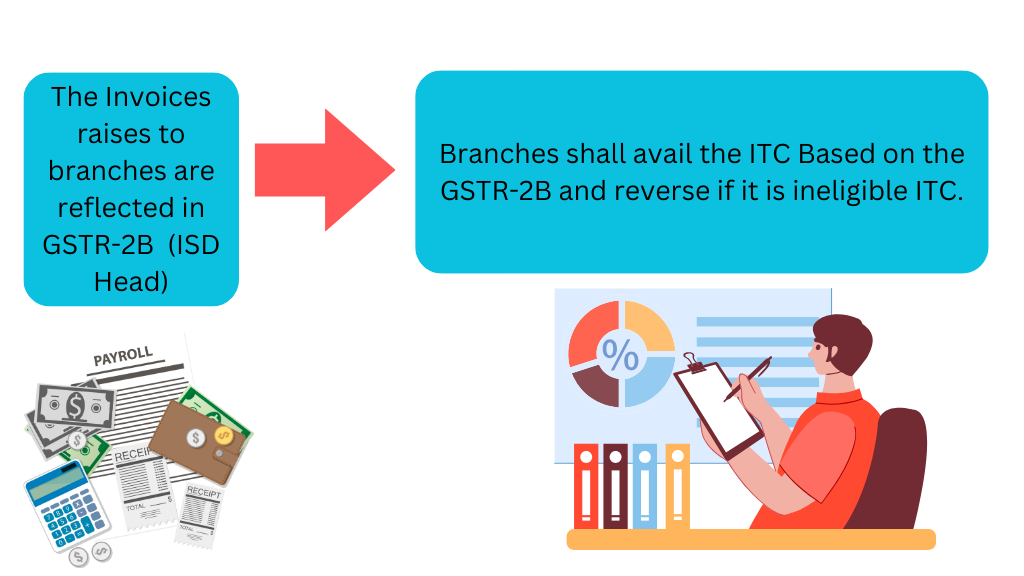

| Input Tax credit distribution Process for ISD along with GST return |

|

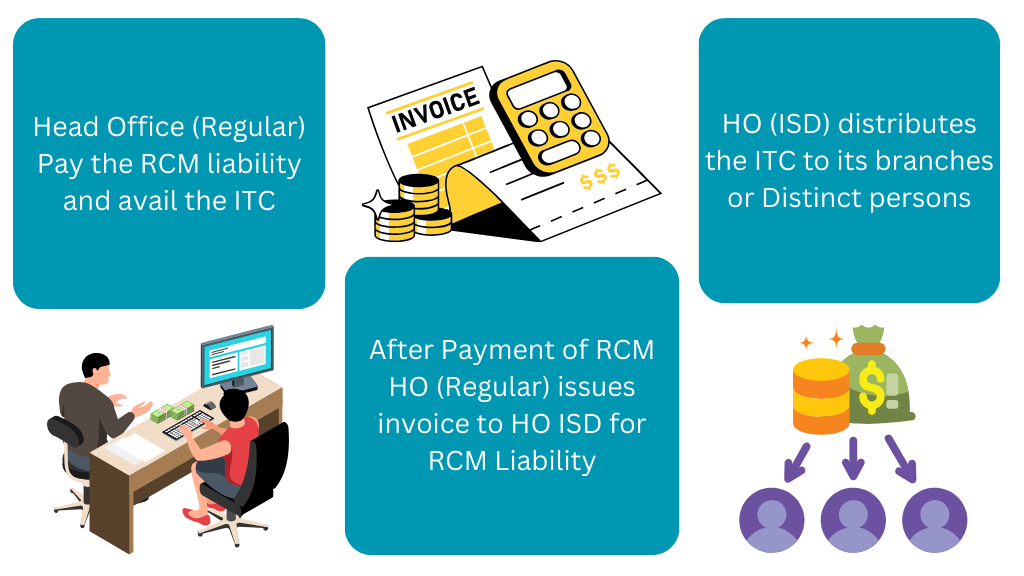

| ITC Distribution Process for RCM Transactions |

|

| Other Important Points |

|

FAQS on Input Service Distributor

What is an example of an Input service Distributor?

Input service distributor is mechanism for distribution of ITC by Head office to its branches.

Example:

ABC Limited has its Head office in Delhi and a branch in Karnataka. The company receives the invoice for Software subscription services used for both branches. To ensure proper distribution of ITC, the Delhi Head office must register as an ISD and allocate the Proportionate ITC to the Karnataka Branch as per theGST Act.

What is the function of ISD?

The Main Function of ISD is to distribute of ITC to its branches. Since ISD can not discharge any liability and avail the credit.

What are input and input services in GST?

Input means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business (Section 2(59) of CGST Act,2017)

Input service means any service used or intended to be used by a supplier in the course or furtherance of business. (Section 2(60) of CGST Act,2017)

Written by

CA Bhavesh Jhalawadia

Rule 39(e) of CGST Rules specifies the following formula for Credit distribution to each recipient

Rule 39(e) of CGST Rules specifies the following formula for Credit distribution to each recipient

Any Credit note issued for reduction of input tax credit to Input service distributor supplier shall be apportioned to each recipient in the ratio of ITC contained in the original invoice.

Any Credit note issued for reduction of input tax credit to Input service distributor supplier shall be apportioned to each recipient in the ratio of ITC contained in the original invoice.