GSTR-1 is outward statement. How to file GSTR-1 is the very important topic, as if you skip any details in GSTR-1,then it will put your client/customers in difficulties for availing input tax credit. G In this article I am going to discuss all the steps for filling GSTR-1.

Table of Contents

ToggleDifferent ways for filling GSTR-1

GSTR-1 can be filed Online and offline.

In offline, your are supposed to downaload excel utility of GSTR01, that is to be filled and then that utility is uploaded online

In online filling, one is required to enter data directly in GST portal. Here we are going to discuss filling GSTR-1 online.

Overview of GSTR-1 monthly return and QURMP scheme

Before we know how to file GSTR 1 return, lets first understand the basics about GSTR-1. First let me clear, GSTR-1 is not a return, its only statement. But in layman language it is know as return.

Here is overview about GSTR-1

| Sr No | Tax Payer | Description | Date of filling |

| 1 | Regular Tax Payer | Monthly statement of Outward supplies of Goods or Services | 11th of the next month |

| 2 | QRMP Tax payer (See Note) | Quarterly statement of Outward supplies of Goods or Services | 13th of next month from end of Quarter. |

The due dates mentioned are subject to changes notified by the concerned department.

If the taxpayer opted for the Invoice Furnishing Facility (IFF) under QRMP scheme, then he may furnish the details of outward supplies to registered person for the 1st and 2nd months of a quarter, using Invoice Furnishing Facility(IFF). Invoice pertaining to last month of a Quarter are to be uploaded in GSTR-1 only.

If the registered person does not opt to upload invoices using IFF under QRMP scheme, then he has to upload invoice details for all the 3 months of the quarter in Form GSTR-1. It may be noted that the IFF is not mandatory but an optional facility.

In this case of GSTR-1 monthly Payment of tax in each Month by 20th of next month

In the case of GSTR-1 QRMP, Payment of tax in each of the first 2 months of the quarter by depositing the due amount in FORM GST PMT-06 by the 25th day of the month succeeding such month .While generating the challan tax payers should select “Monthly payment for quarterly tax payer as reason for generating the challan.

How to file GSTR-1 Online

How to file GSTR-1 in GST portal.

Following are steps for filling GSTR-1 Online

Step-1

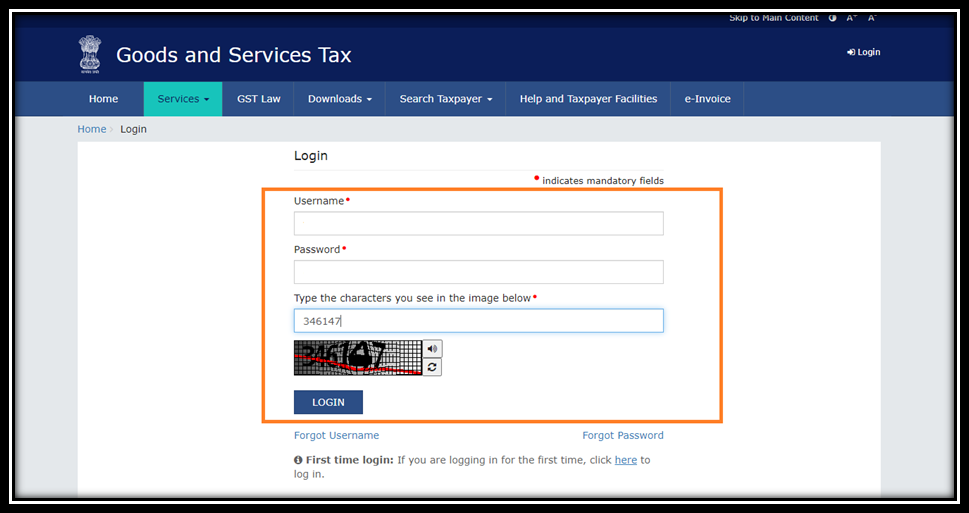

Login on GST portal —> Using USER ID & Password

Step-2

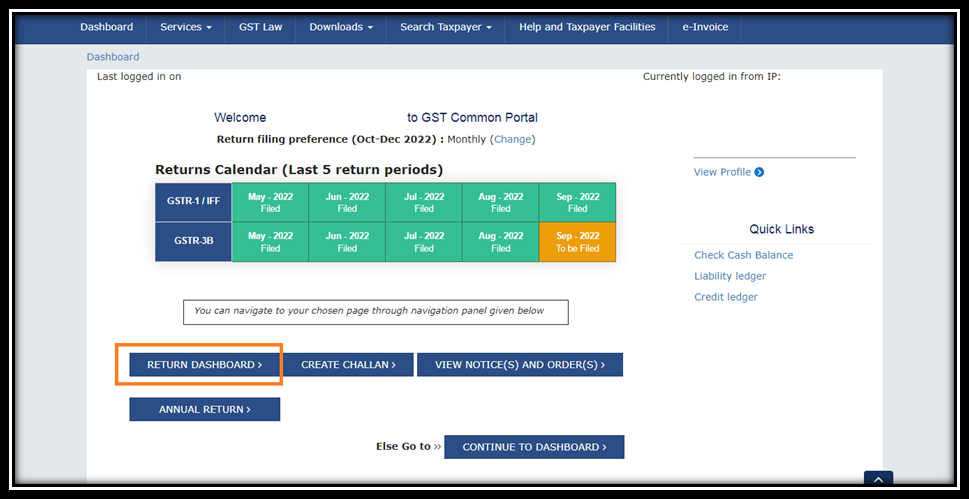

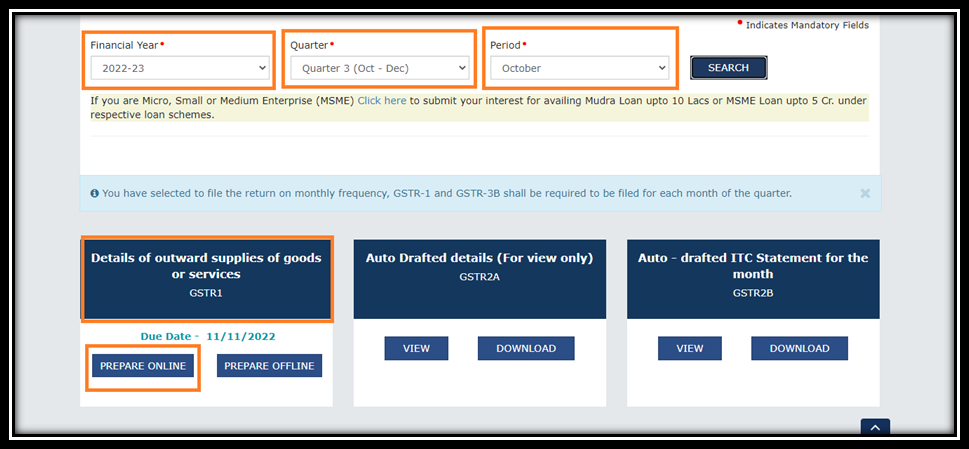

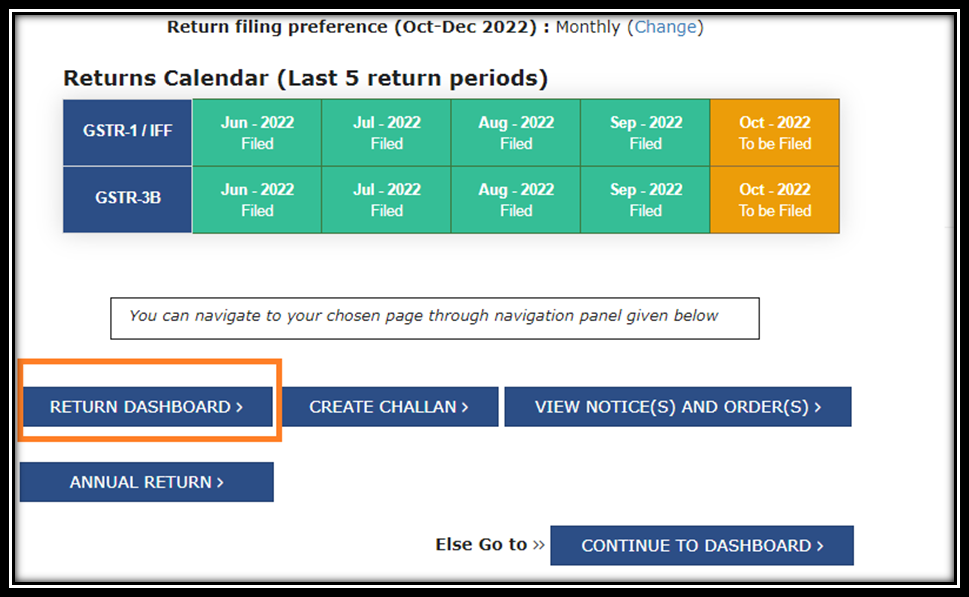

Go to Return Dashboard

Step-3

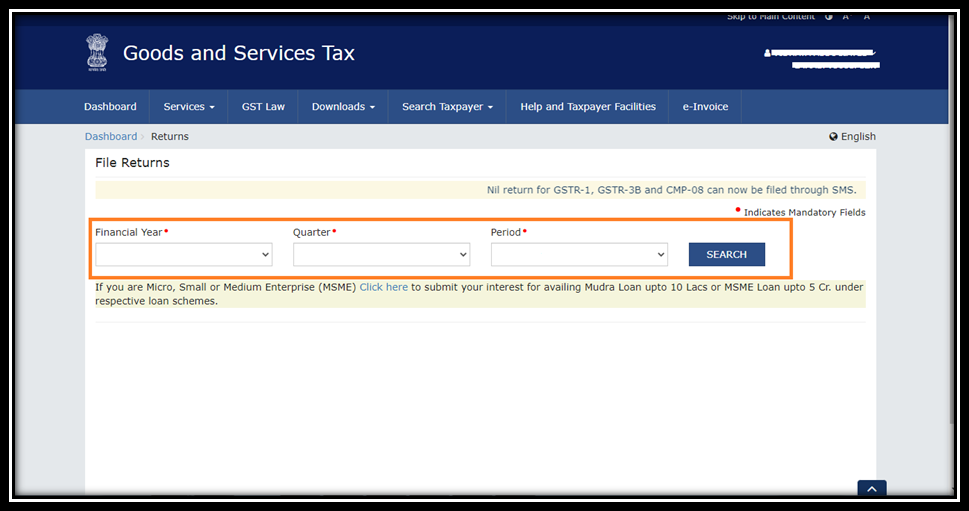

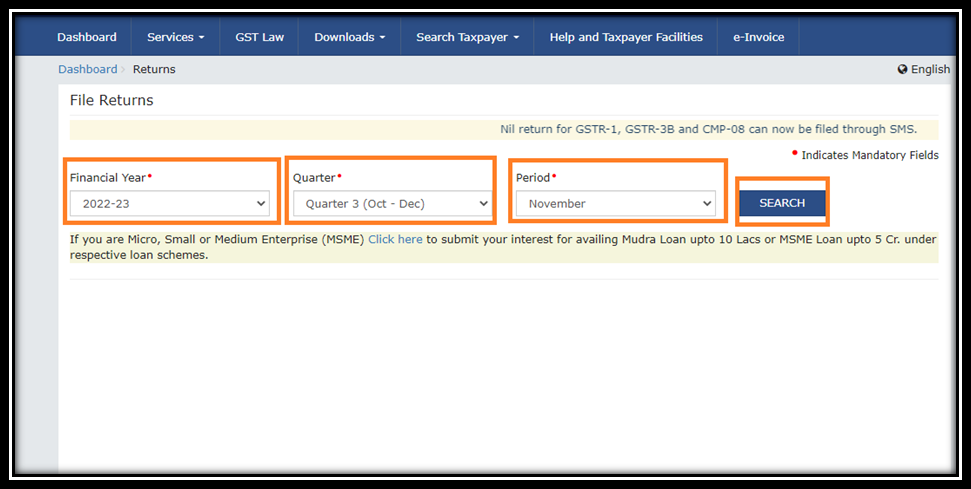

Select the Financial Year —-> Quarter——->Month for which the return are to be filed

Step-4

Select in GSTR-1 Tile —> Prepare Online

Step-5

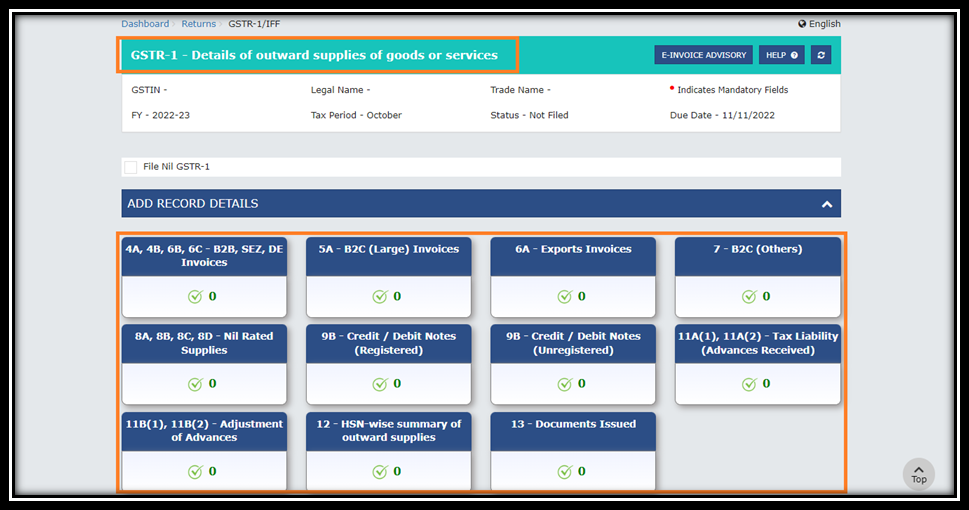

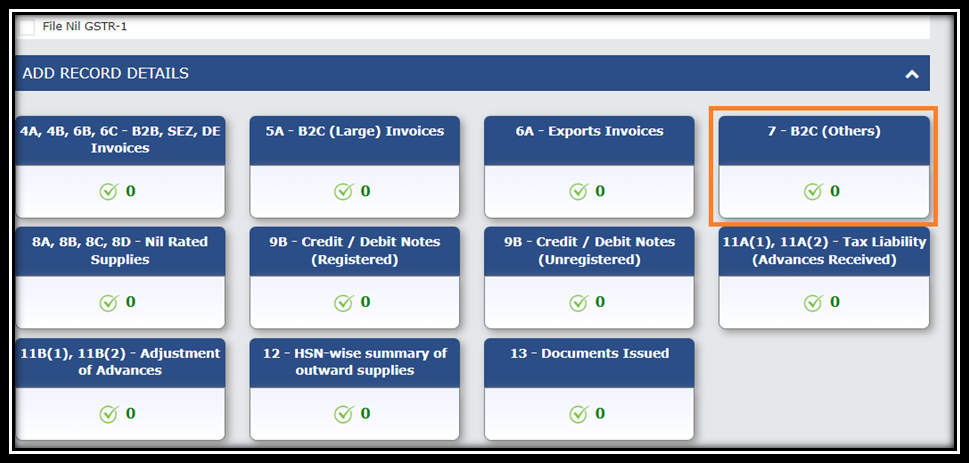

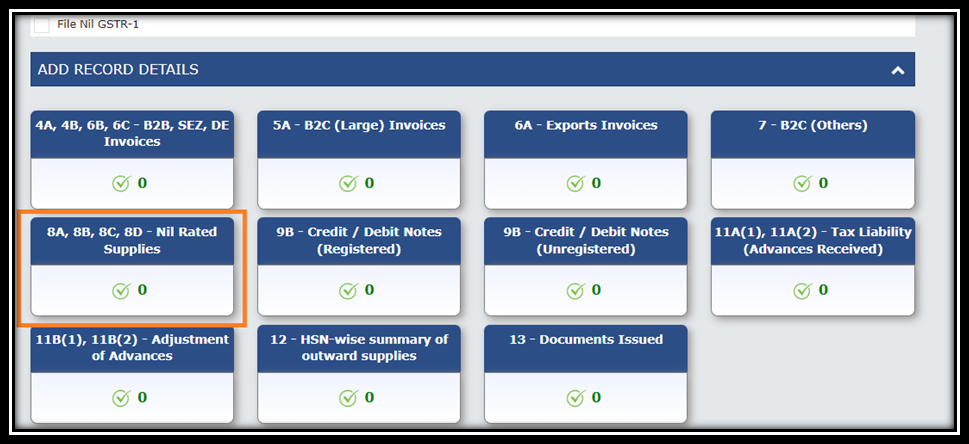

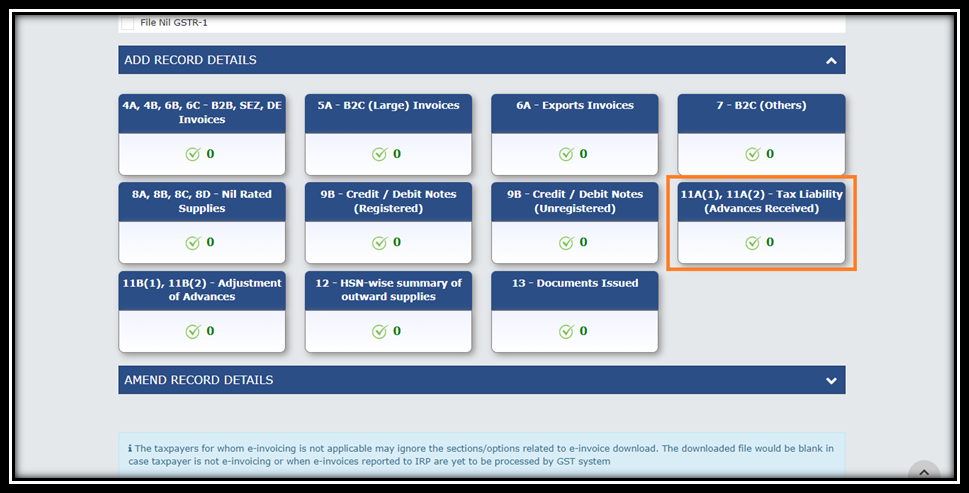

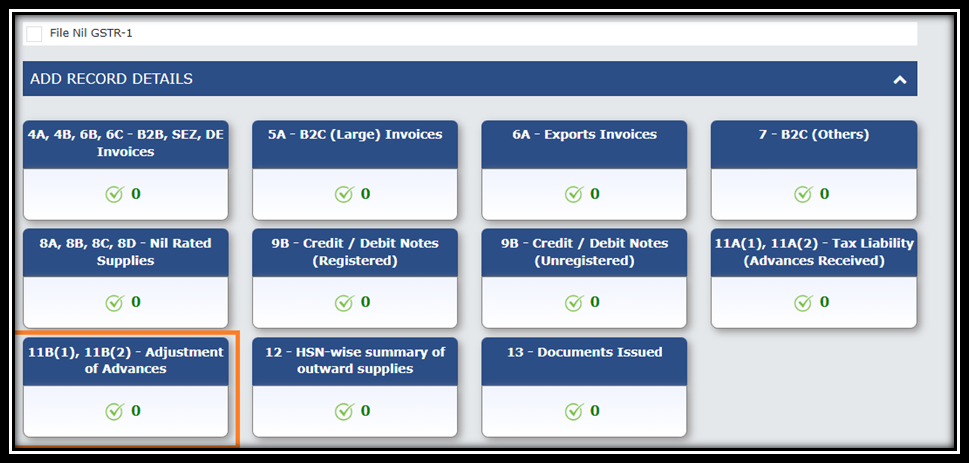

Select the tiles as per requirement—>Fill required details for filling GSTR-1 – Outward supplies of goods & services

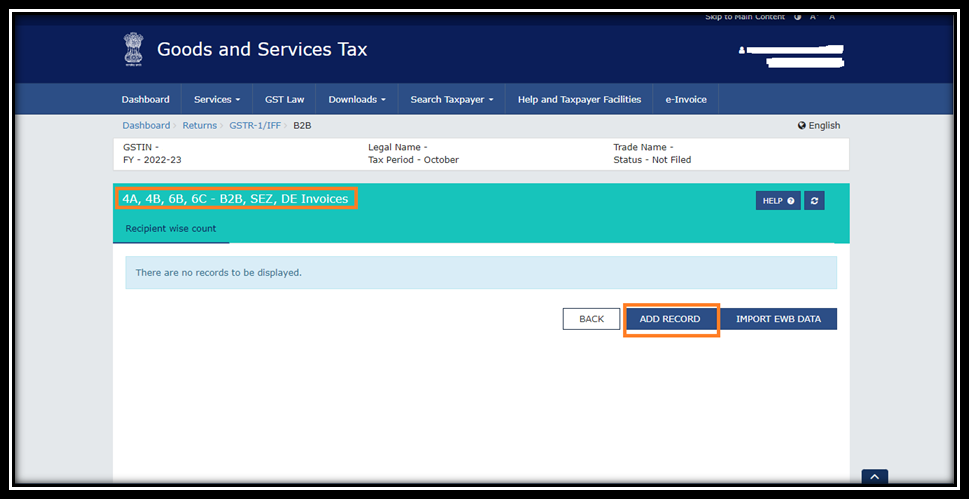

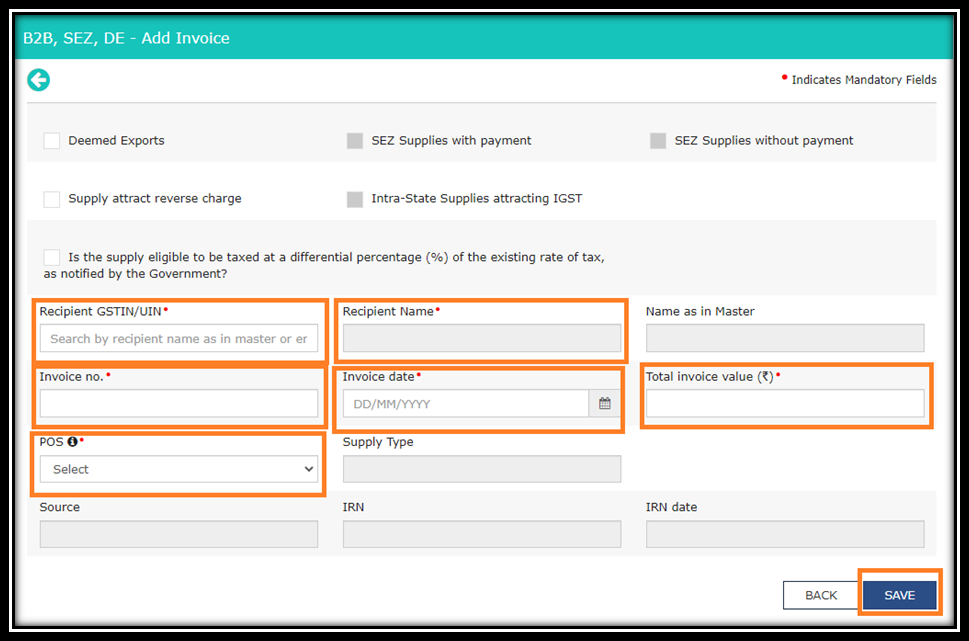

Fill the Details of B2B Invoice, invoice related SEZ units, & Deemed Export Invoices in the first tile of GSTR-1 i.e. 4A, 4B, 6B, 6C –B2B, SEZ, DE Invoices.

- Something to Know -:

B2B Invoices Means -: Any Intrastate Supply (within State) or Intrastate Supply (One state to other state) by registered person to other registered person having valid GSTN.

Before entering in to the above tile.it would be recommended to Prepare the excel sheet of all the B2B Invoices with following Particulars.

- Recipient GSTN (with Active status)

- Recipient Name

- Invoice Number

- Invoice Date

- Total Invoice Value

- Place of Supply (To decide CGST/IGST)

Hint. It will be preferable to file GSTR-1 Online, if registered person having Sales invoices in small numbers.

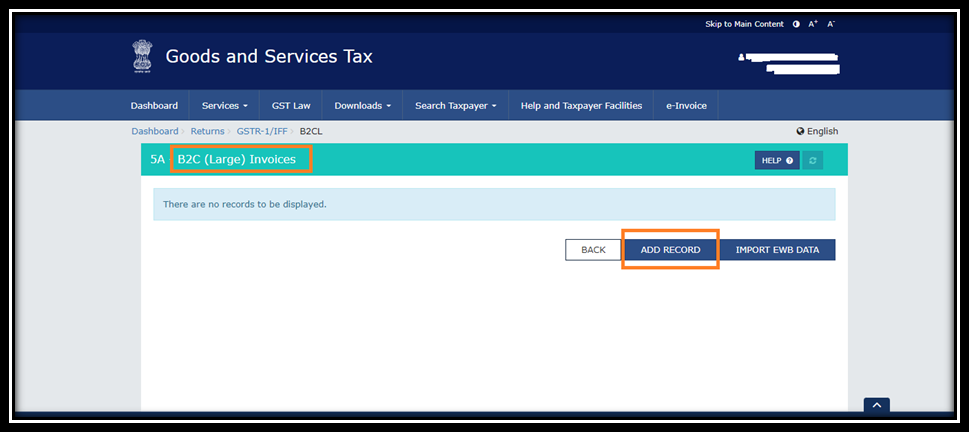

For B2CL Invoices —-> Select second tile ——> i.e. 5A –B2C (Large Invoice)

- Something to Know -:

B2CL Sales Means – Interstate Sales to any unregistered person having Invoice value exceeding Rs. 250000.

- You can add all the B2CL invoices in second tile i.e. 5A B2CL invoices.

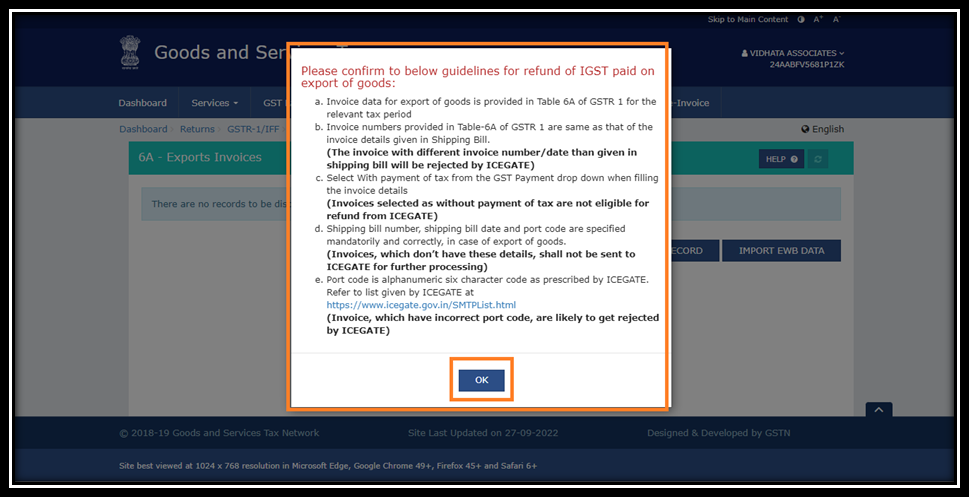

- For Export Invoices —–> Click on the 3rd Tile i.e. 6A Export invoice.

After clicking 3rd tile —> one confirmation Message flash on the screen —–> Click ok to further proceeds.

You can add directly Export Invoices by following the above procedure.

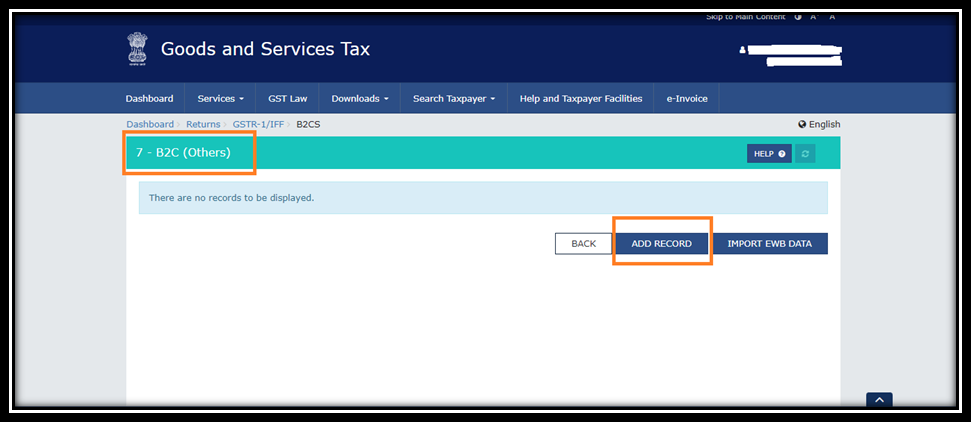

For B2CS Invoices —-> Select 4th tile ——> i.e. 7 –B2CS (Others)

- Something to Know -:

B2CS means- Any intrastate supply to any unregistered person & any interstate supply to unregistered person whose invoice value not exceeding Rs.250000.

You can add B2CS invoices by clicking to ADD RECORD tab

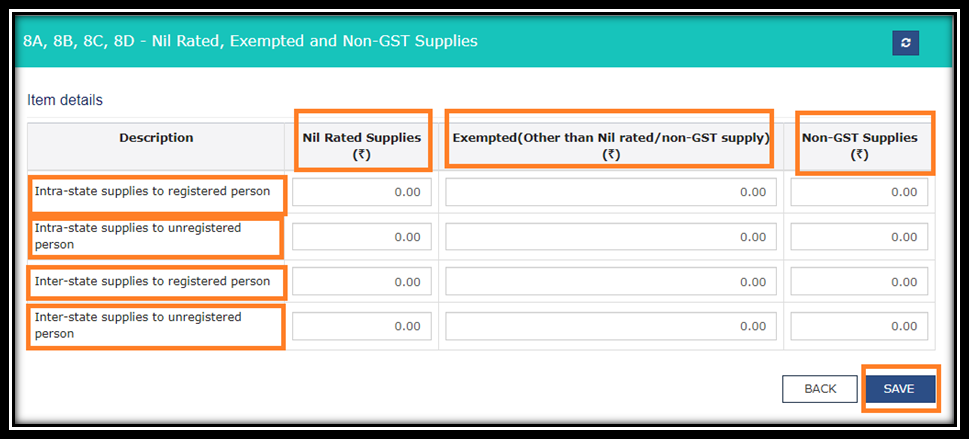

For Nil Rated supplies, Exempted supplies, Non GST supplies—-> Select 5th tile ——> i.e. 8A, 8B, 8C, 8D- Nil rated supplies.

- Something to Know -:

This tile contains 3 types –

Nil rated supply – Goods or services on which GST rate of 0% is applicable are called nil rated goods or services. No ITC available on Nil rated supply. Example of nil rated supply is Salt

Exempted Supply –

Supply of goods or services or both attract nil rate of tax or which may be wholly exempt from tax and includes non-taxable supply.

Non-GST supply-

Supplies which do not come under the scope of GST are called Non GST supply. Example Of non-GST supplies are alcohol for human consumption, Petroleum products.

You can ADD here directly nil rated supplies, Exempted supplies, Non-GST supplies and save it.

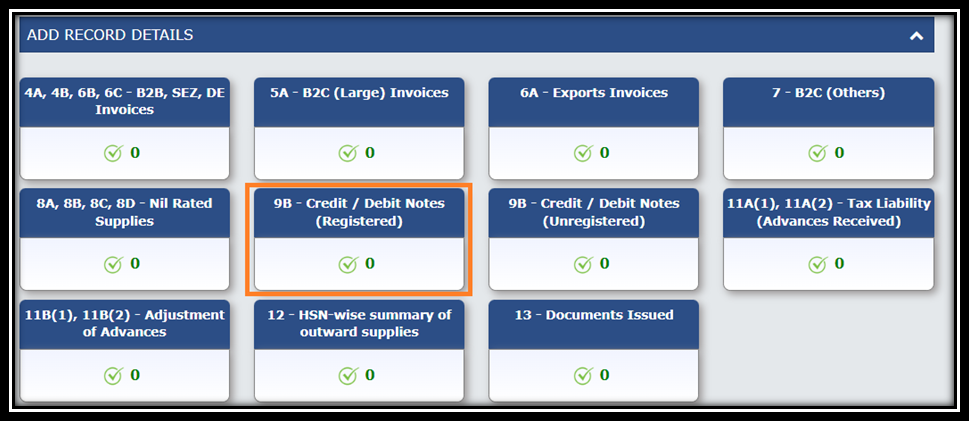

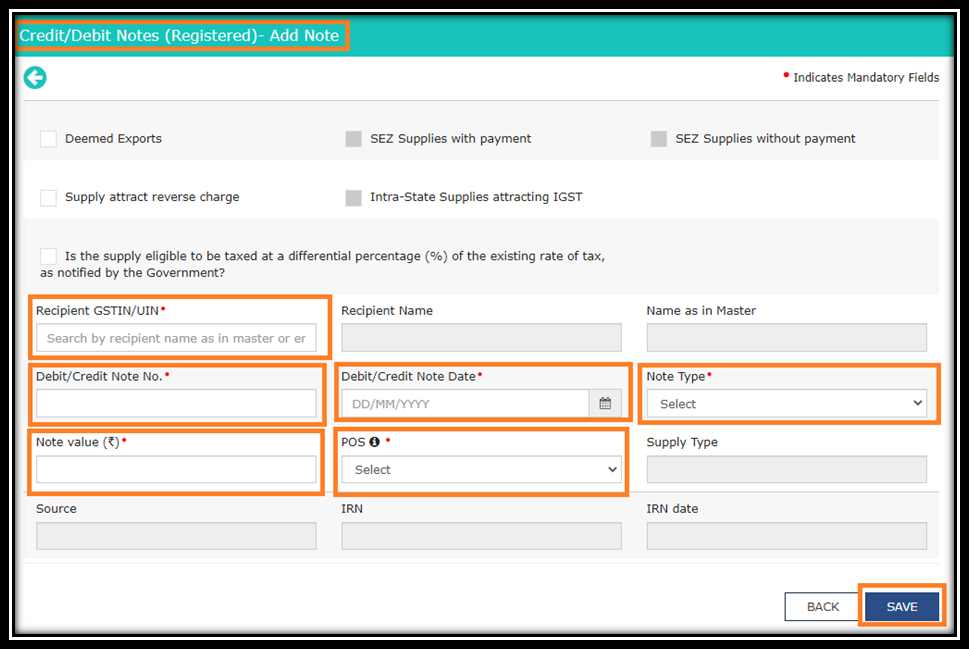

For Registered Credit Notes/Debit Notes—-> Select 6th tile ——> i.e. 9B Credit notes/Debit Notes registered.

- Something to Know -:

Credit notes – it is issued in case of Sales return or rate difference.

Debit notes – Supplier can issue the debit note in case of Price revision which result in to increase of its sales.

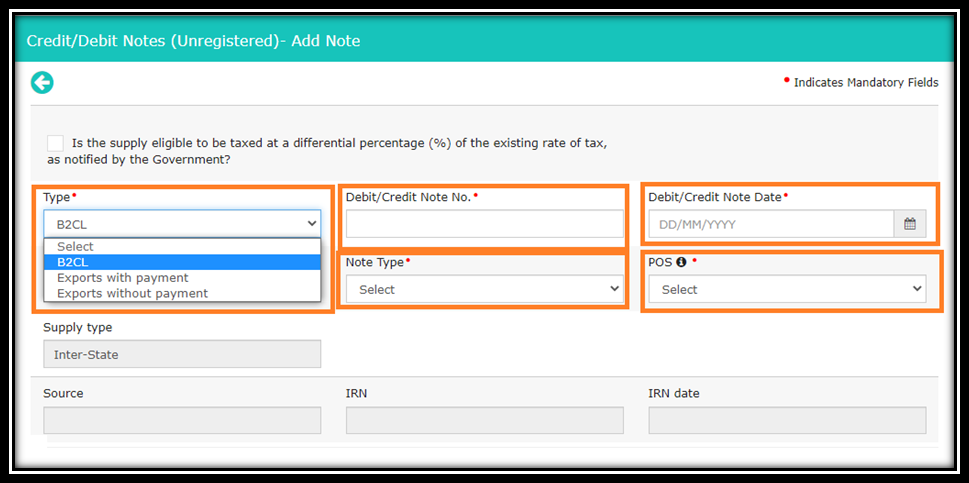

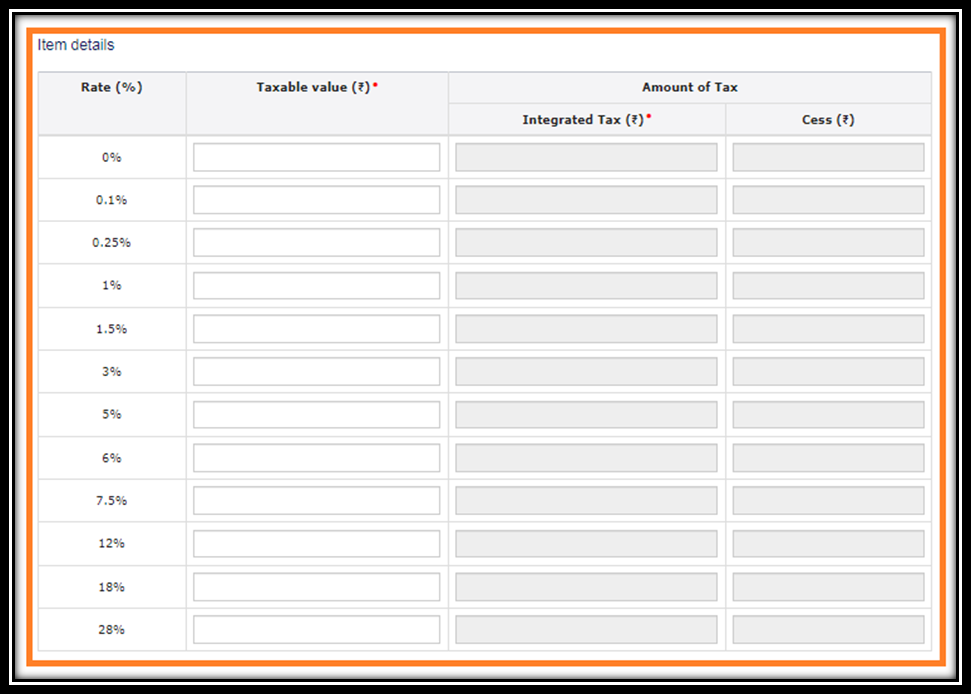

For unregistered Credit Notes/Debit Notes—-> Select 7th tile ——> i.e. 9B Credit notes/Debit Notes unregistered

- Something to Know -:

In case of Credit note/Debit note issued to unregistered person- fill the Type, Credit note/debit note number, date, note type & Place of supply for the same.

You are required to fill all the details rate wise for Credit notes/debit notes to unregistered person

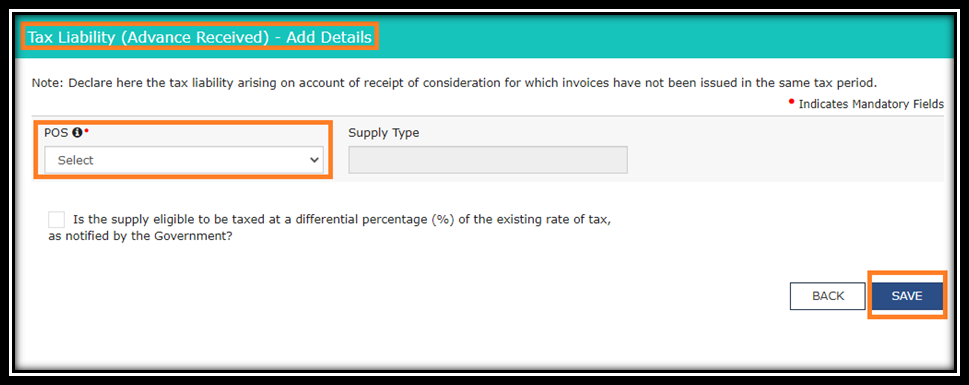

For Advance received—-> Select 8th tile ——> i.e. 11A(1),11A(2) Tax liability on Advance received

Hint – When advance received in case of supply of services —-> GST will applicable on such advance and supplier require to issue Receipt Voucher in such cases.

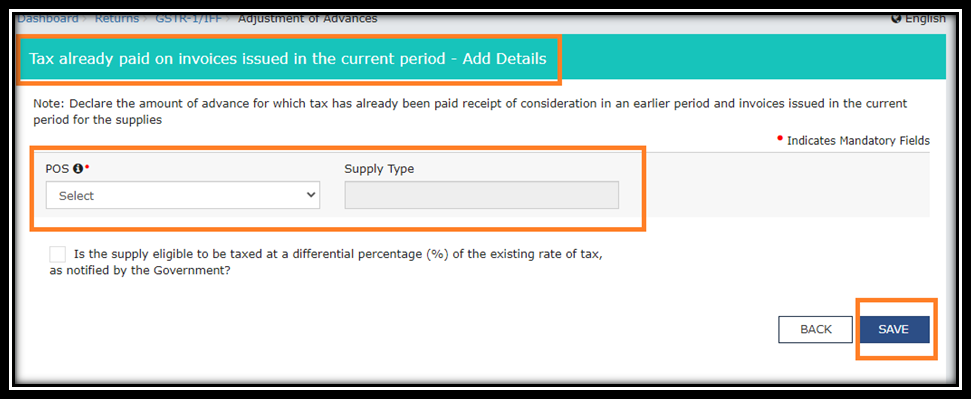

For Advance adjustment—-> Select 9th tile ——> i.e. 11B(1),11B(2) Advance adjustment

Hint – GST Paid on advance received will adjusted when invoice raised. So Advance adjustment will reflect in 9th tile.

For HSN Summary–> Select 10th tile —> HSN wise summary of outward supplies

- HSN-wise Summary is a summary of all the Goods and services that you’ve sold in the respective filing period.

| Particulars | Goods | Services |

| > 5 Crore (T/o in previous financial year) | 6 Digit | 6 Digit |

| < 5 Crore (T/o in previous financial year) | 4 Digit | 4 Digit |

| For Specified chemicals | 8 Digit | – |

| In case of Export | 8 Digit | 6 Digit |

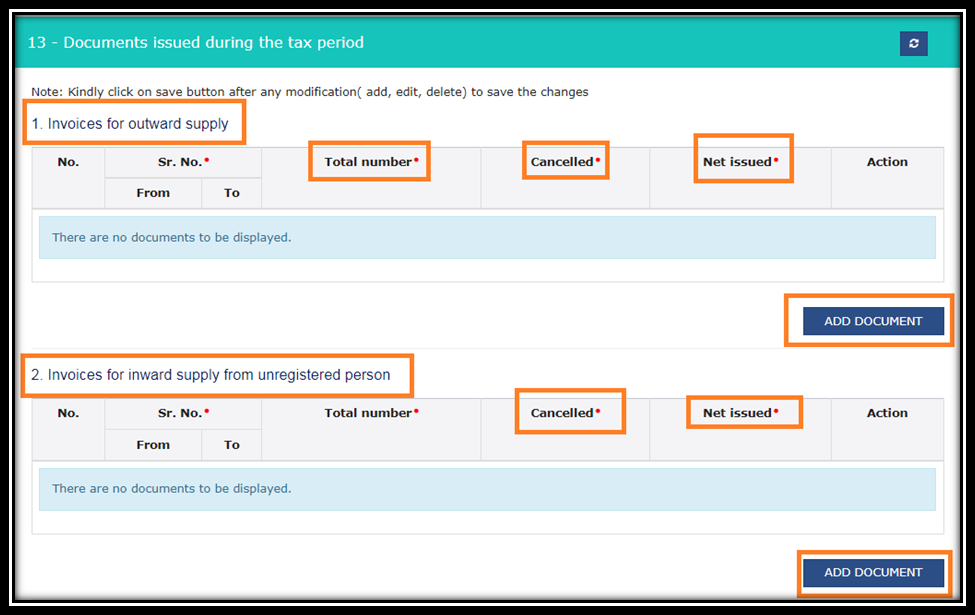

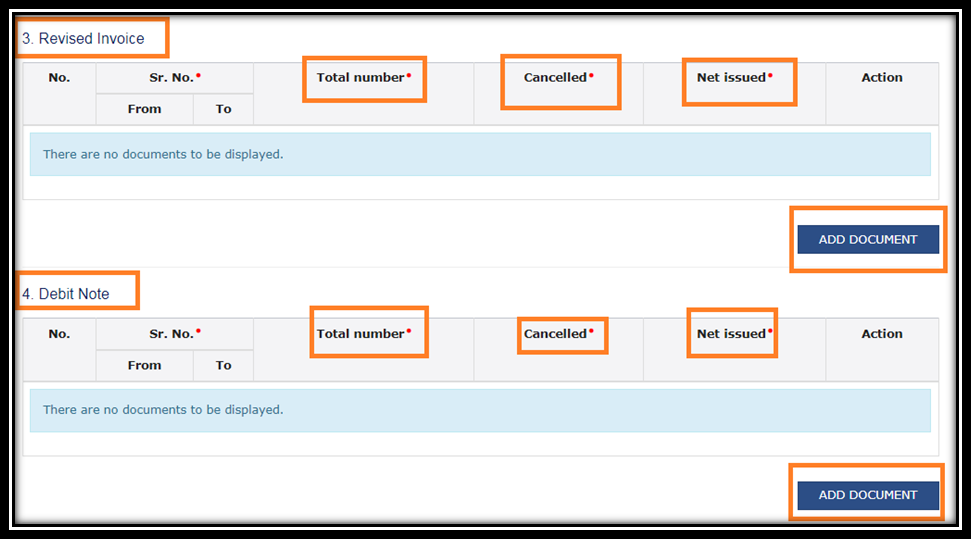

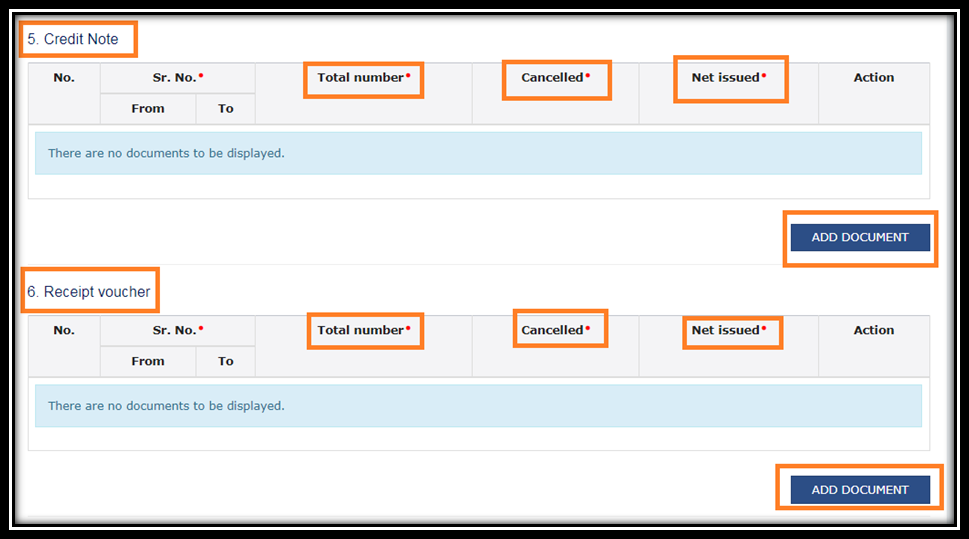

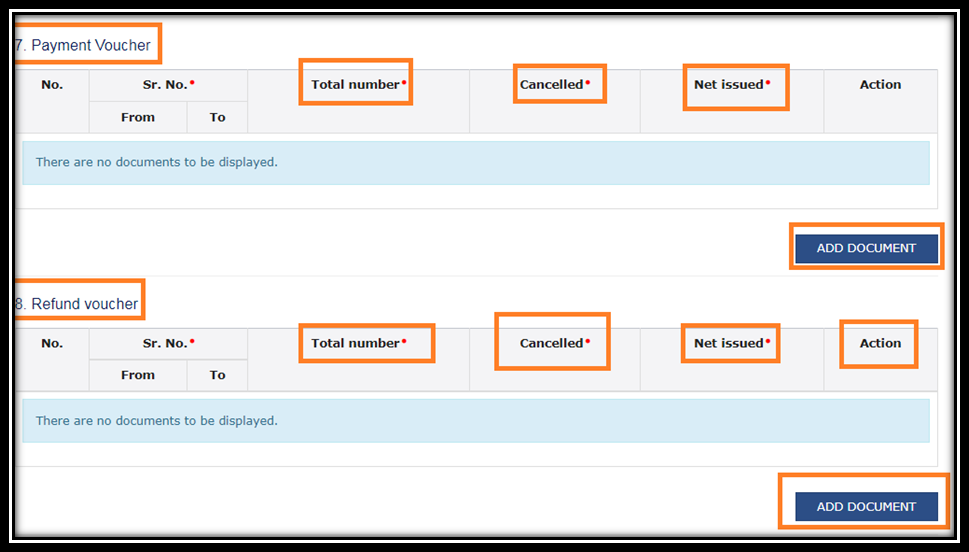

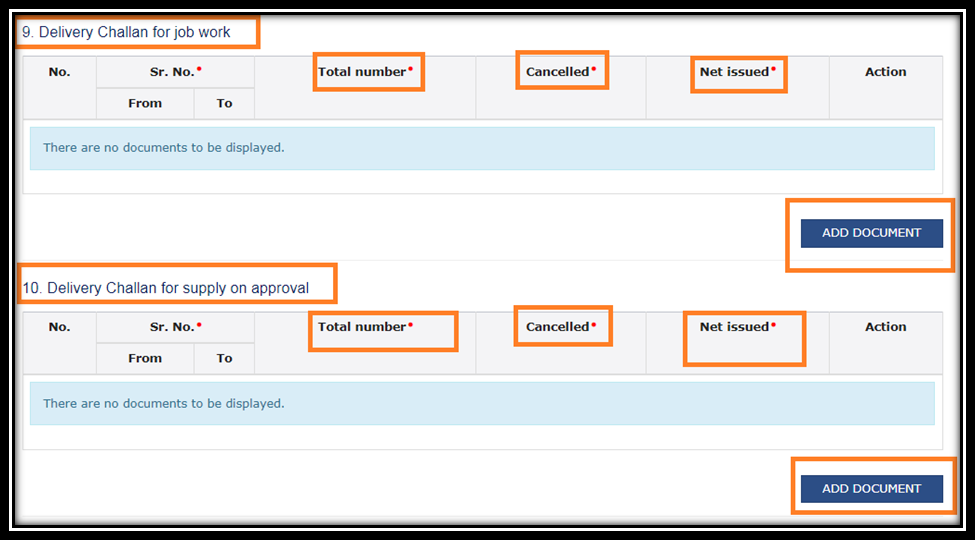

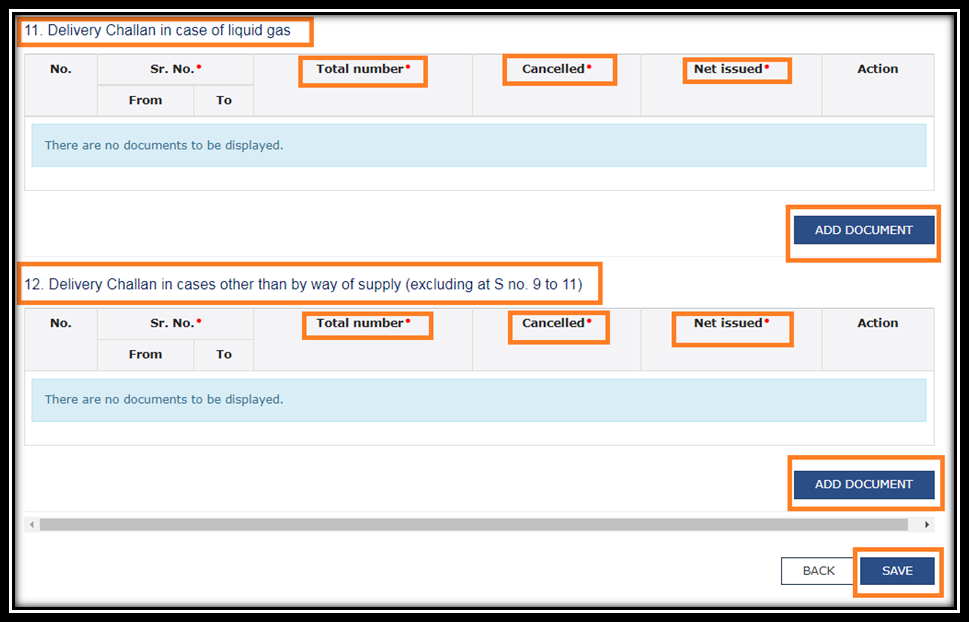

- For Document Summary–> Select 11th tile —> Documents issued.

Details of the documents like invoices, Debit note, Credit Note, Receipt Voucher, Payment Voucher, Refund Voucher and Deliver Challan issued and/or cancelled during the Tax period has to be entered here.

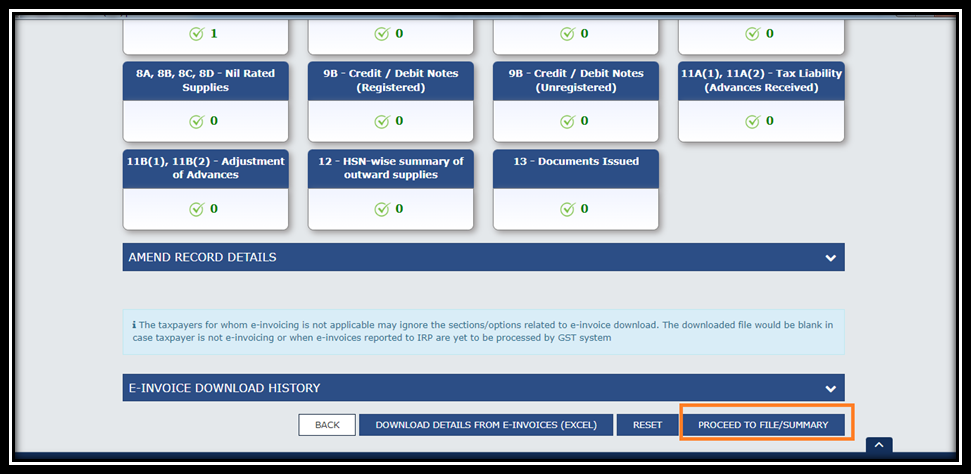

Step-6

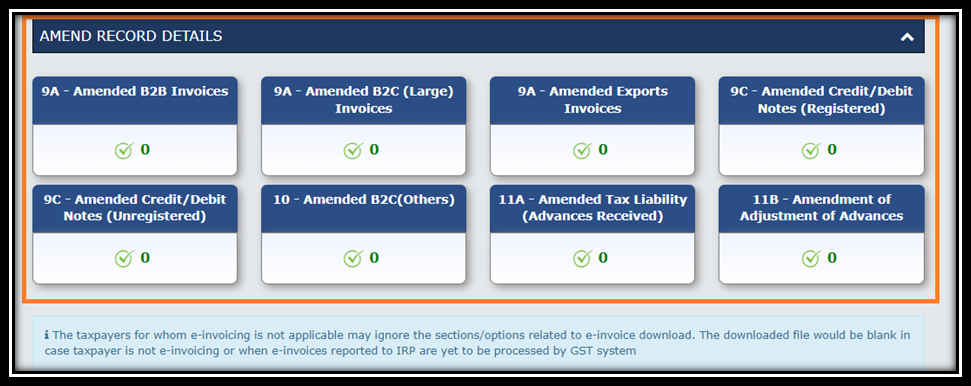

Amendments in GSTR-1

- List of type of Amendments -:

Invoice Level amendments– one can make amendment for the following Invoices issued for-:

1. B2B

2. Export invoices

3. B2CS

4. Credit notes/Debit notes (Registered)

5. Credit notes/ Debit notes (Unregistered)

Note -:

A taxpayer cannot amend invoices that have already been accepted or modified by the recipient of goods. There will be no possibility of amending these invoices

Summary level amendments – You can make summary level amendments for following-

1. B2C

2. Advance Tax liability for Advance received

3. Amendments of Adjustments of advances

Note -:

- at a summary level a new POS cannot be added or amended

- Nil rated items and HSN outward supply summary cannot be changed

Step-7

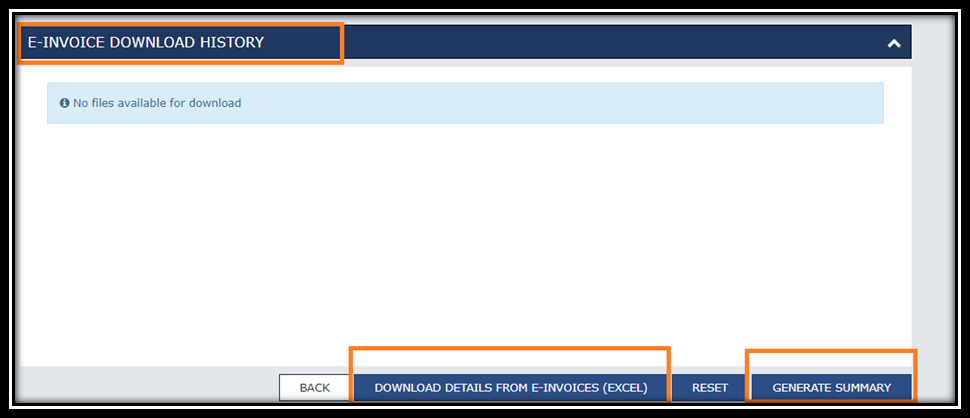

E invoice summary

Hint – E invoices are applicable to every person whose turnover exceeding 10 crore in any of the previous financial year from 2017-18. Hence before filling GSTR-1 it is advisable to cross verify the invoices uploaded on the portal in the E invoice summary.

By click on Download details from E invoices —> can download summary in excel format.

One can generate summary before filling GSTR-1 in order to cross verify all the details of GSTR-1

Summary will generated in the following forms before return filed

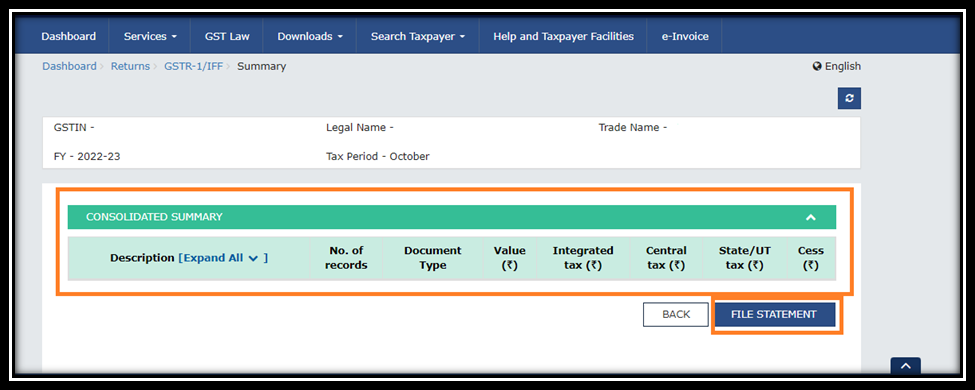

Step-8

Filling of GSTR-1 Return

- Select the checkbox for declaration & two options are available -:

1. File with DSC 2.File with EVC

- In case of EVC —-> OTP sent to registered mobile number—–> and with OTP return can filed.

- Acknowledgement number will receive for confirmation of GSTR-1 filing & afterwards one can download PDF of GSTR-1 return filed copy with easy tap.

How to file NIL GSTR 1

how to file GSTR1 nil return

Select Return dashboard after login in to the portal

Select Financial Year ,Quarter and Period for which you want to file return

Click —-> File Nil GSTR-1

After Selecting above Option –> Tick the Declaration Box—-> File GSTR-1 with DSC/EVC.