Technical issues in Payment for Filing SPL-01/02

Taxpayers are facing technical issues in payment for filing SPL-01/02 on the GST Portal, particularly in Table 4 of the Forms (SPL-01/SPL-02), where payment details are supposed to be auto-populated. To fix the problem CBIC has issued the GST Advisory on it on 12-06-2025.

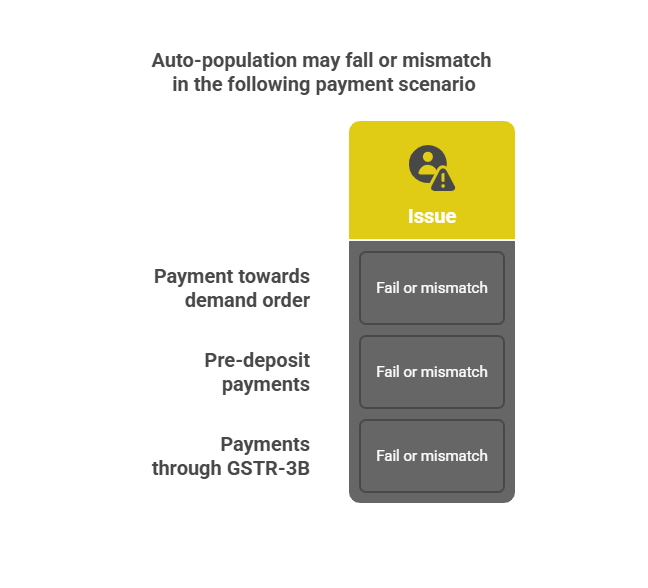

Specific Problem Noted:

In particular, it has been observed that in certain instances, the payment details may not be accurately auto-populated in the applications filed by the taxpayers.

- (a) Amount paid through the “payment towards demand order” functionality

- (b) Pre-deposit amount details

- (c) Payment made through GSTR 3B

Actions Advised for Taxpayer:

Continue filling the waiver application, even if :

- Table 4 shows missing or incorrect payment details.

- Demand amount and payment details do not match.

The GST portal will still allow submission on the application.

Important Instructions:

- Taxpayers must upload supporting documents related to the payments made.

- This includes GSTR-3B filings, payment receipts, or demand order references.

- These attachments will help the jurisdictional officer verify the correctness of the claim during processing.

Conclusion:

Despite mismatches or technical glitches in payment auto-population, taxpayers should not delay the filing of SPL-01/02 applications. it is advised to upload the relevant payment information as attachments along with the online application for verification by the jurisdictional officer.

https://www.gst.gov.in/newsandupdates/read/610

GST Advisory on Filing SPL-01 & SPL-02