GST Advisory on Refund Filing Process for Certain Categories

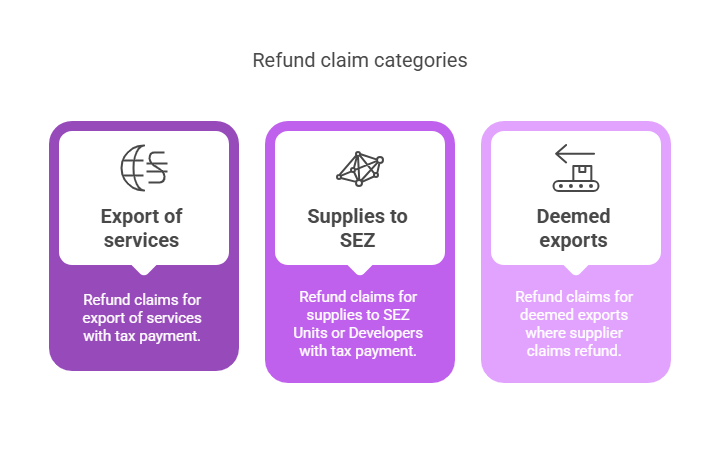

GST Advisory has been issued on the refund filing process for certain categories. The changes apply to refund claims made under these three categories:

1. Earlier, while filing a refund, taxpayers had to choose From and To tax period, Now this step is removed and you just :

- Select the relevant refund category and click Create Refund Application to proceed.

- Before applying for refund just make sure that all your returns like GSTR-1 & 3B are filed up to the date you apply for the refund.

2. Refunds will now be processed based on the individual invoices, not on the overall tax period.

3. Once the invoice is uploaded in the refund application:

- They get locked, meaning you can not change or use them in any other refund claim.

- They will be unblocked only if you withdraw the refund application or the department issues a deficiency memo.

Download PDF of GST Advisory on Refund Process application