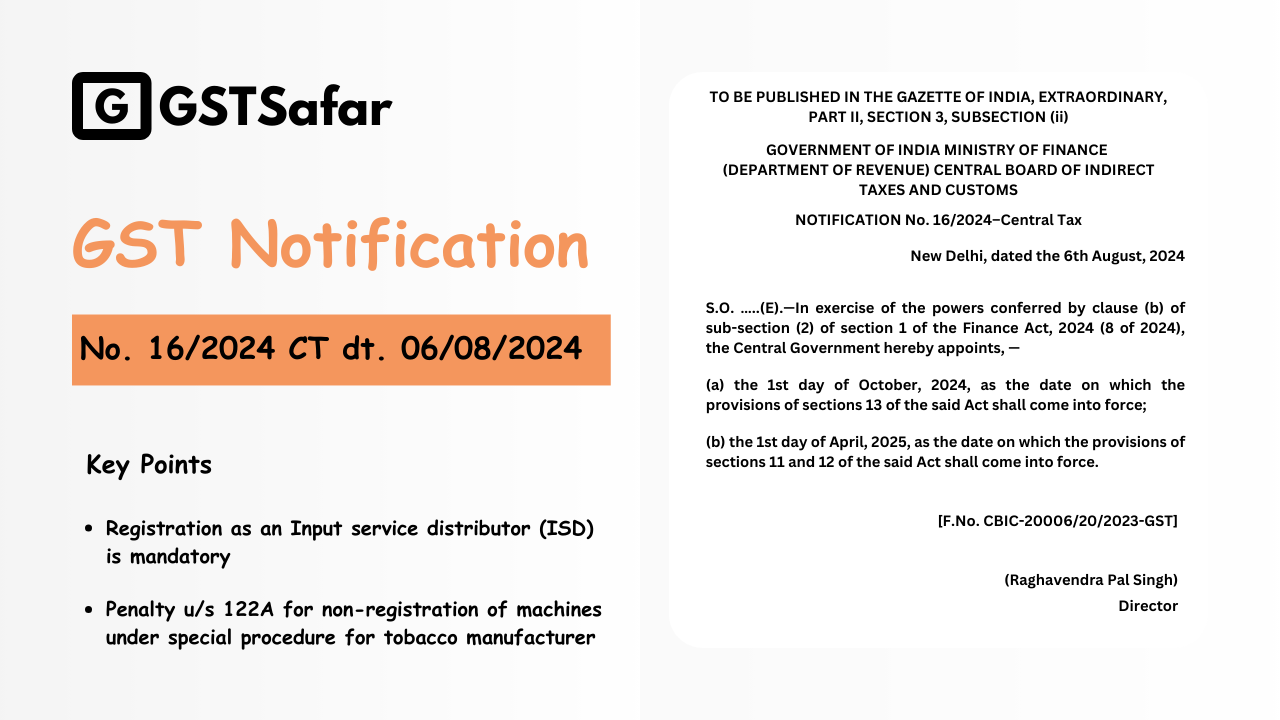

Notification No 17/2024 Applicability of Sections of Finance (No.2) Act 2024

Summary of the Notification No 17/2024 Notification No 17/2024 specifies the applicability of the sections that are either newly inserted or amended as proposed in Finance (No.2) Act 2024. The Government has specified the dates on which the provisions of these sections,proposed in Finance (No.2) Act 2024, will come in to effect. Section of Finance (No. … Read more