Government has issued GST Advisory on GSTR-1/ IFF on 17-01-2024. As per Notification No. 26/2022 – Central Tax dated 26th December 2022 two new tables Table 14 and Table 15 were added in GSTR-1 to capture the details of the supplies made through e-commerce operators (ECO) on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5). These tables have now been made live on the GST common portal. These two new tables will be available in GSTR-1/IFF from January-2024 tax periods onwards.

Purpose: The purpose of this advisory is to make taxpayers aware of the new Table 14

and 15 in FORM GSTR-1 and IFF. These tables are relevant for only those taxpayers who either

supply through E-Commerce operator (ECO) or are themselves liable to pay tax under Section

9(5) of the GST Act.

Introduction: As per Notification No. 26/2022 – Central Tax dated 26th December 2022

two new tables Table 14 and Table 15 were added in GSTR-1 to capture the details of the

supplies made through e-commerce operators (ECO) on which e-commerce operators are

liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5). These tables have

now been made live on the GST common portal. These two new tables will be available in

GSTR-1/IFF from January-2024 tax periods onwards.

Table Wise Details

| Table Details | Description |

| 14 (a) Details of the supplies made through e-commerce operators on which ecommerce operators are liable to collect tax under section 52 of the Act [Supplier to report] | 1. The ECO-GSTIN wise summary of the supplies made through ECO on which ECO is liable to collect tax at sources (TCS) and liability on which has already been reported in any table 4 to 10 of GSTR-1, shall be reported by the supplier in this section. 2. No taxable value or tax liabilities will be auto populated from this table to GSTR-3B. 3. Amendments to be reported in 14A(a). |

| 14(b) Details of the supplies made through e-commerce operators on which e-commerce operators are liable to pay tax u/s 9(5) [Supplier to report]. 15. Details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [ecommerce operator to report] | 1. In this section the summary details of the supplies made through ECO on which ECO is liable to pay tax u/s 9(5) is to be reported by the supplier. Tax on such supplies shall be paid by the ECO and not by the supplier. This is to be reported net of credit / debit note (if any). 2. Such values will be auto-populated to Table 3.1.1(ii) of GSTR-3B. 3. Amendments to be reported in 14A(b). 4. Eco shall report the supplies on which they are liable to pay tax u/s 9(5) in Table 15. Such supplies shall not be reported anywhere else in GSTR-1/IFF. 5. Registered Supplier and Registered Recipient (B2B)– In this section the details of such supplies where both the supplier and receiver of supplies are registered person, is to be reported by ECOs at invoice level. This will be available in IFF also. Debit Note / credit note (if any) to be reported in Table 9B. 6. Registered Supplier and Unregistered Recipient (B2C)– In this section the supplier level details along with POS and rate wise detail of the supplies related to the transaction where the supply is being made from a registered supplier to unregistered recipient need to be reported by e-commerce operator. This will not be available in IFF. This is to be reported net of credit / debit note (if any). 7. Unregistered Supplier and Registered Recipient (URP2B)– In this section the document level details of the supplies made from unregistered supplier to registered recipient through ECO needs to be reported by the e-commerce operator. The detail to furnish will include the document detail and GSTIN of recipient. This will be available in IFF also. Debit Note / credit note (if any) to be reported in Table 9B. 8. Unregistered Supplier and Unregistered Recipient (URP2C)– In this section the POS and rate wise detail of the supplies to be reported by e-commerce operator related to the transaction of such supplies from an unregistered supplier to unregistered recipient through ECO. This will be not be available in IFF. This is to be reported net of credit / debit note (if any). 9. The values shall be auto-populated in Table 3.1.1(i) of corresponding GSTR-3B and such liabilities is to be paid by the ECOs in GSTR-3B in cash. 10. Amendments to be reported in Table 15A(I) & 15A(II). |

Taxable value along with tax liabilities from all the above four sections i.e., B2B, B2C,

URP2B and URP2C of table 15 will be auto-populated to table 3.1.1(i) of GSTR-3B.

There will be no auto-population of e-invoice in Table -15. E-invoices reported for 9(5)

supplies will be populated in FORM GSTR-1 as per existing functionality. E-commerce

operator are advised to examine and add such records in table 15 related to 9(5)

supplies.

Step to report details in Table 14/15:

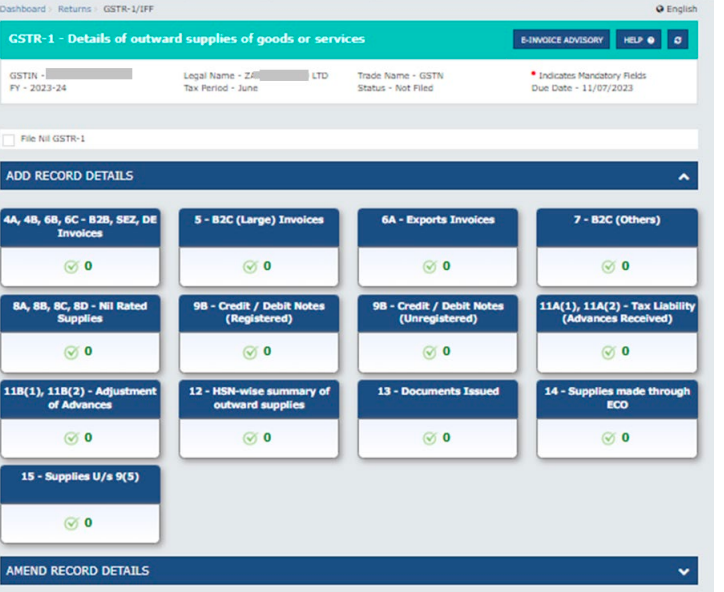

- To view Table 14/15, taxpayer can navigate to Returns Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare online .

2. Taxpayers can access the Table 14(a) & 14(b) by clicking the Liable to collect tax u/s 52

(TCS) and Liable to pay tax u/s 9(5) respectively available at the top of table 14 page.

3. Similarly, the different section of Table 15 can be accessed using the respective tab

available at top of the table 15 page.

4. After adding the records taxpayers can file their GSTR-1 as per the existing process.

Download PDF from Below

Introduction of new table ECO-Documents in GSTR-2B

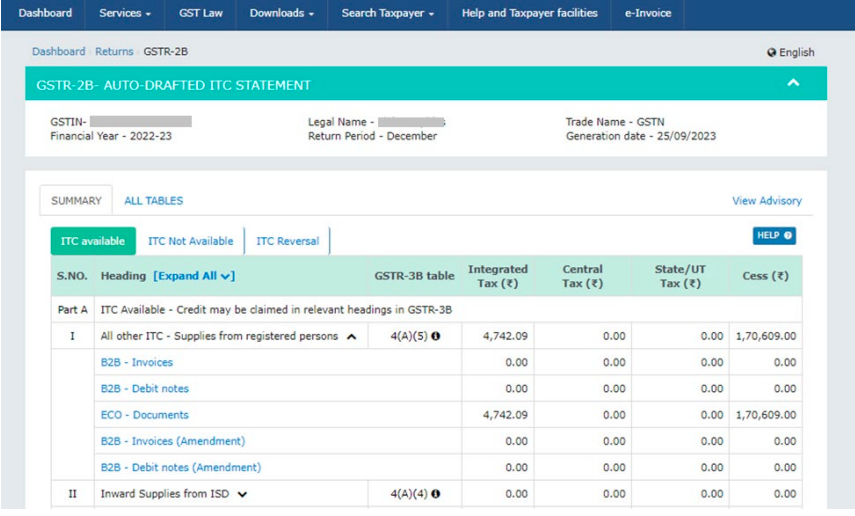

1.The taxpayers are also being provided a facility to pass input tax credit (ITC) to the

registered taxpayers who are receiving the supplies u/s 9(5) through ECO. Such ITC

will be available to the registered recipient in newly introduce section in GSTR-2B. A

new table “ECO – Documents” is being added under all other ITC section in GSTR-2B.

In this table, the registered recipient can view the document details of the supplies

received through e-commerce operator on which e-commerce operator is liable to pay

tax under section 9(5) of the Act.

2. The values will be auto populated from Registered Supplier and Registered Recipient

(B2B) and Unregistered Supplier and Registered Recipient (URP2B) section of table 15

to this new ECO – Documents table of GSTR-2B.

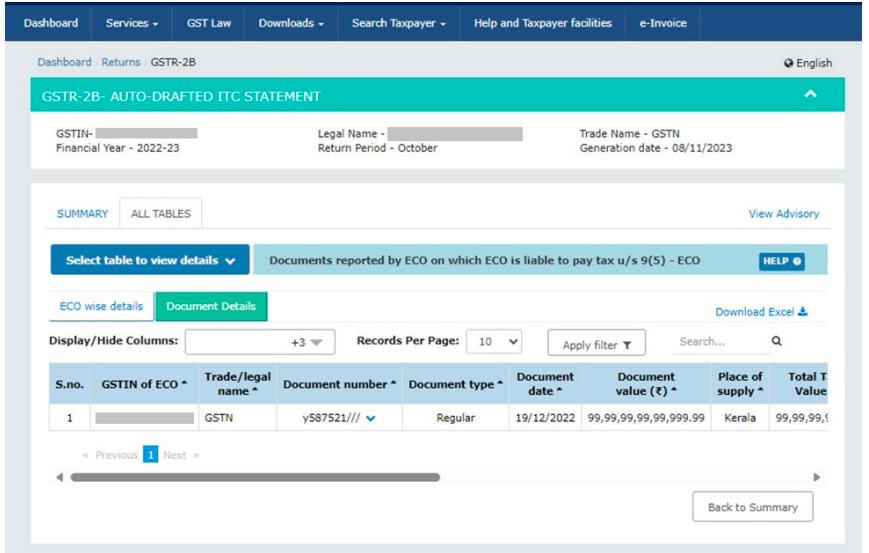

3. To view the ECO-Documents table, taxpayer can navigate to Returns Dashboard >Selection of Period > Auto- drafted ITC Statement for the month GSTR 2B > View

5. To view the records in ECO-Documents table, taxpayer can navigate to Returns

Dashboard > Selection of Period > Auto- drafted ITC Statement for the month GSTR 2B >

View > ECO Documents.

Read similar article