Table 3.2 of GSTR-3B remains editable for April 2025 return

GST Advisory has been issued for Table 3.2 of GSTR-3B remains editable for April 2025 return.

Key Points of GST Advisory:

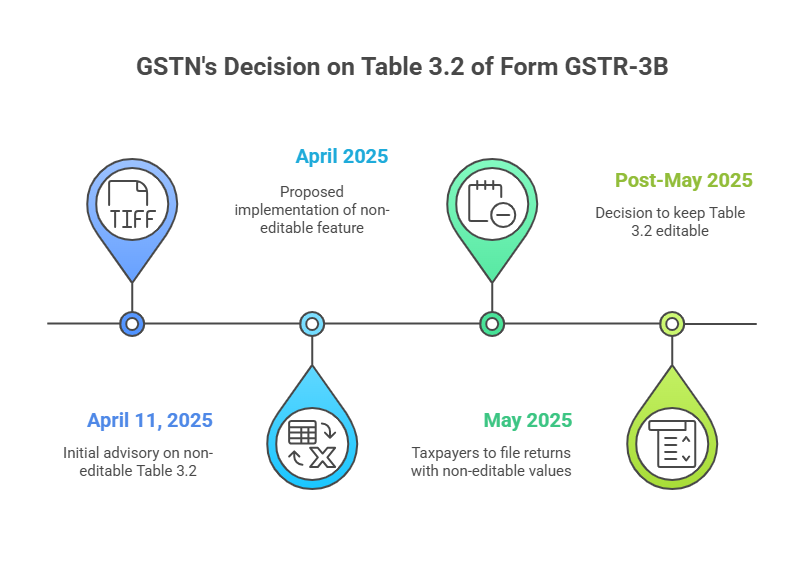

- The GST portal announced on 11-04-2025 that from the April 2025 return onwards, the values shown in Table 3.2 of GSTR-3B, which shows interstate sales from unregistered persons, composition taxpayers, and UIN Holders, will be auto-filed and not editable.

- Many taxpayers raised complaints about this decision. Hence, to avoid the problems and make return filing easier, the government has decided that Table 3.2 of GSTR-3B will continue to be editable for now. Taxpayers can change or correct the autofilled values if needed and ensure the return is accurate.

- If any changes are implemented in the future, a separate announcement will be made.

- In short, you can still edit Table 3.2 in GSTR-3B while filing April 2025 returns (due in May).

Lets understand in simple chart:

Download PDF of GST Advisory on table 3.2 of GSTR-3B

https://www.gst.gov.in/newsandupdates/read/604