Summary of the GST Instruction on Fake Registration – Guidelines for second special all india drive against fake registration:

- On Aug 12, 2024 – The Government issued GST Instruction on Fake Registration comprising Guidelines for second special all-India drive against fake registration.

- The Government issued original nationwide guidelines on 04-05-2023 to identify and verify fake GST Registrations.The aim was to detect and address any fraudulent registration to prevent revenue losses. To monitor the progress of this guidelines National Coordination Committee was established.This Committee headed by Senior member of GST department including senior officers from different States and Centre.

- A meeting of the said National Coordination Committee was held on 11th July 2024, wherein it was discussed that the special All-India drive conducted during the year 2023, was found quite effective in weeding out fake registrations. The Committee felt that there may be a need for further focused and coordinated action by Central and State tax authorities to clean up the tax base and to take concerted action against the fake registrations and fake/bogus invoices, on the same pattern as was done during the said drive. It was, therefore, decided that a second special All-India drive against fake registrations may be conducted by all Central and State tax authorities for two months starting from 16th August 2024.

- The earlier issued Instruction No.01/2023 is being partially updated and the following new guidelines are now issued.

(a) Period of Special Drive:

- The second nationwide drive will be carried out from 16-08-2024 to 15-10-2024 by all central and state tax authority for the identification of fraudulent registration and to protect revenue loss.

(b) Identification of Fraudulent GSTINS:

- For identification of suspicious or High-risk GST registrations, GSTIN works with the Directorate General of Analytics and Risk Management (DGARM), CBIC, based on the detailed data analytics and risk parameters. In case of such suspicious GSTINs falling under the jurisdiction of Central Tax, the details will be shared with the Central Tax authorities by GSTN through DGARM. Besides, the State and Central Tax Authorities, may, at their own option, supplement this list by data analysis/ intelligence gathering at their end, using various available analytical tools like BIFA/ GAIN, ADVAIT, NIC Prime, E-Way Bill Analytics etc., as well as through human intelligence, modus operandi alerts, experience gained through the past detections, as well as the first special All-India drive.

(c) Actions to be taken by field formations:

- On the receipt of list of suspicious GSTINs from GSTN, tax officers must quickly verify these registations with in prescribed time. After verification , if any supplier does not actually exist and it is fake, the tax officer immediately starts the process of suspending or canceling the GST registration by following section 29 of CGST Act,2017.

- In addition, the officer should quickly review whether to block the input tax credit in electronic credit ledger of the fake taxpayer, according to Rule 86A of CGST Rules,2017. Additionally, the details of the recipients to whom the input tax credit has been passed by such non-existent taxpayer may be identified through the details furnished in FORM GSTR-1 by the said taxpayer.

- If the recipient of Input tax credit falls under the same tax authority’s jurisdiction,the tax authority should take appropriate action to demand and recover the ITC that was wrongly claimed by recipient based on the invoice issued by fake supplier without underlying supply of goods or servicies or both.

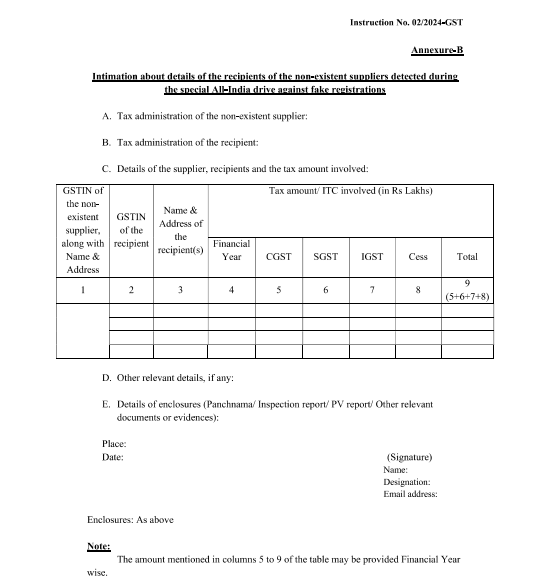

- In cases where the recipient GSTIN pertains to a different tax jurisdiction, the details of the case including the details of the recipient GSTIN, along with the relevant documents/ evidence, may be sent to the concerned tax authority,as early as possible, in the format mentioned in Annexure-B. For sharing such details/ information and coordination with other tax authorities, GSTN Back Office has an online functionality, namely, ‘Initiate Enquiry’ in the Enforcement module, which is available to all tax officers who have been assigned the role of ‘Enforcement Officer’ on the Back Office (BO Portal).

- Each CGST Zone and state must immediately appoint nodal officer for communication of information to relevant tax jurisdiction. Nodal officer’s details including their name, designation,phone number, mobile number and email address must be shared with GST Council Secretariat within 3 days of the letter being issued.GST Council Secretariat will compile the list of the Nodal officers after procuring the details from all the tax administrations and will make the compiled list available to all the tax jurisdictions and to GSTN.

- The nodal officer of the tax jurisdictions may be assigned the role of ‘Enforcement Officer’ on the BO Portal. Wherever the details of the recipient GSTIN need to be shared with other tax jurisdictions, the same may be done through the nodal officer. The said nodal officer will accordingly share the information about the recipient GSTIN with the nodal officer of the concerned recipient tax administration, through the said functionality,attaching a PDF document in the format mentioned in Annexure-B. The nodal officer of the recipient tax administration will further share the details with the concerned jurisdictional tax officers, for necessary action.

- GSTN will issue detailed guidelines/ advisory regarding usage of this functionality, which may be referred to.

- Action may also be taken to identify the masterminds/ beneficiaries behind such fake GSTIN for further action, wherever required, and also for recovery of Government dues and/ or provisional attachment of property/ bank accounts, etc. as per provisions of section 83 of CGST Act. Further, during the investigation/ verification, if any linked suspicious GSTIN is detected,similar action may be taken/ initiated in respect of the same.

(d) Feedback and Reporting Mechanism:

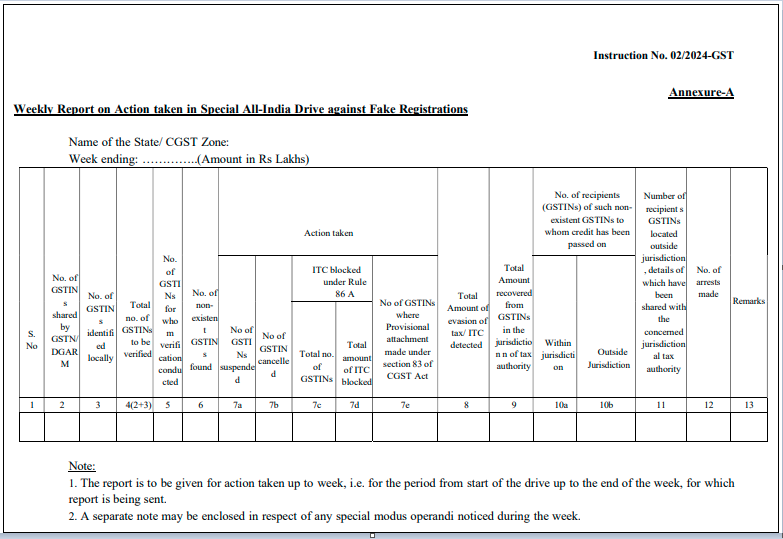

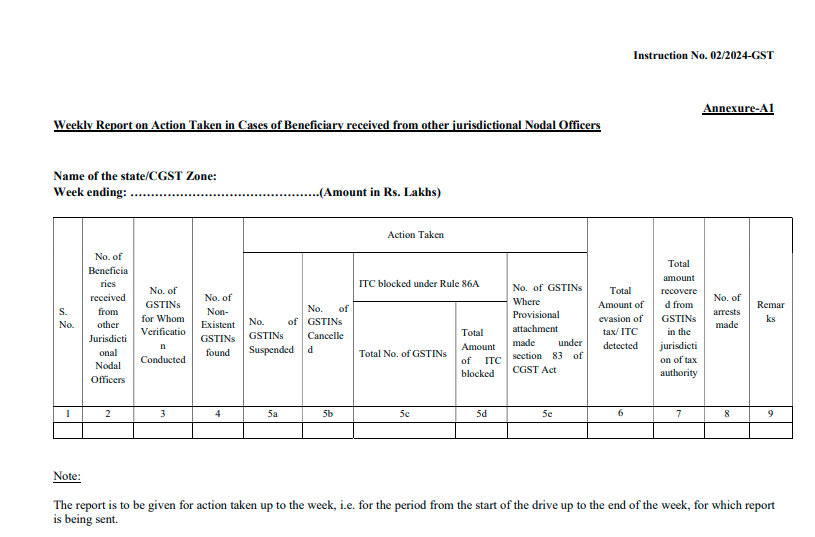

- Report should be prepared by each state and CGST zone for actions they have taken. This report should be prepared in the format provided in Annexure-A of GSTINs identified by GSTN or locally, Annexure -A1 for GSTINs received from other tax administrations through the “Initiate Enquiry Module”. The nodal officer will upload these reports to the designated portal on a weekly basis, specifically on the first working day after the weekends to enable the GST Council Secretariat to monitor the same.

- If any novel modus operandi is detected during the verification/ investigation, the same may also be indicated in the said action taken report. On the conclusion of the drive, GSTIN-wise feedback on the result of verification of the suspicious GSTINs shared by GSTN, will be provided by the field formations through the nodal officer to GSTN, as per the format enclosed in Annexure-C.

- The Principal Chief Commissioner/ Chief Commissioner of the Central GST Zones and the Chief Commissioner/ Commissioner of the States/ UTs may monitor the progress of action taken in respect of list of suspicious GSTINs received from GSTN and chosen locally. The action taken in respect of the GSTINs received from other tax administrations through the ‘Initiate Enquiry’ module may also be monitored.

- Reports will be gathered from Various tax offices by GST Council Secretariat and provided quickly to National Coordination Committee including any new or unique method of fraud discovered during special drive if any,which will be subsequently shared with Central and State Tax administrations across the country.

Annexure-A: Weekly Report on Action taken in Special All-India Drive against Fake Registrations

Annexure-A1: Weekly Report on Action Taken in Cases of Beneficiary received from other jurisdictional Nodal Officers

Annexure-B: Intimation about details of the recipients of the non-existent suppliers detected during the special All-India drive against fake registrations

Annexure-C: GSTIN-wise feedback regarding the outcome of the action against the suspicious GSTINs