The CBIC notified the reduction in the applicability of GST E-invoicing threshold from 10 Crores to Rs 5 Crores with effect from 1st August, 2023. E-Invoicing will be mandatory for registered persons whose aggregate turnover in any preceding financial year from 2017-18 onwards exceeds five crore rupees in respect of supply of goods or services or both.

Table of Contents

ToggleLatest amendment in e-invoice

GST e invoice latest notification 10/2023 Central Tax dated 10.05.2023 has been issued. Notification 13/2020 dated 21.03.2020 is for applicability of e-invoice.

As per this notification at present e-invoice is applicable to entities having aggregate turnover exceeding Rs 10 cr. Earlier this limit was Rs 20 cr, but it was reduced from 20 cr to 5 cr w.e.f. 01-08-2023.

Means at present e-invoice is applicable in gst to entities having aggregate turnover exceeding Rs 10 cr w.e.f 01.10.2022.

Now again CBIC has issued this latest gst notification 10/2023 Central Tax to amend notification no 13/2020 Central Tax.

So now as per latest gst notification e-invoice shall be applicable to entities having turnover exceeding Rs 5 cr from 01.08.2023.

E-invoice applicability

Many people are confused about the applicability of e-invoice as there are many changes in applicability of e-invoice in GST. Actually this e-invoice concept is being introduced by government in phased manner.

E invoice turnover limit from April 2022 is Rs 20 crores. Initially when e-invoice concept was implemented in October-2020, turnover limit was Rs 500 crores. But this limit was initial Rs 500 crores and gradually it has been reduced in phased manners as under

Turnover limit for e invoicing under gst

| Phase | 1 | 2 | 3 | 4 | 5 | 6 |

| Effective Date | 1st October,2020 | 1st January,2021 | 1st April,2021 | 1st April,2022 | 1st October, 2022 | 1st August, 2023 |

| If Aggregate Turnover in any preceding F.Y from 2017-18 onwards exceeds | Rs.500 Crore | Rs.100 Crore | Rs.50 Crore | Rs.20 Crore | Rs 10 Crore | Rs 5 Crore |

E-invoice meaning

- What is meant by e-invoicing? This question is very relevant as its going to transform the system of invoicing in GST.

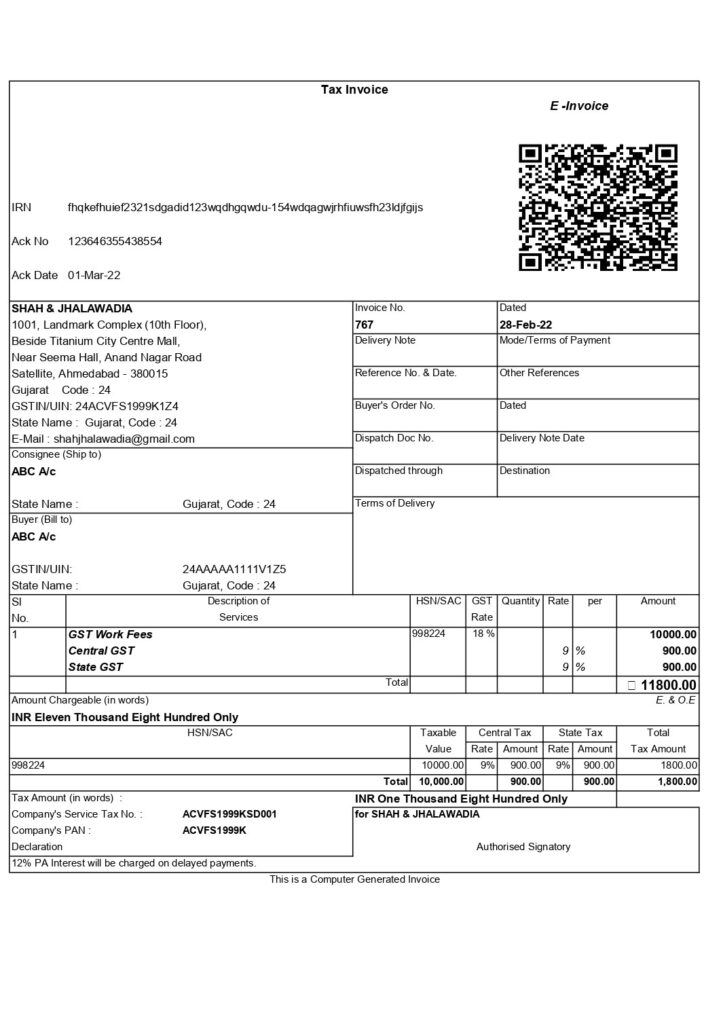

- As per Rule 48(4) of CGST Rules, notified class of registered persons have to prepare invoice by uploading specified particulars of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).

- After following above ‘e-invoicing’ process, the invoice copy containing inter alia, the IRN (with QR Code) issued by the notified supplier to the buyer is commonly referred to as ‘e-invoice’ in GST. Because of the standard e-invoice schema (INV-01), ‘e-invoicing’ facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format. Please note that ‘e-invoice’ in ‘e-invoicing’ doesn’t mean generation of invoice by a Government portal

What is the purpose of e-invoice?

- The GST Council approved the standard of e-invoice in its 37th meeting held on 20th Sept 2019 and the same along with a schema has been published on GST portal.

- E-invoicing in India is a big move, due to the volume of business transactions undertaken every day, as well as the plethora of different, non-standardized formats used in invoice generation.

- The benefits of e-invoice are that It will improve business-to-business communication by reducing transcription errors and cost involved; It will simplify exchange of documents between suppliers and buyers, just like sending/receiving e-mail; GST reporting will be a lot easier and indeed a by-product

- The main objective is to enable interoperability across the entire GST eco-system i.e. an e-invoice generated by one software should be capable of being read by any other software. Basically, through machine readability, an invoice can be uniformly interpreted.

- In addition to the above, this new system of e-invoicing aims to make invoice reporting an integral part of a business process and remove the tedious task of invoice-compilation at the end of a return period. Claiming fictitious Input Tax Credit (ITC) by raising fake invoices is also one of the biggest challenges currently faced by tax authorities.

- The e-invoice system will help to curb the actions of unscrupulous taxpayers and reduce the number of fraud cases as the tax authorities will have access to data in real-time. The basic aim behind adoption of the e-invoice system by tax departments is ability to pre-populate the return and to reduce the reconciliation problems.

E-invoice notifications

In order to implement e-invoicing in GST, the first e-invoice notification no 68/2019 Central Tax dated 13.12.2019 was issued and thereafter series of negotiations were issued relating to e-invoicing.

Here is the list of notifications issued for e-invoicing

| Notification No | Details |

| 68/2019 CT dated 13.12.2019 | Notification 68/2019 CT dated 13.12.2019 inserted the new sub rules 4,5 and 6 in Rule 48 in CGST Rules 2017. |

| 69/2019 CT dated 13.12.2019 | This notification notified the common portal for the purpose of e-invoice. |

| 02/2020CT dated 01.01.2020 | This notification introduced The Central Goods and Services Tax (Amendment) Rules, 2020 Substituted Form GST INV-1 as e-invoice schema (Schema further amended vide Notification 60/2020 Dt. 30-7-2020) |

| 13/2020 CT dated 21.03.2020 | e-invoicing to start from the 1st October 2020; Notifies registered persons, other than government department, a local authority, a SEZ unit and those referred to in sub-rules (2), (3), (4) and (4A) of rule 54 of the said rules, whose aggregate turnover in any preceding financial year from 2017-18 onwards exceeds Rs. 20 Cr (earlier was 10 cr) as a class of registered person who shall prepare invoice and other prescribed documents, in terms of sub-rule (4) of rule 48 of CGCT Rules, 2017, in respect of supply of goods or services or both to a registered person or for exports.) Note: With effect from 01.10.2022 the word Rs 20 cr will be replacedto Rs 10 cr. |

| 60/2020 CT dated 30.07.2020 | Central Goods and Services Tax (Ninth Amendment) Rules, 2020 New form substituted for GST INV-01 (i.e. notified revised Schema/format for e-invoice) |

| 73/2020 CTDated | special procedure for taxpayers for issuance of e-Invoices in the period 01.10.2020 – 31.10.2020 |

E-invoice applicability under GST

- It is crucial to know the e-invoice applicability turnover

- It will be applicable to taxpayers whose aggregate turnover (based on PAN) in any preceding financial year from 2017-18 onwards exceeds Rs. 5 Cr

- Applicable only for B to B transactions. Means for B to C transactions E-invoice shall not be applicable However for export E-Invoice shall be applicable

Who is exempted from e-invoicing?

Notification 13/2020 Central Tax dated 21.03.2020 can be known as e-invoicing exemption notification also as it gives the list of exemption from e-invoicing

In the case of the following persons/services E-Invoice shall not be applicable

- Insurance Company (Exemption to entity)

- Banking [including NBFCs (exemption to entity)

- Goods Transport Agency transporting goods by road in goods carriage (exemption to only GTA Service)

- Person supplying Passenger Transport Services (exemption to only Passenger transport service)

- Cinematographer films in multiplex screen (exemption to only this service)

- SEZ Unit (exemption to entity)

Note-Its only to SEZ unit but no to SEZ developer

- Government department

- Local Authority

Meaning of aggregate turnover

Aggregate turnover in GST is total of following supply

- Taxable Supply

- Exempt Supply

- Export Supply

- Interstate Supply inter-State supplies of persons having the same Permanent Account Number

Notes

- IT excludes GST tax and CESS

- It excludes Reverse Charge Mechanism (RCM) suppl

In other words we can say that this is aggregate turnover formula

What are the documents covered for e-invoicing?

Documents covered under e-invoice are as under

- Documents Covered

- Tax Invoice

- Credit Note

- Debit Note

What are the supplies covered for e-invoicing?

supply covered under e invoice under gst are as under

- Types of supplies covered

- B2B

- Supplies to SEZ with or without payment (it’s B2B)

- Deemed Exports (it’s B2B)

- Exports (with or without payment)

Examples for Applicability of e-invoice

Note: This examples have been taken based on e-invoice applicability having aggregate turnover exceeding Rs 20 cr. Make sure answers of this examples will change if you want to calculate applicability of entities having aggregate turnover exceeding Rs 5 cr

Example-1

X Ltd is having aggregate turnover as under since 2017-18

E-invoice is not applicable to X Ltd as aggregate turnover does not exceed in any year from 2017-18 onwards

Example-2

P & Co is having aggregate turnover as under since 2017-18

E-invoice is applicable to P & Co from 01/04/2022 as its aggregate turnover exceeds Rs 20 Cr in 2018-19

Analysis from the examples

Important thing is that it is not necessary that turnover should be higher than rs 20 cr in all the preceding years from 2017-18. If aggregate turnover exceeds Rs 20 cr in any of the preceding year from 2017-18 onwards, then e-invoice will be applicable to the company

E-Invoice portal

- Invoice Registration Portal (IRP) is the website for uploading/reporting of invoices by the notified persons.

- Vide notification no. 69/2019-Central Tax dated 13.12.2019, the following ten portals were notified for the purpose of preparation of the invoice in terms of Rule 48(4).

- www.einvoice1.gst.gov.in;

- www.einvoice2.gst.gov.in;

- www.einvoice3.gst.gov.in;

- www.einvoice4.gst.gov.in;

- www.einvoice5.gst.gov.in;

- www.einvoice6.gst.gov.in;

- www.einvoice7.gst.gov.in;

- www.einvoice8.gst.gov.in;

- www.einvoice9.gst.gov.in;

- www.einvoice10.gst.gov.in.

The first Invoice Registration Portal (IRP) is already active and can be accessed at: https://einvoice1.gst.gov.in/ Other portals will be made available in due course

Registration under e-invoice

- Its very common question IS that how to register for e invoice

- Here the small idea given about it.

- The registration mechanism for the GST taxpayers for the e-invoice system is a simple process. If a taxpayer is already registered on the e-way bill portal, he/she can use the same login credentials to Log-in to E-Invoice system on the E-Invoice portal https://einvoice1.gst.gov.in

- If a taxpayer is not registered in the EWB portal then he/she can register on the e-invoice system on the E-Invoice portal https://einvoice1.gst.gov.in

- Taxpayer needs to have the GSTIN issued under the GST system and mobile number registered with the GST system with him.

Process of E-Invoice under GST

- What is process of e-invoice in GST is the question after registration under e-invoice

- Taxpayers will continue to create their GST invoices on their own Accounting/Billing/ERP Systems.

- Necessary changes on account of e-invoicing requirement (i.e. to enable reporting of invoices to IRP and obtain IRN), will be made by ERP/Accounting and Billing Software providers in their respective software. They need to get the updated version having this facility.

- These invoices will now be reported to ‘Invoice Registration Portal (IRP)’

- On reporting, IRP returns signed e-invoice with unique ‘Invoice Reference Number (IRN)’ along with a QR Code.

- Then, the invoice (with QR Code) can be issued to receiver. A GST invoice will be valid only with a valid IRN.

E-invoice can be generated by any of following three options

- Free Offline Utility (‘Bulk Generation Tool’, downloadable from IRP)

- API based (integration with Taxpayer’s System directly

- API based (integration with Taxpayer’s System through GSP/ASP)

(Process explained by video link is complete video of whole process given in e-invoice portal at following link)

Click here https://einvoice1.gst.gov.in/Others/BulkGenerationTools

Status for Enablement of GSTIN on e-invoice portal

- On fulfillment of prescribed conditions, the obligation to issue e-invoice in terms of Rule 48(4) (i.e. reporting invoice details to IRP, obtaining IRN and issuing invoice with QR Code) lies with concerned taxpayer

- However, as a facilitation measure, taxpayers who had crossed the prescribed turnover in a financial year from 2017-18 onwards have been enabled to report invoices to IRP. Note that this list has been prepared based on the turnover of GSTR-3B as reported by GSTINs to GST System. Thus, it is not the final one, in case a taxpayer has or had aggregate turnover exceeding Rs 20 cr in any financial year since introduction of GST, is mandated to report e-invoice to IRP.

- To know whether taxpayer is enabled in GST or not, follow the following steps

Step-1 Go the the site https://einvoice1.gst.gov.in/

Step-2 Go to the search section

Step-3 Click on e-invoice status of taxpayer

Step-4 enter GSTN and CAPTCHA

You will find whether you are enabled in e-invoice or not

- In case any registered person, is required to prepare invoice in terms of Rule 48(4) but not enabled on the portal, he/she may request for enablement on portal: follow the following steps

Step-1 Go the the site https://einvoice1.gst.gov.in/

Step-2 Go to the registration section

Step-3 Click on e-invoice enablement

Step-4 enter GSTN and CAPTCHA

- In case any registered person, whom e-invoice is not applicable in terms of Rule 48(4) but enabled on the e-invoice portal, the same may also be brought to the notice at support.einv.api@gov. in so that necessary action can be taken.

Format of E-Invoice

Print e-invoice

- E-invoicing System allows users to take print the e-invoice. When the user selects the ‘Print’ sub-option under ‘e-invoice’ option.

- The user has to Select Ack No or IRN based on the availability. Next, user enters the 64-character invoice reference number or 11-digit Ack No as per the selection and clicks go

E-invoice help line number

Toll free number is 1800-103-4786

FAQs

Is e-invoicing mandatory for B2C?

No. E-invoice is mandatory for only B2B transaction

Who is exempted from e-invoicing?

The following persons and supply are exempt from e-invoicing

-Insurance Company (Exemption to entity)

-Banking [including NBFCs (exemption to entity)

-Goods Transport Agency transporting goods by road in goods carriage (exemption to only GTA Service)

-Person supplying Passenger Transport Services (exemption to only Passenger transport service)

-Cinematograph films in multiplex screen (exemption to only this service)

-SEZ Unit (exemption to entity)

–Note-Its only to SEZ unit but no to SEZ developer

-Government department

-Local Authority

What is the turnover limit for e-invoicing?/When e-invoice is applicable?

From 01/10/2020 Rs 500 cr

From 01/01/2021 Rs 100 Cr

From 01/04/21 Rs 50 cr

From 01/04/2022 Rs 20 cr

From 01/10/2022 Rs 10 cr

Is e-invoice mandatory for export?

Yes it’s mandatory for export. Refer notification 13/2012 CT dated 21.03.2020 as amended by Notification 70/2020 CT dated 30.09.2020

What is IRP?

Invoice Registration Portal (IRP) is the website for uploading/reporting of invoices by the notified persons.

Vide notification no. 69/2019-Central Tax dated 13.12.2019, ten portals were notified for the purpose of preparation of the invoice in terms of Rule 48(4). Out of this tel portals at present www.einvoice1.gst.gov.in is active

Is e-invoicing mandatory for 5 crore turnover?

from 01-08-2023,E invoice is mandatory for person whose turnover from 2017-18 onwards exceeds Rs.5 crore by notification no.10/2023 dated 10-05-2023.

What is the latest turnover limit for e invoice?

Turnover limit is exceeding Rs.5 Crore from 2017-18 onwards eligible for E invoice.

Gain you GST knowledge by reading more articles

Latest GST updates in July-2022

Key Decisions of 47th GST Council Meeting

CBIC issues Guidelines for Recovery Proceedings under CGST Act, 2017